Model 840 and 848

Skip information indexElectronic filing of form 840

Access to "Model 840: Electronic completion and submission" must be done with an electronic certificate whose holder is the declarant, a social collaborator or an agent to carry out this procedure.

If you do not need to provide documentation, you can also submit the application in paper form by downloading the form found in "Information" .

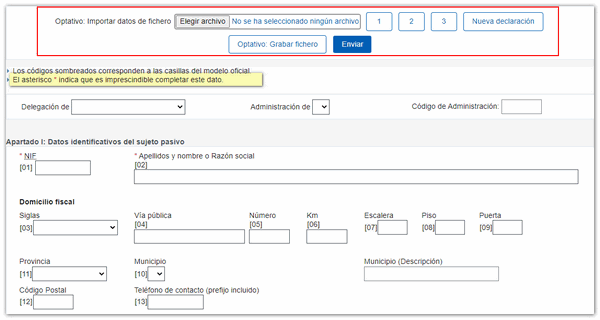

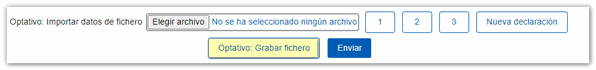

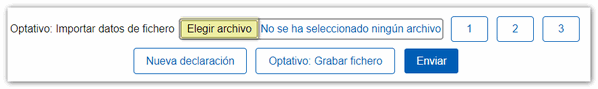

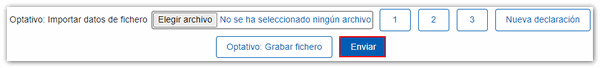

The button bar at the top of the model shows the different pages of the declaration and the options for "Import data from file" , "New declaration" , "Save file" and "Send" .

Using the button "Optional: Save file" You can save a completed and correct declaration to submit it at another time or from another computer.

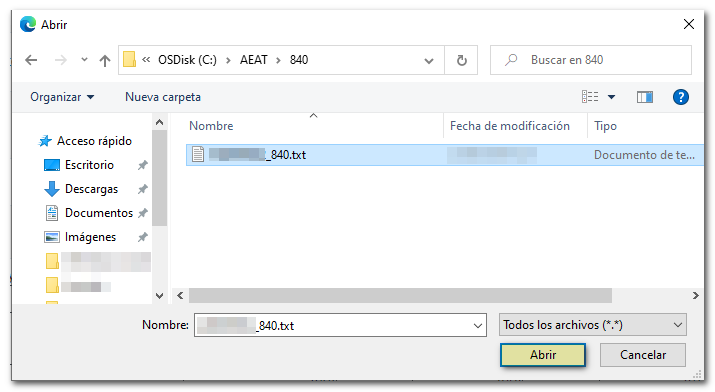

A file of type NIF .840.txt will be saved in the "Downloads" folder on your computer or in the directory that is set by default in the browser.

Option "Optional: Import data from file. Choose file" allows you to import the file previously saved from the form itself or generated with a program other than AEAT . This file must be text and conform to the logical design published for the current model. The registration designs are published on the web.

By pressing the "Choose file" button you can select the file from the location where it is saved.

Once you have completed the declaration, click on "Submit" to submit it online.

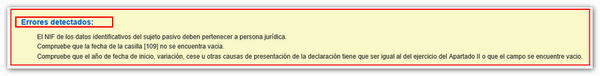

If errors are detected in the information completed during this step, you will be able to see a description of the errors detected at the top of the screen.

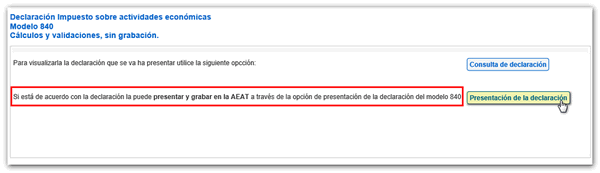

If no errors are detected, a screen will appear with the options "Return Inquiry" (shows a draft of the return not valid for filing) and "Filing the return". Click on the latter to continue with the presentation

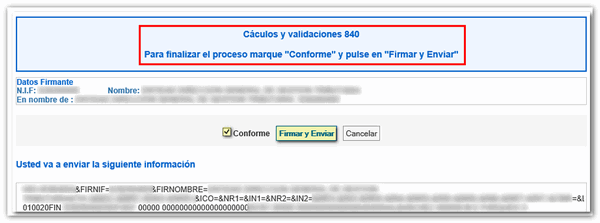

In the next window, check the box "I agree" and press "Sign and Send" .

The result of a successful filing will be a filing receipt with an embedded PDF , containing a first page with the filing information (registration entry number, Secure Verification Code, receipt number, filing day and time and filer details) and the full copy of the declaration on the following pages.

If you wish to submit additional documentation to the submitted model, access with an electronic certificate or Cl@ve through option "Provide additional documentation, model 840" . This application allows the transmission of documents in various formats that will be linked to the declaration by means of the file number or electronic reference.

If you do not need to provide documentation, you can also submit the application in paper form by downloading the model form.