How to file a tax return for Wealth Tax

To access the Heritage 2024 web form, identify yourself with an electronic certificate, DNIe, Key, reference of the current campaign holder or with the identification system for citizens of the European Union (eIDAS) using another country's ID.

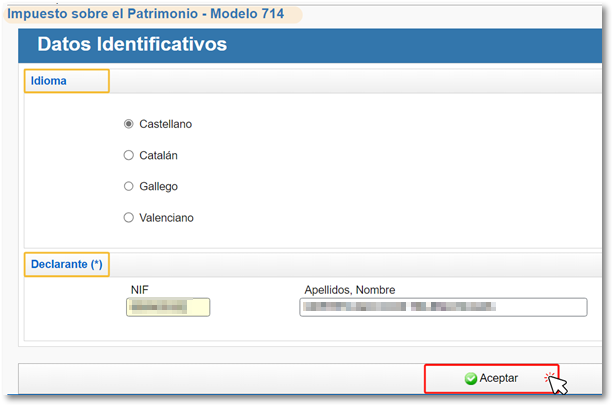

If this is your first time accessing the site, the initial page will contain identification data and the language of the declaration, which you can modify if necessary. After checking the initial screen, press "Accept" to continue.

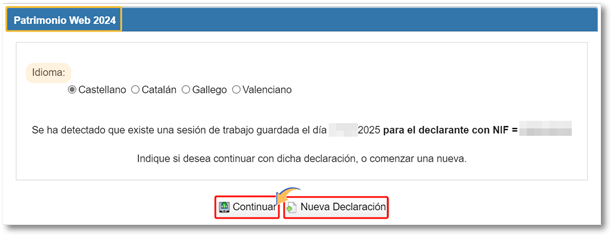

If you have already been working with the form, the system detects this and allows you to continue with the declaration or start a new one.

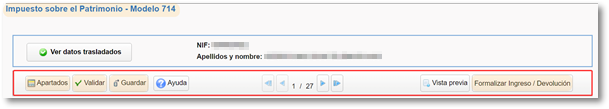

Once in the web form you can complete the declaration by browsing through the different pages that make it up or by using the "Sections" button to access the different sections. It is possible to "Save" the declaration to retrieve it later in a new session by clicking "Continue" in the initial window.

Once you have completed the form, press the "Validate" key to check for errors, warnings, or alerts. In the case of errors, they must be corrected in order to continue.

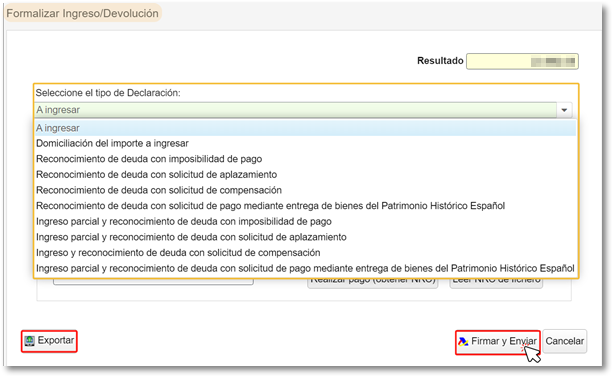

If you don't want to add any additional information, press "Formalize Income/Refund", select the type of declaration and choose the payment method.

From the "Formalize Income/Refund" window you can also obtain a file with format BOE , adjusted to the current registry design, using the " Export " button located in the lower left corner, with the name NIF of the declarant, fiscal year, 0A and with extension .714.

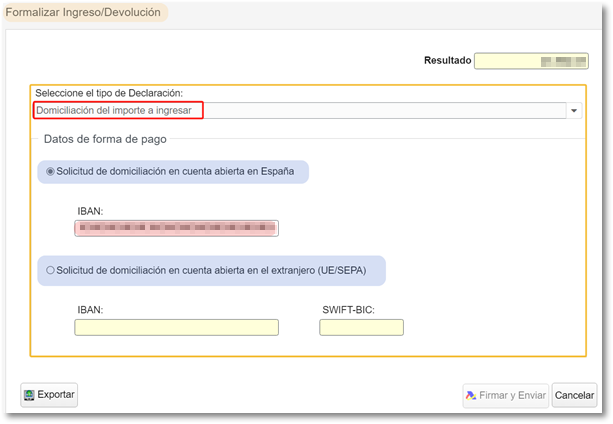

Direct debit be if the return is filed between April 2 and June 25, 2025, inclusive. Enter the IBAN to which you wish to direct debit the declaration, which must be a bank account reported to the AEAT that allows direct debits and of which you are the owner. It can be an open account in Spain or abroad ( EU/ SEPA ).

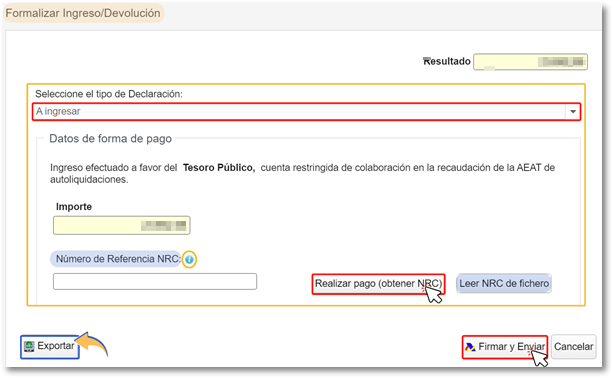

If you choose to pay using NRC or other payment methods that require a deposit, and if you access with Cl@ve , electronic certificate or DNIe , press the "Make payment (get NRC )" button to link to the payment gateway and obtain the NRC proof of payment. If you access with a reference, it will not be possible to make the payment by obtaining the NRC using the "Make payment (get NRC )" button, but if you have already obtained one directly with the options offered by your financial institution, you can indicate it in the "Reference Number NRC " box.

Another alternative would be debt recognition options. In these cases, a link to submit the deferral or compensation request will be displayed on the response sheet for successfully submitting the application. Press "Process debt " and the settlement details will appear with the debtor's details and the settlement key.

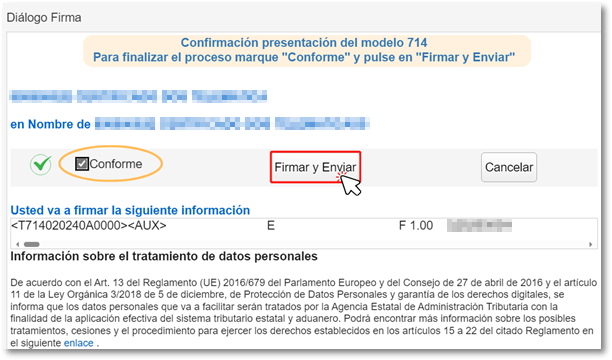

Press "Agree" and then "Sign and Send" .

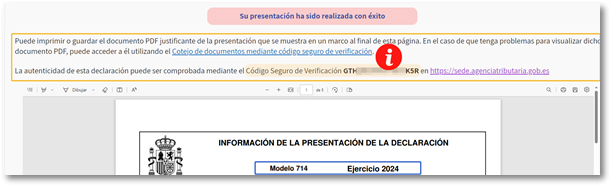

If the declaration is submitted correctly, a page will be returned with the message "Your submission has been completed successfully" and the assigned secure verification code. In addition, a PDF will be displayed containing a first page with the submission information (registration entry number, Secure Verification Code, receipt number, day and time of submission and presenter data) and, on the subsequent pages, the submitted declaration. Check the notice board to see if you need to make any corrections.