Securities Portfolio for partners

- What is the purpose of a Securities Portfolio?

- Access to the application

- Securities Portfolio Interface

- Types of operations

- Results

- Synchronization with Renta WEB

1. What is the purpose of a Securities Portfolio?

The Securities Portfolio application allows the automatic transfer of portfolio data to Renta WEB. This data is automatically obtained through Informative Declarations 189 and 198 since 2018, adding all the modifications the user has made over the years. You can check the Securities Portfolio and add or modify the corresponding information.

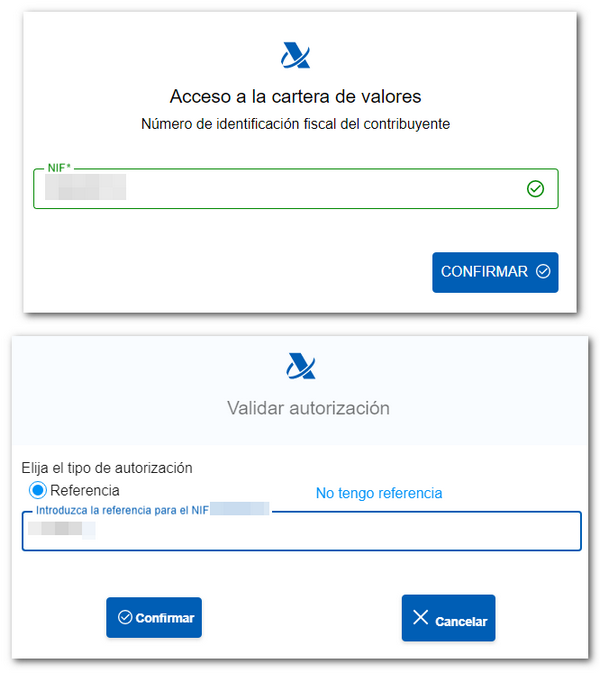

2. Access to the application

Access is available in the Income portal procedures and in the APP AEAT .

There are 2 versions:

-

Securities Portfolio Service: in your own name, accessing with an electronic certificate, DNIe , Cl@ve or the Income reference.

-

Securities Portfolio Service for collaborators: The collaborator will identify himself with his electronic certificate and provide the Income Tax reference of the portfolio holder.

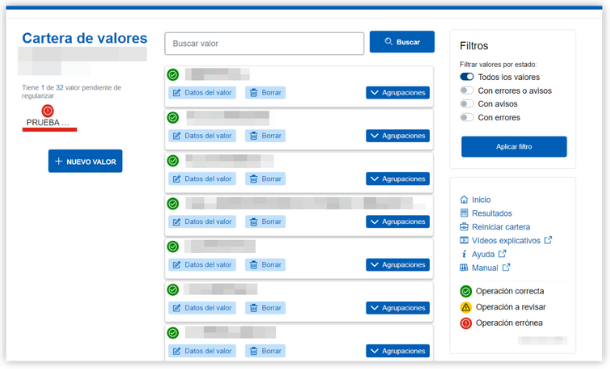

3. Portfolio Interface

After logging in, you will access the main screen of the application, divided into different sections:

-

On the left side you will find a quick view of the values pending regularization .

-

On the right side you can select different filters to locate certain values. You will also see the information of interest, with the help of the application, explanatory videos, the "Results" button and the legend of symbols that identifies the status of the operations .

-

In the central part there is the search engine and the list of values, which will be updated based on the applied filters.

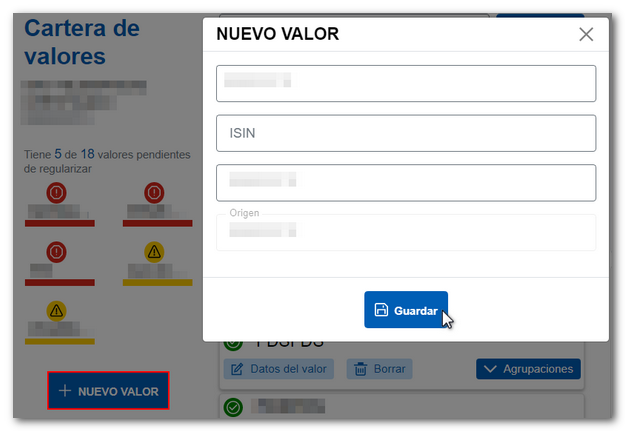

To add a value, press the button "New value" and provide the NIF or ISIN of the value and a description. Press the "Save" button.

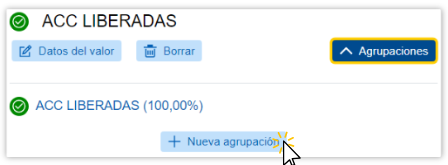

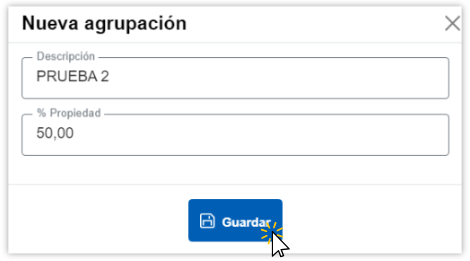

You can edit the information or delete the value. In addition, the groups that have that value will be displayed and from the "New grouping" button you can add the corresponding groups, providing a description and the percentage of ownership. Then press the "Save" button.

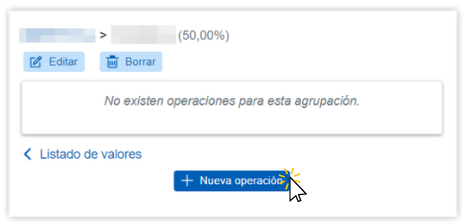

From the detail of a "Grouping" , you can add operations or modify operations that were already loaded in the application.

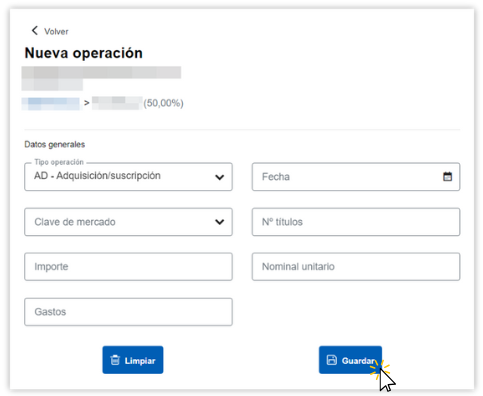

To register a transaction, press the button "New transaction" and fill in the transaction type, transaction date, market code, source code, number of shares, amount, etc. as appropriate. Press "Save" to record the log.

To modify an operation, press the button "More information" and press "Edit" . Modify the necessary data and press "Save". If you want to delete the operation, press the "Delete" button.

Note: Values, groupings, and operations you delete cannot be recovered.

4. Types of operations

The information that will be initially uploaded to the application will be that compiled in annual reporting forms 189 and 198 since 2018, as well as any changes you have made to the Portfolio over the years.

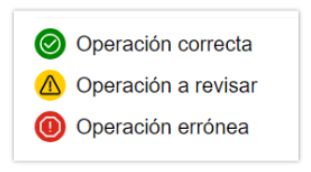

You can identify the status of operations by the following icons:

-

Successful operation (Green circle with check mark): If all operations in a grouping are correct, the grouping will also be consistent. If there are transmissions, a result will be generated that can be transferred to Renta WEB

-

Operation to be reviewed (Yellow circle with warning sign): The operation is inconsistent, but there are no transmissions. Therefore, a result that can be transferred to Renta WEB is not generated, although it does not prevent the transfer of other results.

-

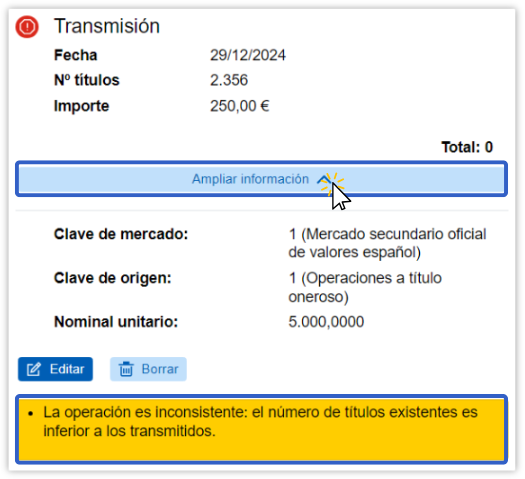

Erroneous operation (Red circle with exclamation mark): There are inconsistencies and there is also transmission. It needs to be corrected to make the grouping and value consistent.

IMPORTANT NOTE: If any value is in red, no results will be transferred to Renta WEB.

It is advisable to correct the first incorrect operation, as in some cases this may automatically validate the remaining operations.

By accessing the operation details from "More information" , you can check what the error detected is. Then press "Edit", correct the error and save the operation, check if it is no longer in red and the status of the rest of the operations, the grouping and the value.

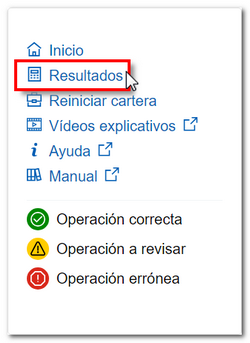

5. Results

Once you have completed entering and reviewing data in the portfolio, you can check the acquisition and transmission values calculated for the different years using the "Results" button. Select the exercise and press "View Results" .

Only those securities that have tax implications for Income Tax purposes will appear, that is, those in which shares are transferred in the corresponding fiscal year.

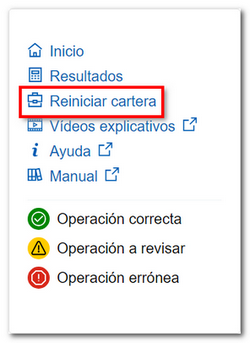

To reset the portfolio and recover the data that was initially loaded into the portfolio (which is only the data available to the Tax Agency) before making the changes, there is the option "Change work portfolio" , "Reset portfolio" .

NOTE : Please note that any changes you have made manually in this exercise and in previous exercises will be lost.

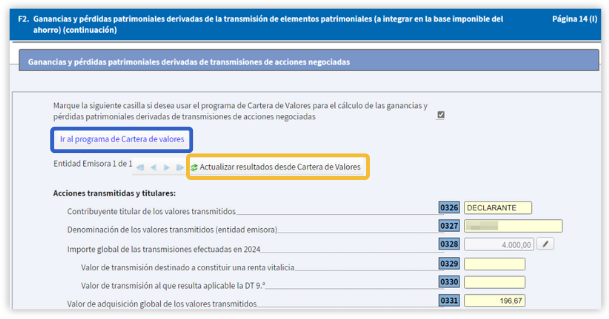

6. Synchronization with Renta WEB

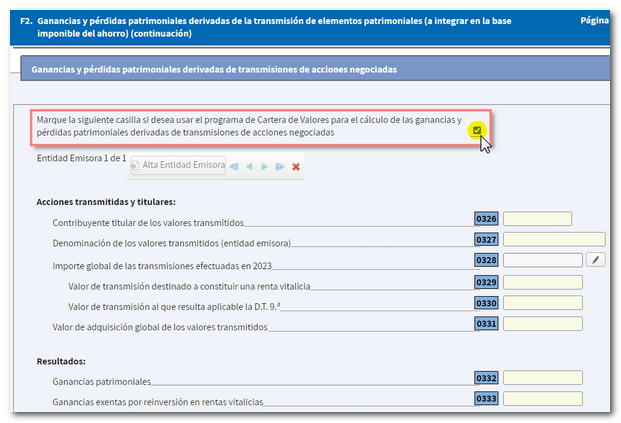

For data to be transferred from the Securities Portfolio to Renta WEB, in addition to having a consistent portfolio, without erroneous transactions and with transfers during the fiscal year, it is necessary to check the corresponding box in section F2 of your tax return. This box may be checked by default depending on the tax data, or the taxpayer will choose whether or not to check it.

If you use the data transfer from the Securities Portfolio program, you will not be able to modify or add data in the corresponding boxes in Renta WEB, as they are mutually exclusive. That is, you can use the results transfer from the Securities Portfolio or enter that data directly in Renta WEB.

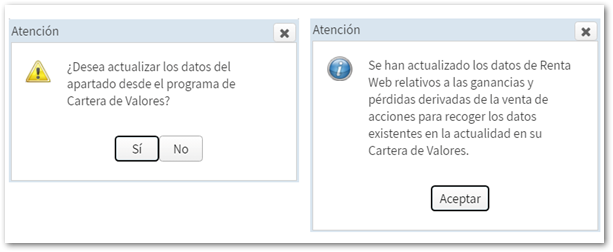

If it is detected that for that NIF there have been changes in the Securities Portfolio, both applications are synchronized and transfer the data to the declaration.

You can check in section F2 of the declaration that the data has been transferred correctly. You can update the result from the Securities Portfolio and you will have a link to said application. You will also find a link to the "Securities Portfolio" program from the "Statement Summary" .