What to do if you have questions when completing the declaration in Renta WEB

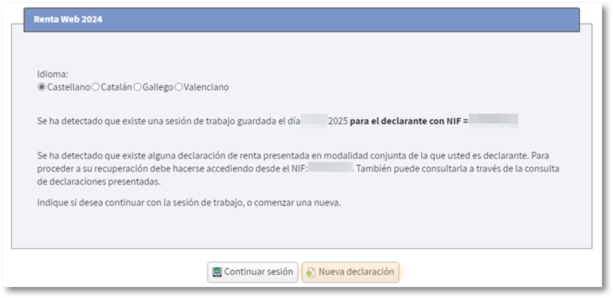

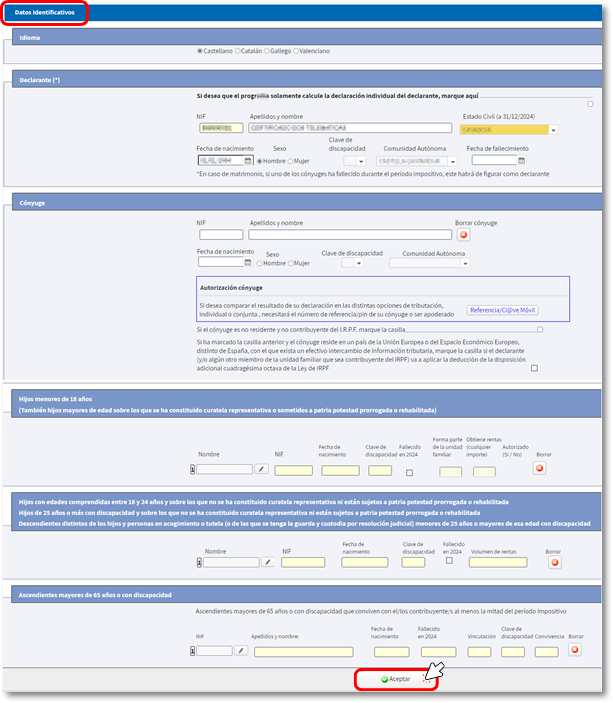

The first time you access Renta WEB to complete your tax return, the "Identification Data" screen will appear for you to verify and complete if necessary.

This page includes the information of the declarant, spouse, descendants and ascendants, if any.

Information regarding marital status and NIF of the spouses cannot be modified later. If you need to modify this information, you will have to register a new declaration when you access the "Renta WEB" service again.

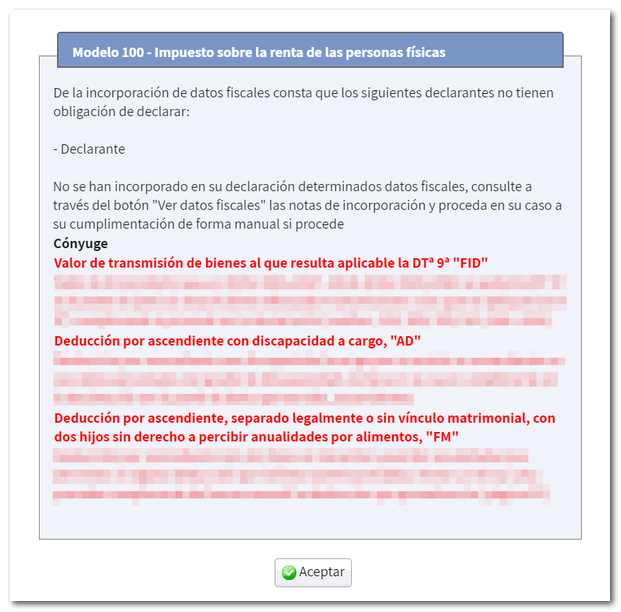

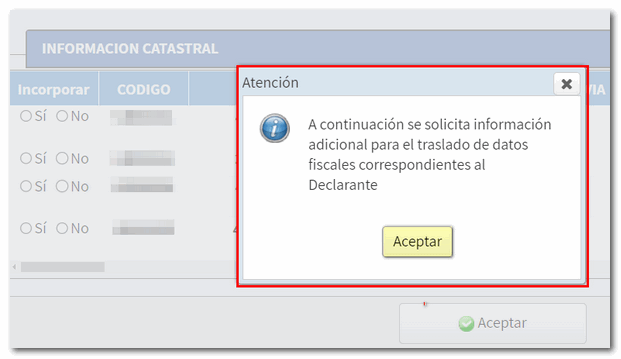

If additional information of some kind is required to transfer tax data, a notice will be displayed indicating this and the transferable data screen will show additional information.

If there is tax information that could not be entered due to a lack of information or for another reason, a warning will be displayed specifying the sections in which this information should be entered.

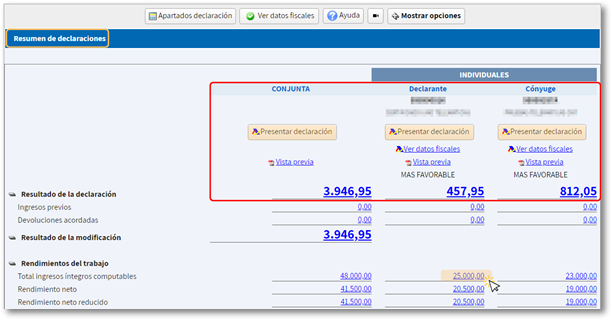

If you do not need to enter additional information to transfer other tax data not initially included in the declaration, you will directly access the " Declaration Summary ", where you can see the result for each declarant according to the data entered. Check the result of the declaration for each calculated modality and if you are satisfied with the result, you can submit it from this same window.

If you want to add more data or make any checks or modifications, you can do so using the " Declaration sections " button or access the different sections from the numerical hyperlinks for each concept in the "Declaration summary".

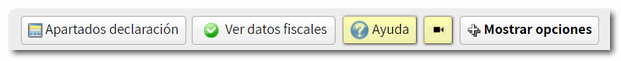

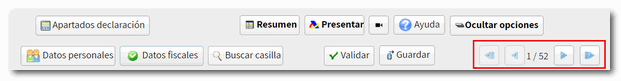

In the top options bar, you have two help buttons that can be useful when resolving queries related to completing or submitting the declaration. The " Help " button with the presentation help manual and the camera icon that links to the videos Renta WEB tutorials published.

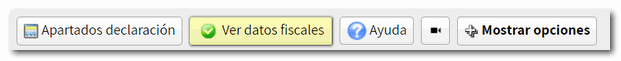

From the " View tax data" button you can review the data included and not included in the declaration and the note to include them if necessary.

To continue working with your return, once you have accessed the different sections, you can use the arrow commands to navigate between pages. These will be enabled once you click on " Show options" .

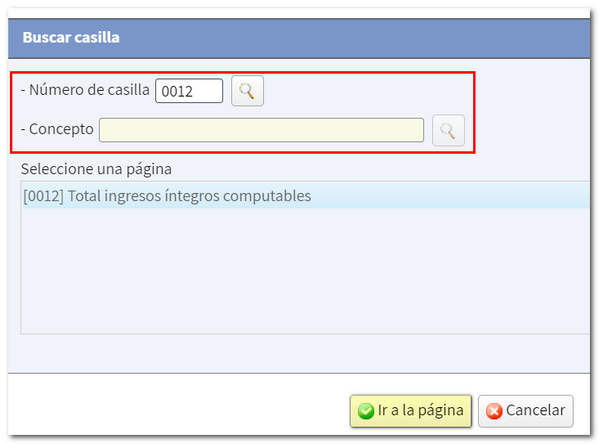

The " Find box " option, located next to the "magnifying glass" icon, will help you locate a specific box or concept in the declaration. Search by "Box number" or "Concept", select from the results obtained and click "Go to page".

If you have any questions about where to enter a deduction, a specific income or any other data, you have the following help services available:

- The Virtual Income Assistant , a tool that lets you formulate your own questions, answer them in a personalized way, and select from different options until you get the answer you need. Once all the information has been reviewed, a PDF can be generated, which will be an exact copy of what appears on the screen. This will require authentication via Cl@ve Mobile Cl@ve or electronic certificate. Includes a chat service staffed by specialists from the Comprehensive Digital Administration, available from 9:00 a.m. to 7:00 p.m., Monday through Friday (to access it, you must indicate that you did not receive the information you needed).

- Request "Assistance and appointment"where you can request personalized assistance for any of the services in the catalog offered by the Tax Agency through these channels: telephone appointment, offices appointment or chat.

- The telephone number 91 333 53 33 General information and appointment with a schedule from Monday to Friday, from 9 a.m. to 7 p.m. (until 3 p.m. in August).

- The telephone service of Basic Tax Information on the phone number 91 554 87 70, with hours from Monday to Friday, from 9 a.m. to 7 p.m. (until 3 p.m. in August).

- Consult the manuals, brochures and help videos prepared for the 2024 Income Tax campaign.