Submission of tax returns by corporate partners

Social collaboration in tax management allows for the completion of multiple procedures and actions over the Internet on behalf of third parties.

Social partners can register "delegates": employees of the collaborator, who can use their certificate as a natural person or as a company employee to act on behalf of third parties.

Thus, the submission of declarations on behalf of third parties is enabled both for the social collaborator and for the delegates of said collaborator.

Electronic certificates for presentations by social partners

The social collaborator may use electronic certificates of a natural person (if it is a natural person), of a representative of a legal person (if it is a legal person) or of the Entity Seal (only for machine-to-machine communications).

For their part, the delegate of a social collaborator may identify themselves with a certificate of a natural person of a personal nature or of an employee of the entity.

Submission of self-assessments with the amount to be paid

Order EHAC 1433/2007, of May 17, opens social collaboration for the presentation, on behalf of third parties, of the declaration models whose telematic presentation is mandatory, as well as for the transfer of the Direct Debit Order previously communicated to the Social Collaborator by the third parties he represents, for the purposes of payment of the tax debt resulting from the declaration.

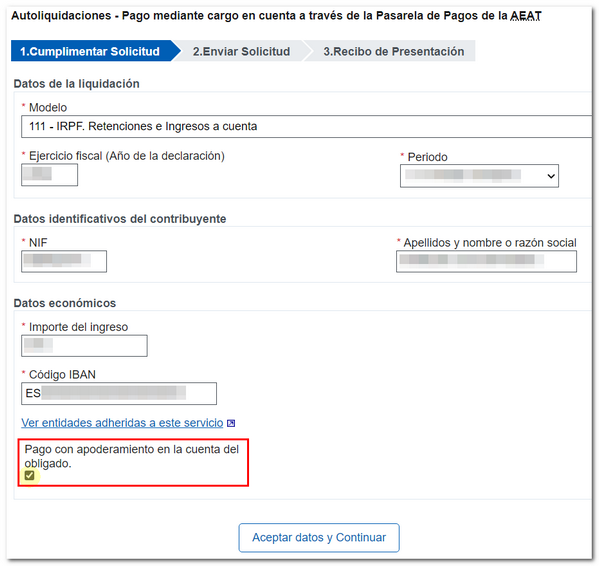

Social partners may submit third-party declarations that represent income when payment is made by direct debit. However, to make the payment and obtain the NRC , the payer must be the account holder, unless he or she has power of attorney from the obliged party (account holder) for the specific PAGOAPODECC procedure.

When this power of attorney exists, the box "Payment with power of attorney in the account of the obliged party" must be checked.

In the event that no power of attorney has been registered to make the payment, it is necessary that the indicated account belongs to the holder of the certificate used.

If you choose to submit the corresponding request for deferral or fractioning of debts together with the declaration, the procedure can also be carried out by a social collaborator who has signed the corresponding collaboration agreement with the AEAT.