Consultation and cancellation of information returns (Fiscal Year 2020 and subsequent years)

Skip information indexConsultation and cancellation of information returns (Fiscal Year 2020 and subsequent years)

From the electronic office you can consult, modify and cancel informative declarations. The options available when accessing the "Return enquiries and cancellations" service depend on the method of filing the return and the status in which it is found.

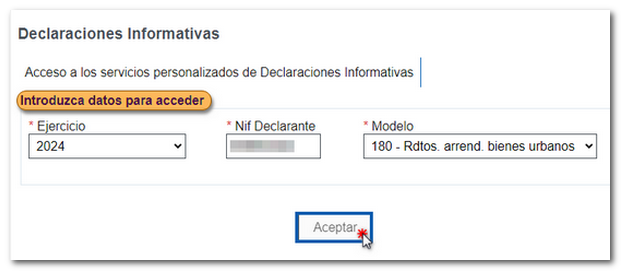

Select the fiscal year, indicate the NIF of the declarant and choose the model from the drop-down menu. By default, the model of the procedure you are in will appear. Then, press "OK".

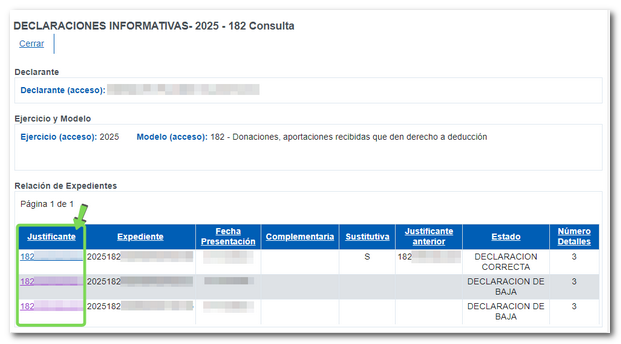

The list of files will be displayed, including the supporting document number, the file, the date of submission, whether it is a supplementary or substitute declaration, the supporting document number of the previous declaration, the status and the number of details (records).

To consult the declaration, see the available services and the history of the file, click on the receipt number located in the " Receipt " column.

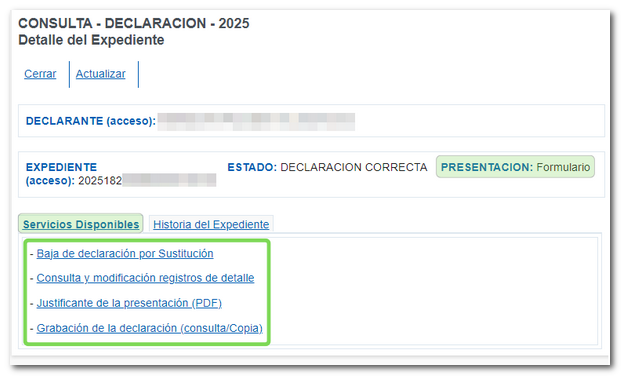

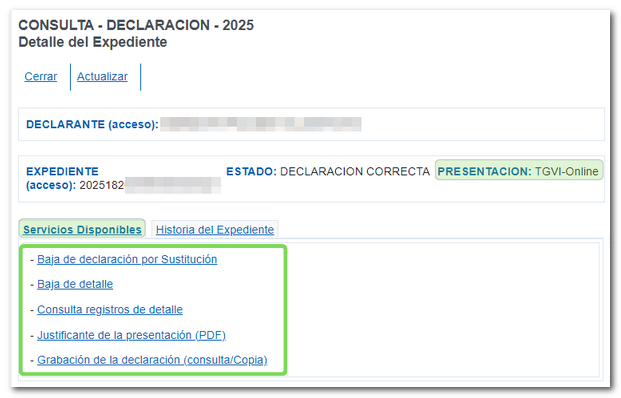

In the declarations whose status is " CORRECT DECLARATION ", depending on the presentation method of the model, by form or " TGVI - Online" (file), the following options will be displayed in the "Available Services" tab:

-

Deregistration due to substitution

-

Query and modify detailed records (if the declaration was submitted using form )

-

Low detail (if the declaration was submitted using file )

-

Check detail records (if the declaration was submitted using file )

-

Proof of submission ( PDF )

-

Recording of the statement (consultation/copy)

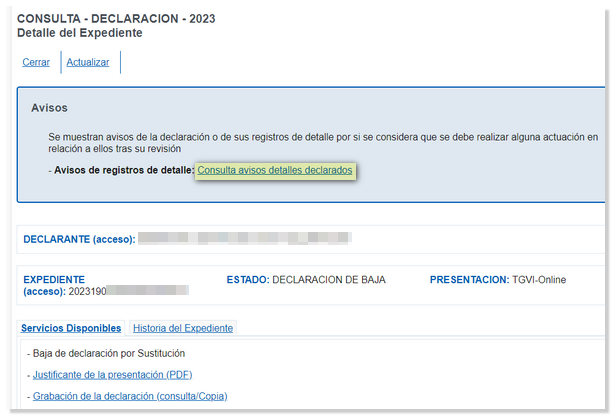

If the declaration was submitted with notices, a box will be displayed indicating this, from which the file can be downloaded in TXT format with the list of the same.

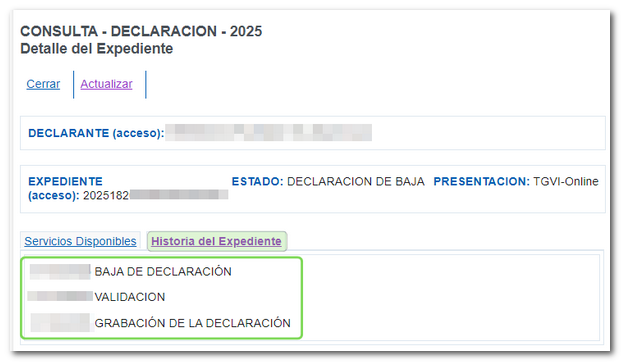

In the " File History " tab you will find a list of the actions that have been carried out with the declaration and the date of action.