How to disable obtain reference number using box function

When it is considered that there is a risk that unauthorized third parties may be aware of certain data from the declaration or cases of taxpayers who have published their Income Tax return (with visibility of box 505), the taxpayer can use the option "Disable obtaining reference by box" of the electronic office to prevent obtaining the reference of the file using the amount in box 505 of the 2023 Income Tax return.

The disqualification is permanent until it is rehabilitated in an office of the AEAT .

You can carry out this procedure at the Administration and online. The option is available in the "Featured Procedures" section, "All Procedures" on the Income portal.

To disable the obtaining of references with box 505 you will have to identify yourself with Cl@ve Mobile, certificate, DNI electronic or with identification eIDAS (for citizens of the EUusing the identification of another country).

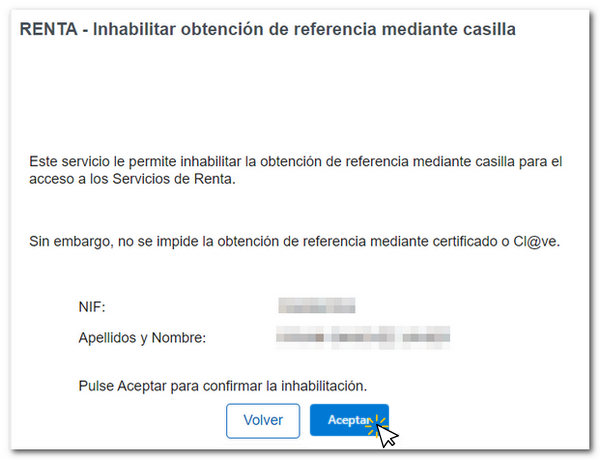

Verify that the data is correct and click "Accept". Please note that if you change your mind, the service can only be reinstated in person at the Administration.

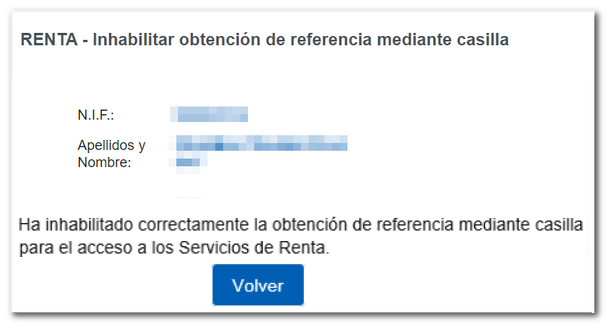

After disqualification, the applicant NIF will revoke, if applicable, the last reference generated and will not be able to carry out procedures via the Internet with that reference number. However, you can obtain and use references if they are obtained with an electronic certificate, electronic DNI or Cl@ve .

If you access the reference collection service again, the application will not offer the option to obtain a reference using box 505 of the 2023 Income Tax Return.