Renta WEB service for social collaborators

You can access the Renta WEB service as a social collaborator to process the declaration of your representatives, from the general option "Draft / declaration processing service (Renta DIRECTA and Renta WEB)" .

Next, identify yourself with your electronic signature by clicking on the option "Certified or electronic ID ".

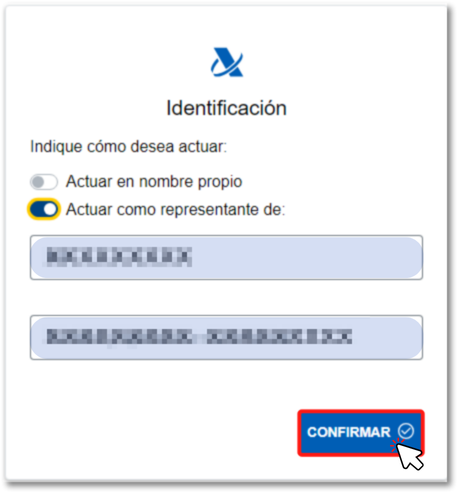

Then, select "Act as representative of" and enter the details of the person you are acting for and click "Confirm".

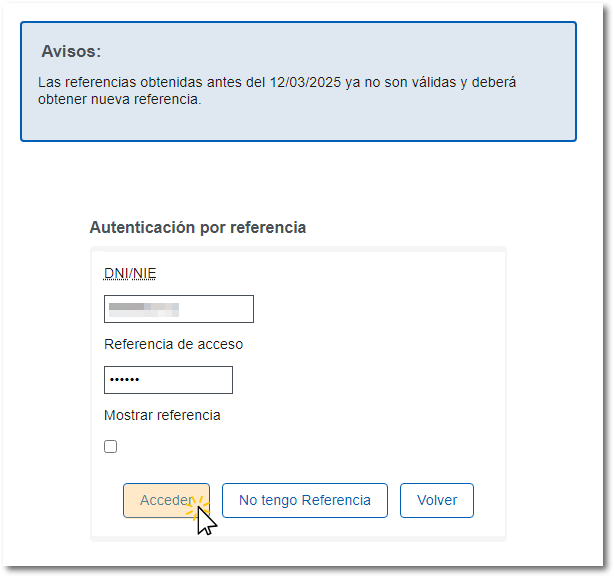

In the next window, you will need to enter the reference of the taxpayer's Income Tax file. Click "Login".

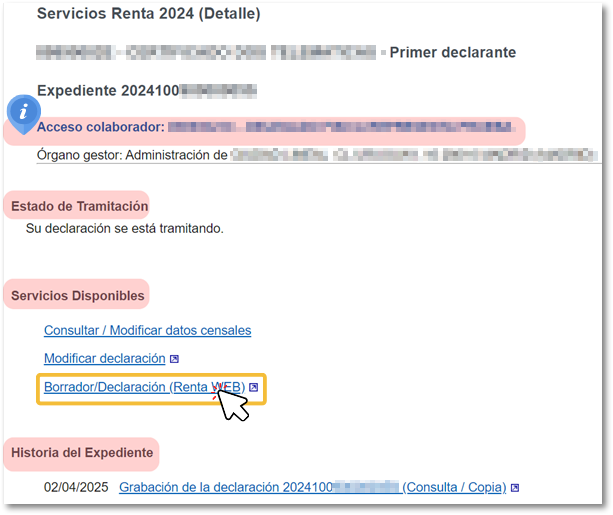

Once in the taxpayer's file, click on the link "Draft/Return (Renta WEB)" in the "Available Services" section to access the return.

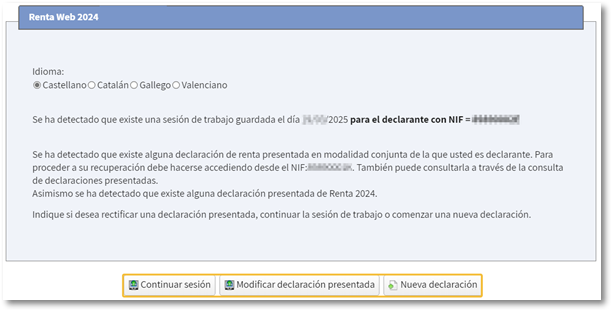

If you have already accessed Renta WEB at some other time, a pop-up window will inform you of the existence of a previous declaration, which you can recover from the option " Continue session ", modify a previously submitted declaration from " Modify submitted declaration " or start a new process from " New declaration ", incorporating the tax data again. You can also choose the co-official language in which you wish to make the declaration.

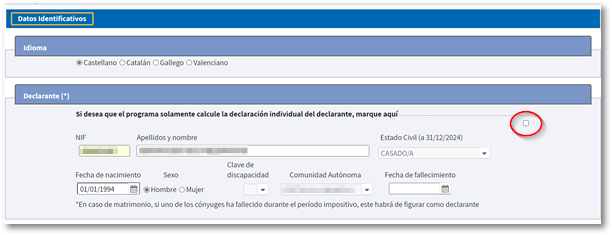

If this is your first time accessing the system, the identification data of the declarant and the rest of the members of the family unit will be displayed on the first screen. If it contains incorrect or inaccurate data or if any specific information has been omitted, you must modify it before continuing. Please note that identifying information cannot be modified later, except by generating a new declaration.

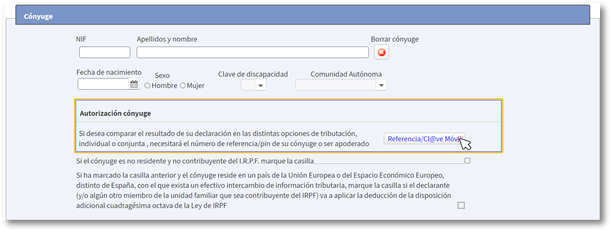

If there is a spouse, you must authorize the transfer of the spouse's tax data with the reference number or Cl@ve . If you do not wish to enter your spouse's tax information, check the box for calculating your individual tax return.