One-click Income Tax Return

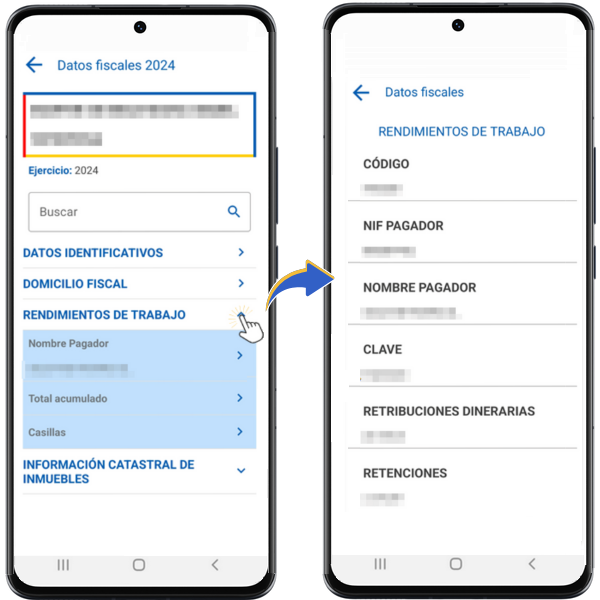

The APP- AEAT allows taxpayers for whom the AEAT has all the data to file their Income Tax return with a single click. In this case, once you've logged in to the application, go to "Income Tax," "Income Tax 2024," and click "Process Draft/Return."

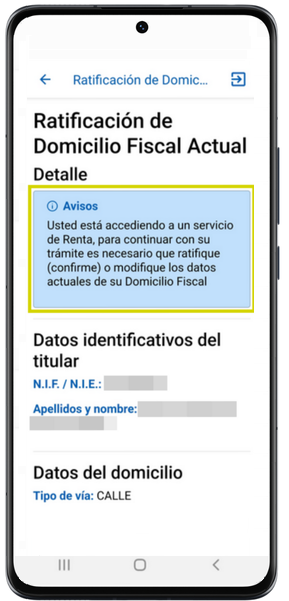

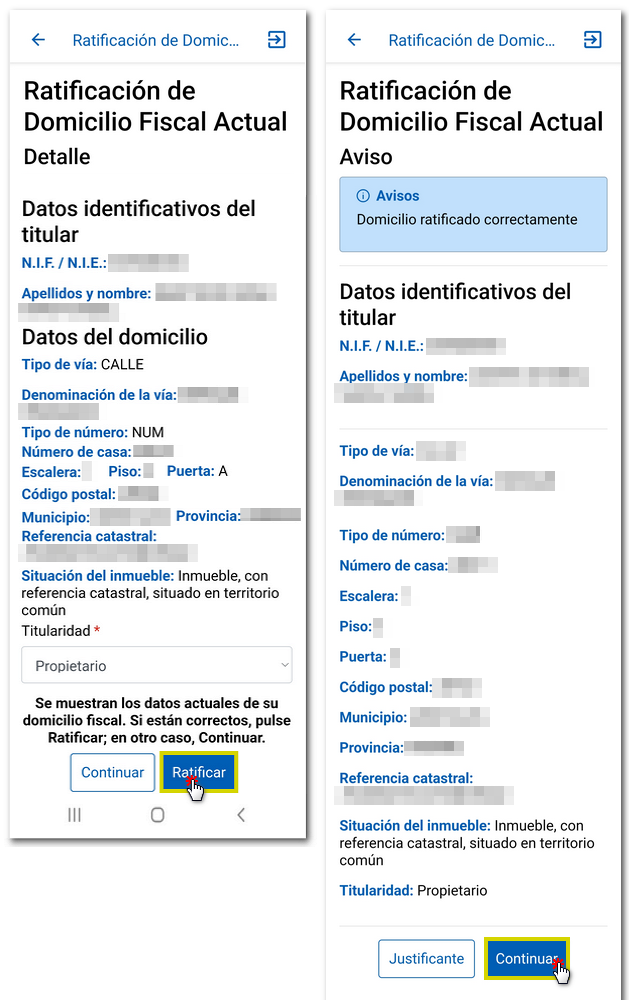

If you have not confirmed your tax domicile, you must confirm it to access the processing of the declaration. The identification data of the owner and the current habitual residence will be displayed. If they are correct, click "Ratify"; Otherwise, click "Modify". Select the ownership of the property, by default the one indicated in the previous exercise will appear; If you select the "Tenant" key, you must indicate the NIF of the landlord. Once the current habitual residence has been confirmed, you will receive a receipt and can continue with the process. Click "Continue".

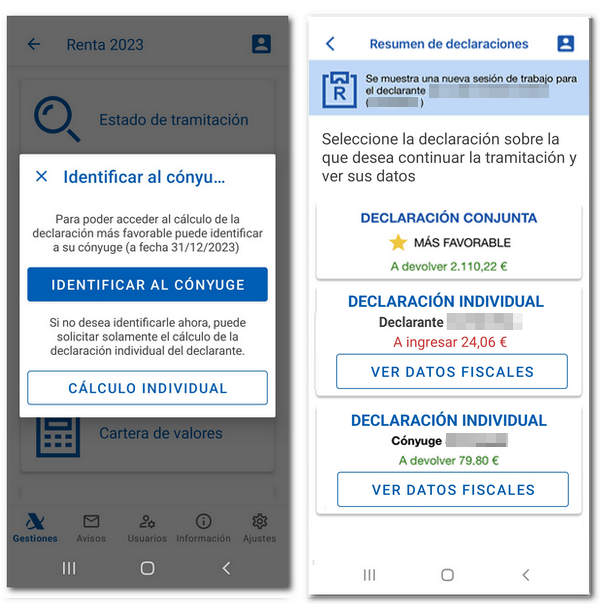

The application will offer the declarations available in your work session (individual of the declarant, and if applicable, of the spouse and children) for those declarations for which the AEAT has the necessary information to perform the calculation, knowing which is the most favorable (individual or joint taxation option).

You can continue with the previously saved work session or, if it does not exist, the calculation of the declarations will be requested (if you have a spouse, he or she must be identified as a user in the application, and if he or she is not yet, the possibility of identifying him or her at that time or requesting the calculation of the individual declaration will be offered). In addition, the tax domicile of the spouse and descendants may be ratified (if you have a spouse and descendants and their tax domiciles have not been ratified), allowing them to be modified and ratified.

For each declaration, the type of declaration (individual or joint) will be indicated, whether it is the most favorable type, whether the member of the family unit is not required to file the declaration, whether it is an individual declaration and the result of the declaration (to be paid or returned together with the amount).

Information on LADY REGULARIZATION will be provided, it will be shown in the same cases as shown in Renta WEB.

You can select any declaration to continue with the process.

From the tax return summary, you can access the tax information of family members who have filed individual tax returns during the work session.

Before filing the return, the application will allow you to view your data (result of the return indicating whether it is a refund or a payment, the name, surname and DNI / NIE of the members of the return together with their Autonomous Community), preview the return in PDF using the "Preview" button, add or modify the IBAN and the tax allocation (Catholic Church and Social Purposes).

If you are not required to file a tax return, you will receive a message in the "Notices" section: "According to the information we have, you are not required to file your tax return."

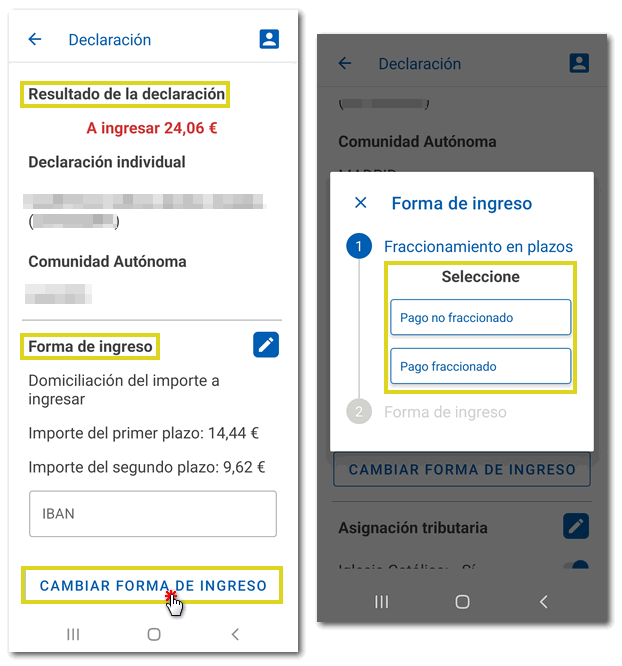

In statements to be entered:

- During the direct debit period (until June 25), the payment will be split into two installments by default, with the amount of both direct debit payments.

- Once the direct debit period has ended, the non-split payment and document to be deposited in the Bank/Box will be displayed by default.

Depending on what appears in the APP for each declaration, you can modify the installment plan and payment method based on the current direct debit or installment payment period:

- Both amounts split and domiciled

- Split and payment at Bank / Cash Register (first payment at Bank / Cash Register and second payment by direct debit)

- Not split and domiciled

- Not split and payment at Bank / Cashier

NOTE: You can only choose to split the payment if the payment is submitted on time.

Also, if you have indicated a different payment method in Renta WEB, specifically for the split or non-split payment methods with direct debit or with "Deposit in Bank or Cash", when you return to the APP- AEAT you will be able to submit your declaration according to the indicated method.

In the "Bank account" field, the account entered in the previous year will appear, but if there is no IBAN account established, you can enter it directly.

If there is already a bank account IBAN listed in this field, please verify it; If you wish to change it, you can do so directly in the field where it appears filled in. Delete the content and fill in the field with the new IBAN . After making changes, click "Save Changes".

If the declaration calculation submitted to you contains a bank account opened abroad (EU/KNOW), you can file the declaration from the APP, but if you want to modify said account, the new account can no longer be EU/KNOW (only IBAN).

Validations on the IBAN field are performed when you click "Save Changes".

If you wish to change the payment method, click on "CHANGE PAYMENT METHOD" and the windows will appear allowing you to indicate whether you wish to split the payment method or not. Depending on what you select, you will get some options or others. Finally press "Save changes"

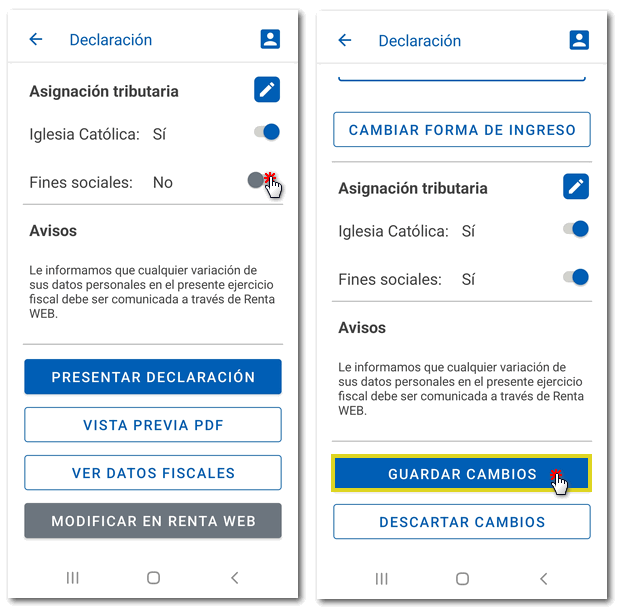

You can also modify the tax allocation for the Catholic Church or Social Purposes in the "Tax Allocation" section. Move each button to "Yes" or "No" depending on your choice. Once modified, press "Save Changes".

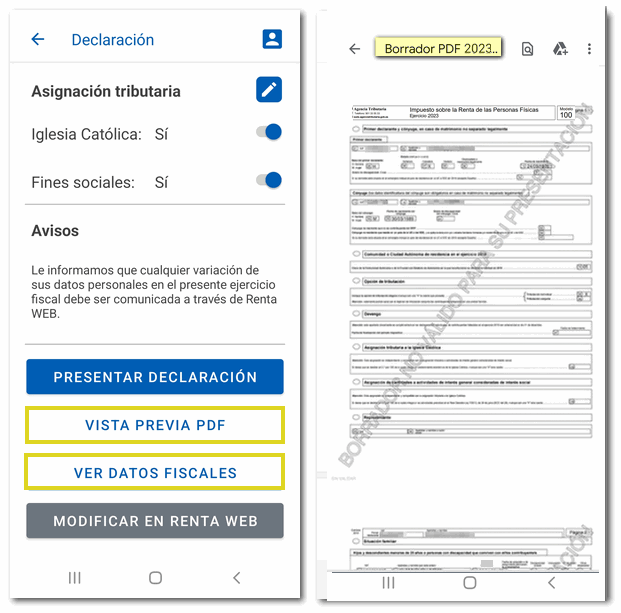

Before filing, you can review the data included in the declaration by obtaining a preview in PDF format, with the watermark "Draft not valid for filing".

Also, from this window you have the option to consult your tax data again.

If all the data is correct, click "Submit declaration" and:

- If you are filing a joint return and have a spouse or filing an individual return for a spouse who is not yet identified on the application, you will be asked to identify him or her in order to continue filing.

- If you are filing an individual return for your child and he or she is not yet identified in the application, you will be asked to identify him or her in order to continue filing.

- If you are filing an individual taxpayer return, filing will continue.

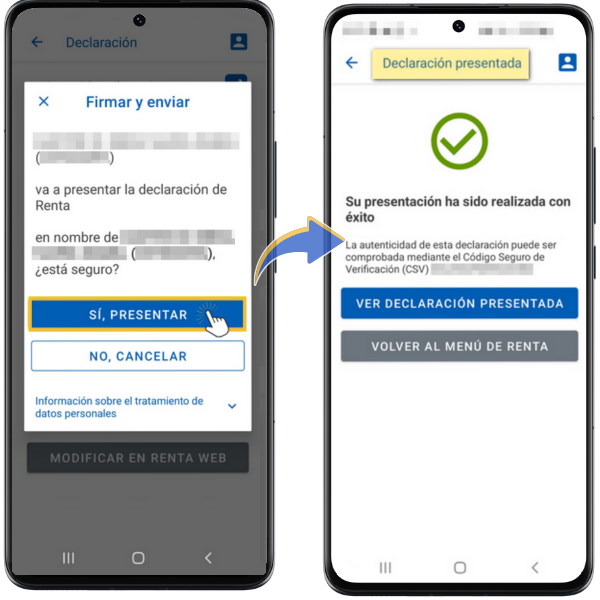

You can then confirm that you wish to file the return by clicking "Yes, file." In addition, in this same window you will have access to information about the processing of your personal data.

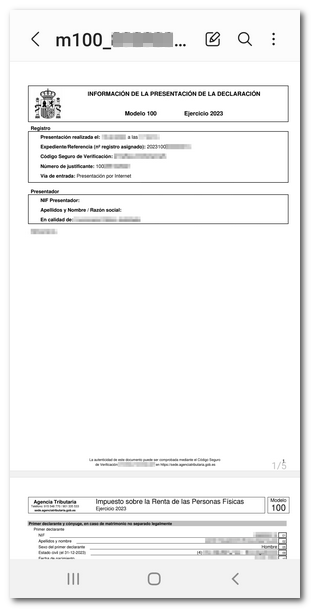

If the submission has been made correctly, a text will appear indicating that the submission was made successfully and the Secure Verification Code ( CSV ) will be offered, which allows you to obtain a copy of the document from the "Document verification using a secure verification code ( CSV )" section of the electronic office.

Once you have filed your return, click on "View Filed Return" to get the PDF of the return you just filed. At that time you are offered the option to view it or save it to the device.