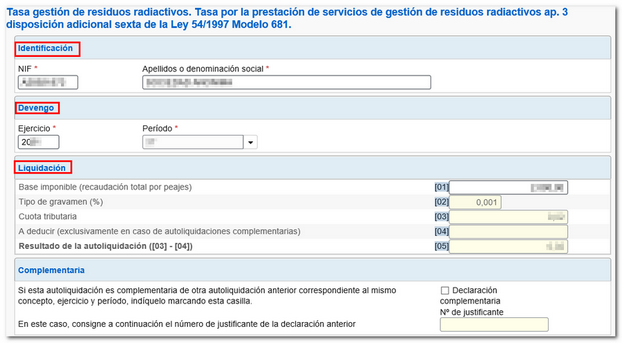

Model 681

Form 681 can only be submitted online, so an electronic certificate or electronic DNI is required.

In addition to the holder of the declaration, it may also be submitted by a third party acting on his or her behalf, whether it be a social collaborator or a representative to carry out the procedure.

Fields marked with an asterisk are mandatory.

At the bottom of the form are the buttons available in the form.

-

Show or hide information about errors or completion notices.

-

"Delete Return" deletes the data from the return you are working on to start a new one.

-

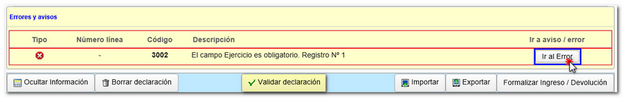

Using the " Validate declaration " button, check if you have any warnings or errors. The list of errors and warnings detected will be displayed, which you can access for correction from the "Go to Error" or "Go to Warning" button next to the description of the fault. Remember that the notices provide relevant information that should be reviewed but do not prevent the filing of the tax return. If the declaration contains errors, these must be corrected.

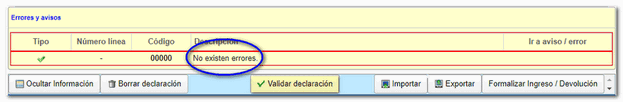

If no errors are detected, the description will report no errors.

-

You also have the buttons " Import " and " Export ". Use the "Export" button to save the information entered as long as the declaration has been successfully validated. The file is saved by default in the download folder that the browser has by default, however, you can choose the path in which you want to save the file in BOE format, which will have the name NIF of the declarant and the extension .681. From " Import ", you can retrieve the declaration obtained through an external program or with this form. Note that from this option, if there are data indicated in the form, these will be lost when the file is imported.

-

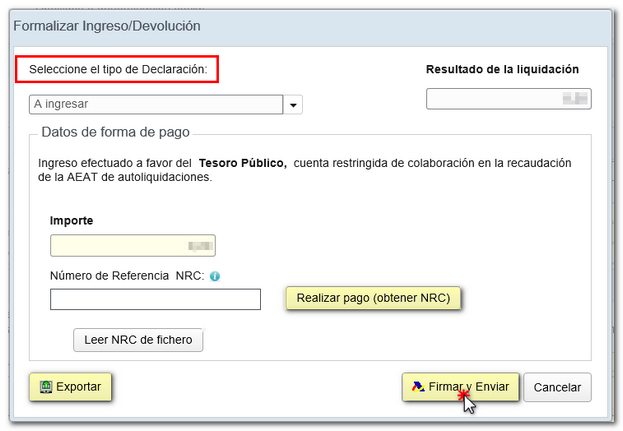

Use the " Formalize Income/Refund " button to submit the declaration once it has been completed and validated.

In the pop-up window, select the type of return. If the result is to enter, it will be necessary to first obtain the NRC and then submit the self-assessment. The NRC is the Full Reference Number, a 22-character code that serves as proof of payment. From the form itself, in the "Make payment (get NRC )" button, it is possible to connect to the payment gateway to automatically generate a NRC with the data contained in the declaration.

In this same window it is also possible to obtain the declaration with the format of the published logical design and extension .681 from the button "Export" You can choose the path where you want to save the file, which will be named NIF of the declarant - fiscal year - period and the extension .681. You can retrieve the declaration using the "Import" option at any time if you close the window.

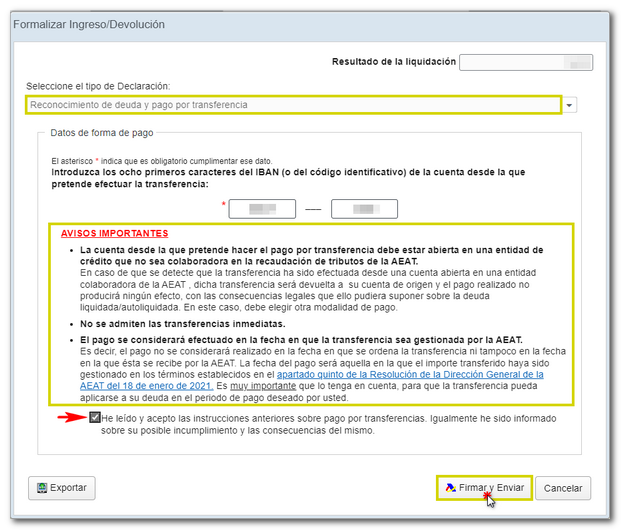

Form 681 also includes the option of debt recognition and payment by transfer from a bank account opened in a NON-COLLABORATING Credit Institution, by choosing "Debt recognition and payment by transfer" from the drop-down menu "Select the type of Declaration".

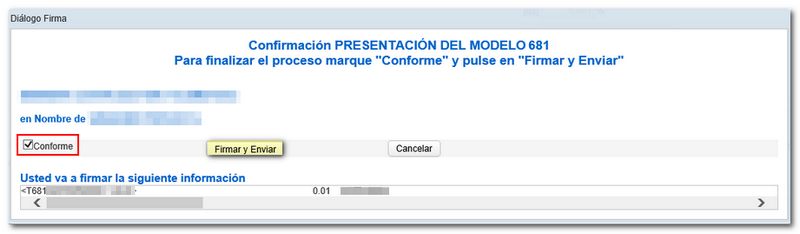

Finally, press " Sign and Send ", a window will appear with the information of the encoded declaration and the data of the presenter and the declarant. Check the "I agree" box and press "Sign and Send" to complete the submission.

The result of a successful submission will be a response page showing the text "Your submission has been successfully submitted" with an embedded PDF containing the submission information (Secure Verification Code, receipt number, day and time of submission, and presenter details).

In cases where there is recognition of debt, on the response sheet for successfully submitting the claim, a link will be displayed to submit the deferral or compensation request called "Process debt". The settlement details will then appear with the debtor's data and the settlement key. You must choose between one of the available options.