Form 122

Skip information indexPaper submission of model 122

For the paper submission of model 122, you have a form to fill out online and obtain the PDF with the declaration previously validated by the AEAT server.

To access the pre-declaration, basic authentication will be required: DNI + Validity date (or the issue date if it is a permanent DNI ) or NIE + support number. Please note that the NIF of the declarant must be that of the authenticated user.

Fill in the corresponding data. Fields marked with an asterisk (*) are mandatory.

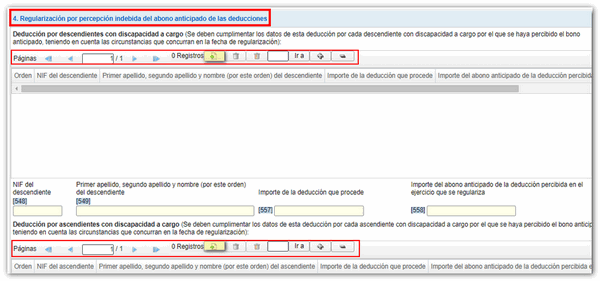

In section 4 you can add new records from the icon of the blank sheet with the green "+" sign, delete them or access the details of each one to modify them, if necessary, from the button panel in each of the sections, with the different functionalities.

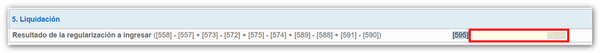

In the section " 5. Settlement ", the result of the adjustment to be entered will be automatically calculated, based on the data indicated in the previous sections.

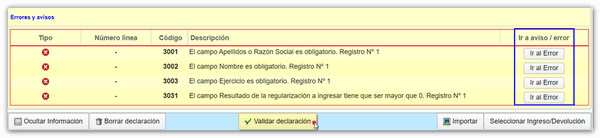

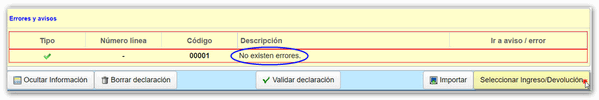

Press " Validate declaration ". If there are errors, they will appear on the screen with the "Go to error" access so that they can be corrected.

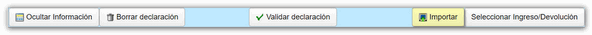

From the " Import " button, you can incorporate a file created with another program, as long as it conforms to the registration design approved for model 122, or that you have previously exported from the model itself.

Once completed correctly and without errors, click on the button " Select Income/Refund " located on the bottom button bar.

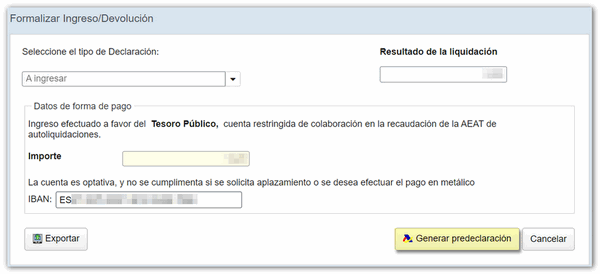

If the selected declaration type is "To be paid", the "Payment method details" section will be enabled, where you can optionally include the bank account in which the charge will be made. To finish, press " Generate pre-declaration ".

A PDF will be generated with the content of the declaration in two copies, one for the taxpayer and another for the Collaborating Entity, which you must sign and deliver to the Collaborating Entity if it is to be entered. Remember to write the NIF on the Income or Refund Document and sign it before submitting it.