How to file a tax return using Renta WEB with a Bank or Savings Bank payment document

If the result of your declaration is an income and you choose as payment method "Document to be deposited in Bank/Box" , once the declaration has been confirmed and submitted through Renta WEB, the income document will be generated to be printed and payment made at a collaborating entity, Bank or Box.

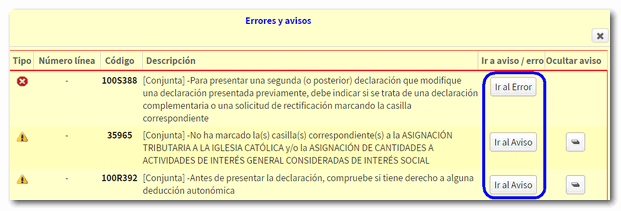

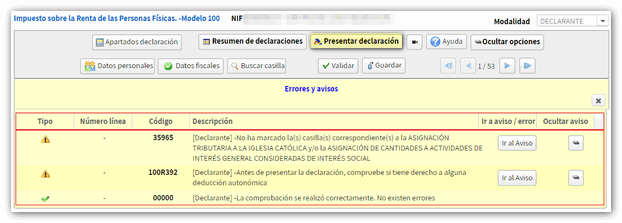

Once you have completed your tax return on Renta WEB, you can check for errors using the " Validate " option. Click on "Show options" to enable the rest of the actions available in Renta WEB.

The warnings do not prevent you from filing your return and appear only so that you can verify the data you entered. On the other hand, if the message is an error, you must correct it to continue with the presentation. You can review the warnings or errors by clicking "Go to Warning" or "Go to Error". The notices do not prevent you from filing the return and are only there to verify completion. If the message is an error, you must correct it for the declaration to be considered valid.

After validation without errors and if you do not have to enter any further information, press " Submit declaration ". Keep in mind which modality you are in at the time of filing the declaration.

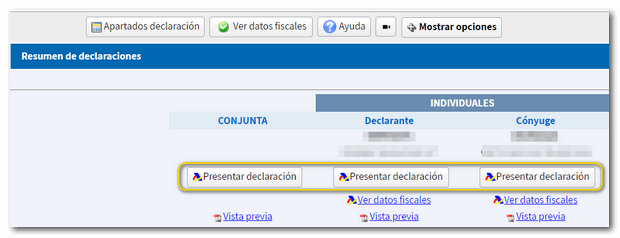

You can also submit it from the "Return Summary" if you are satisfied with the result of the return.

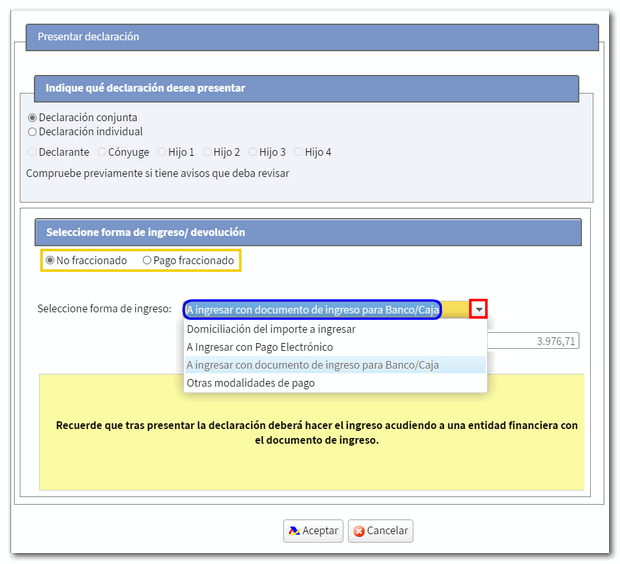

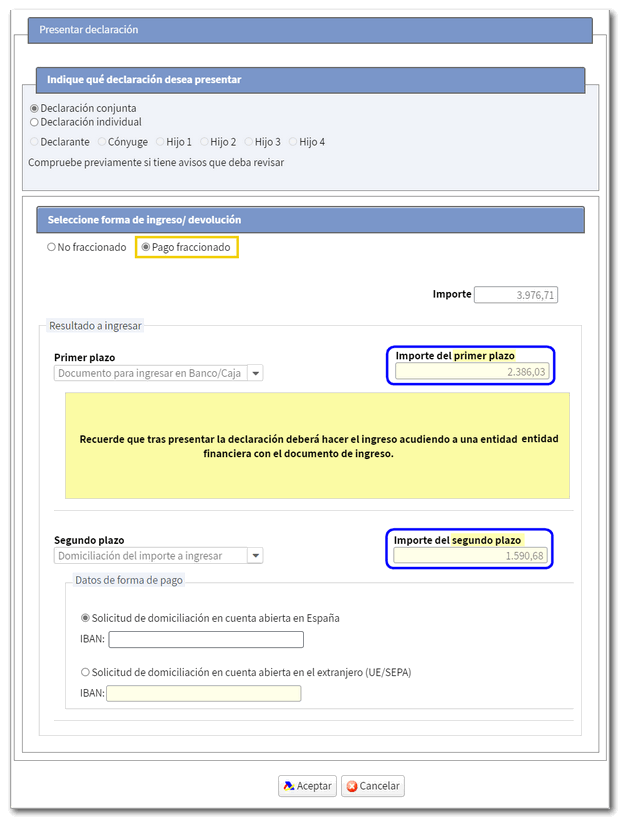

Select whether you want to file an individual or joint return. You can choose as payment method "To be paid with payment document for Bank/Savings Bank" whether you choose split payment in two installments or non-split payment.

If you choose to split your payment, you can select "Bank/Treasury Deposit Document" for both installments, just the first installment, or just the second installment.

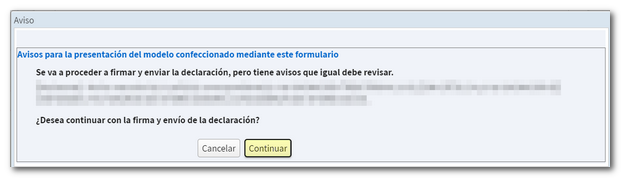

Before continuing, a box appears indicating whether there are any pending notices to be reviewed. If you don't need to review them, continue with the presentation.

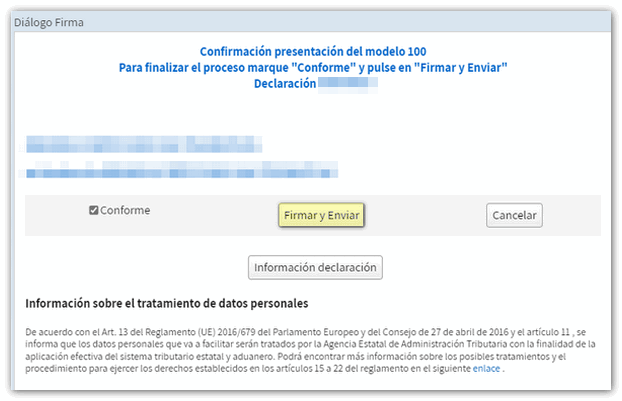

In the new window, check the "I agree" box and click "Sign and Send."

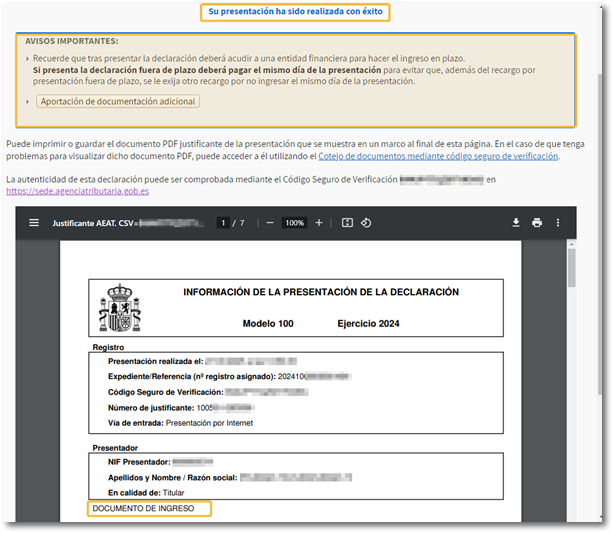

The declaration will be submitted electronically but pending payment at the offices of the collaborating entities, Bank or Savings Bank. The PDF will be generated, containing a first page with proof of submission.

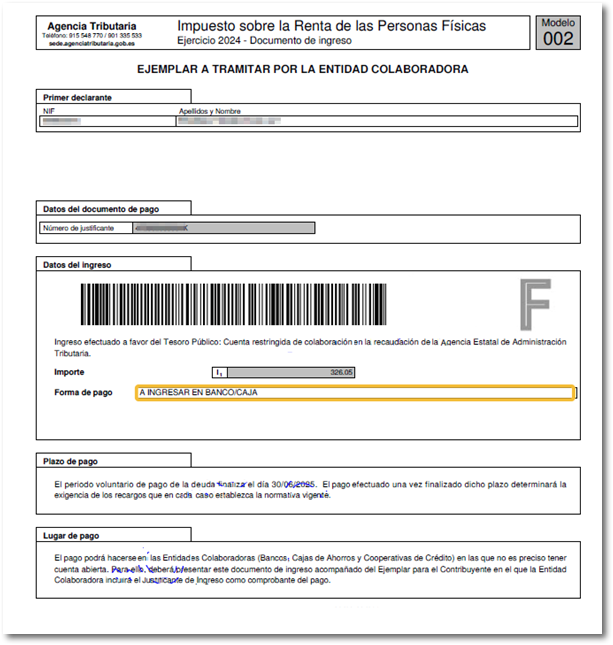

On the back pages, you'll find the complete declaration and the Income Document (Form 002) for the Collaborating Entity, which you must present to your Bank or Savings Bank.

To print the statement, click "File", "Print" or click on the printer icon. If you cannot see the menu options, right-click on the document and choose "Print" from the menu.