Model 318 - Technical assistance

The electronic submission of Form 318 is done through a form that is completed online and sent directly.

You can access by identifying yourself with Cl@ve , certificate or DNI electronic. If you have questions about how to obtain an electronic certificate or how to register in the Cl@ve system, consult the information available in the related content.

If the declarant does not have an electronic certificate, it is necessary that the person making the submission be authorized to submit declarations on behalf of third parties, either by being registered as a collaborator or by being authorized to carry out this procedure.

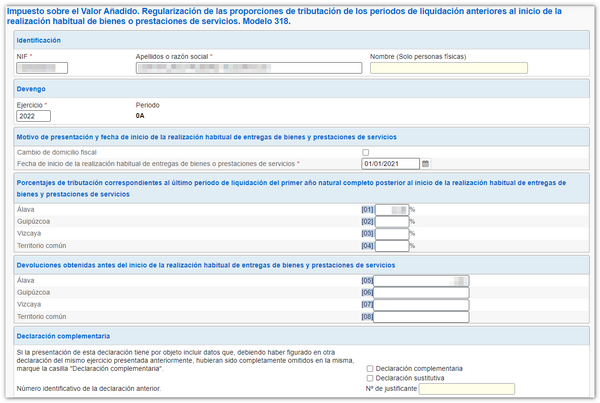

After identifying yourself, you will access the form. Fill in the identification details and enter the rest of the necessary data.

If you are submitting the declaration to include data that was not indicated in a previous declaration for the same year or that was declared incorrectly, check the "Supplementary declaration" box.

If you wish to cancel and replace the previously submitted declaration because it contains incorrect information, check the "Replacement declaration" box. In any case, you must complete the 13-digit receipt number corresponding to the previous declaration.

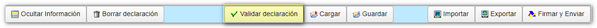

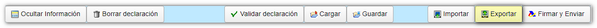

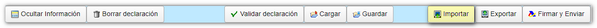

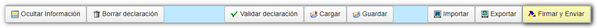

From the bottom button bar you can access the functions to validate the declaration, save and load data, export and import declarations and submit the declaration.

Before filing the declaration, it is advisable to check if there are any warnings or errors using the "Validate declaration" button. At the top of the button panel, a tab will be displayed with the detected errors and warnings. Click "Go to notice" or "Go to error" to access the section to review or correct.

Please remember that notices are for informational purposes only and do not prevent submission. Instead, errors must be corrected before the return can be filed.

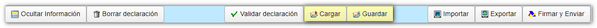

You can save the data entered at any time, even if there are errors or the declaration has not been completed, by clicking on the "Save" button. A file with the .ses extension will be downloaded, which you can save locally, on your computer or on an external device. To retrieve the data later, you must access the declaration and click on the "Upload" button to retrieve the .ses file that you saved previously.

If there are no errors, it is possible to "Export" a file with the declaration in format BOE , (with the extension .318), valid for presentation.

Using the "Import" button, you can incorporate a declaration file in BOE format that has been previously exported from the same form or generated from an external program, following the specifications of the registry design published in "Registry Designs".

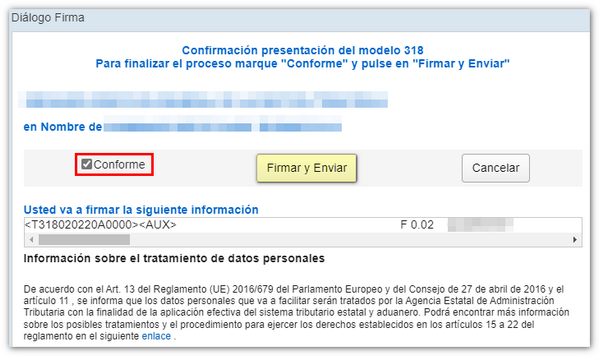

Once the declaration is complete and validated without errors, click "Sign and Send" to submit the declaration.

Check "I agree" and "Sign and Send".

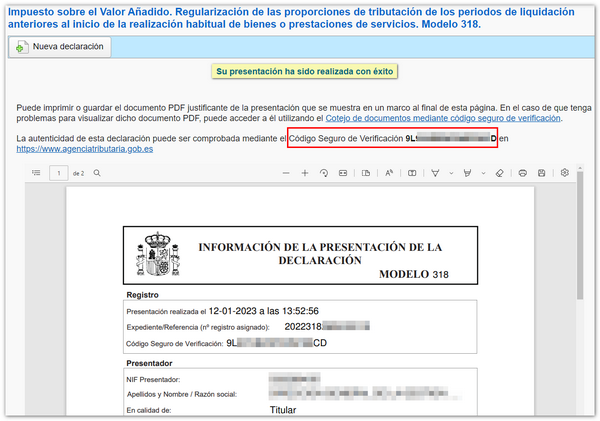

The declaration will be submitted and you will obtain proof of submission with the assigned CSV and the complete copy of the declaration.