Models 349 to 721

Skip information indexModel 721

Access to the presentation of model 721 can be done with an electronic certificate, electronic DNI or with Cl@ve . In addition to the holder of the declaration, the submission may be made by a third party acting on his or her behalf as a representative.

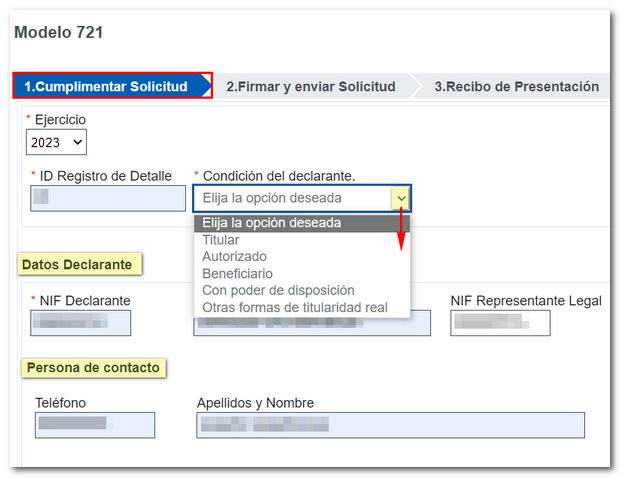

In the " 1. tab Complete Request " select the "Fiscal Year" of the declaration, indicate the "Detail Record ID" (it is a field chosen by the declarant, which must be unique, since, once used, it cannot be used again in the same fiscal year to which the declaration refers, even if the status of the record is "Cancelled") and the "Declarant Condition" in the drop-down menu, which can be: holder, authorized, beneficiary, with power of disposition and other forms of real ownership.

Next, continue filling out the rest of the sections. The fields marked with an asterisk are mandatory, although we recommend filling out all the fields to avoid errors or warnings.

In " Declarant Data " indicate the NIF of the declarant, Name or company name and NIF of the legal representative, if applicable. In addition, please provide a telephone number, surname and first name of the contact person.

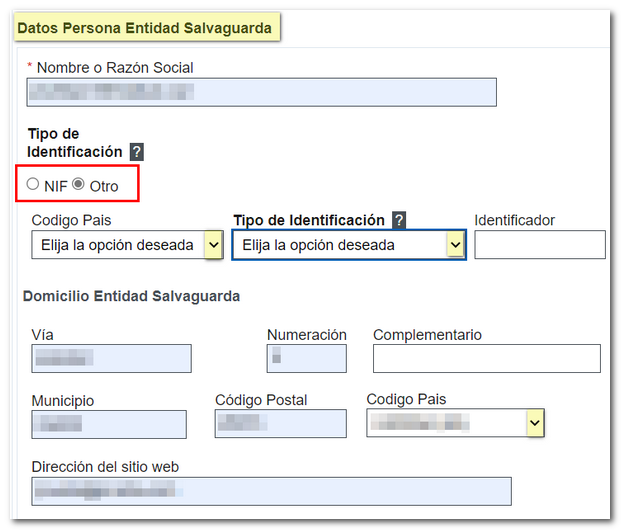

In "Safeguard Entity Personal Data" indicates the name and company name, in "Identification type" it is checked by default " NIF " and the box to enter the NIF , however, you can check the "Other" option and select the corresponding identification type from the drop-down list: NIF - VAT , passport, official identification document issued by the country or territory of residence, certificate of residence and other supporting document. If the ID type is NIF - VAT You do not need to fill in the "Country Code" field; for the rest of the options, it will be a mandatory field.

Below is the rest of the Safeguarding Entity's data.

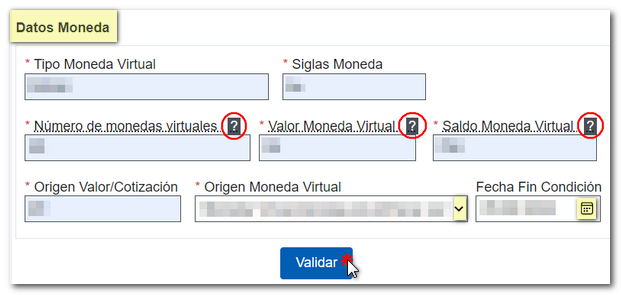

In the " Currency Data " section, fill in all the fields. To find out the maximum size of the "Number of virtual coins", "Virtual Currency Value" and "Virtual Currency Balance" fields, hold the mouse over the question mark symbol (?). Note that decimals must be separated using the period sign (.) instead of the comma sign (,). Only 6 decimal places are allowed, applying the rounding criterion if necessary.

To find out the information you must enter in each field, for example, "Value/Quote Origin" and "Virtual Currency Origin", you can consult the document "Contents of the information declaration on virtual currencies located abroad, form 721" available in the "Information" section.

The "Condition End Date" field is not filled in if the origin of the virtual currency is declared for the first time or has been declared in previous years.

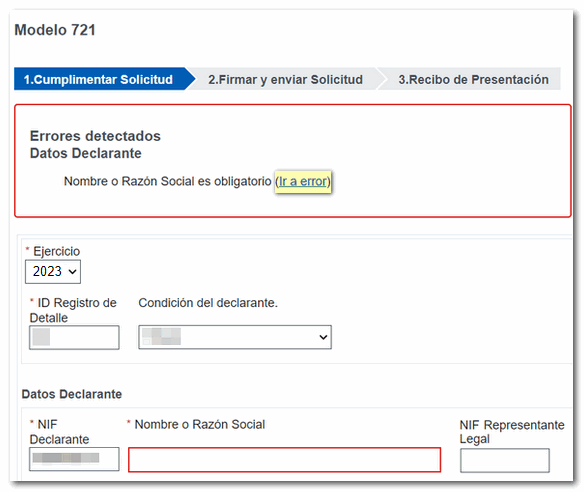

Finally, press the "Validate" button to check if there are any errors or you can continue with the submission of the model.

In case there is any error, you will have the description of it at the top and the option "Go to error" which will take you to the corresponding box to correct it. If everything is correct, you can continue to sign and send the declaration.

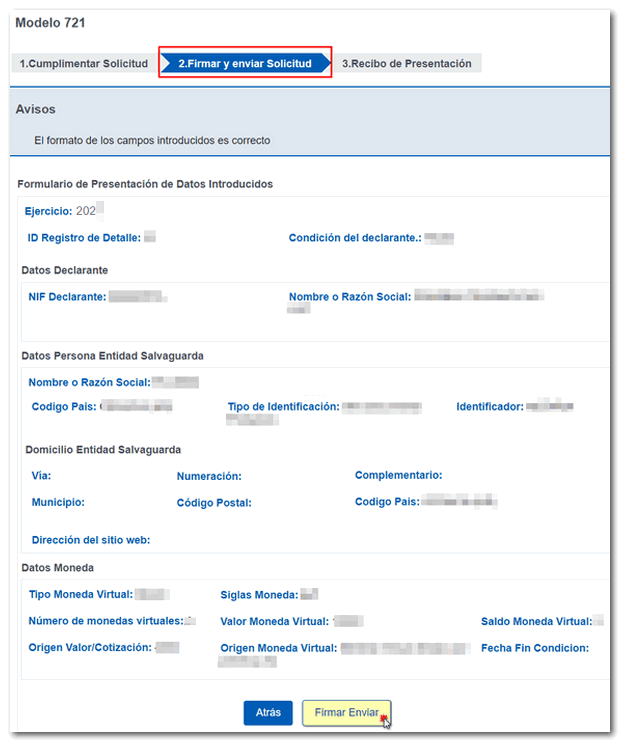

In the tab " 2. Sign and Send Request " You will get the summary of the data entered, check the information you are going to send, if the data is correct, press "Sign and Send" .

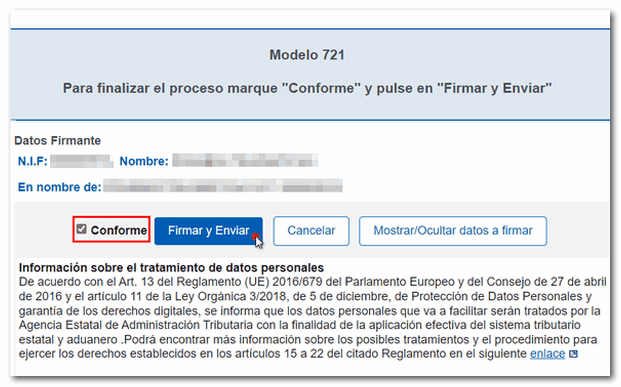

Then, in the data confirmation window, check the box "I agree" and click the button "Sign and Send" to finish the submission.

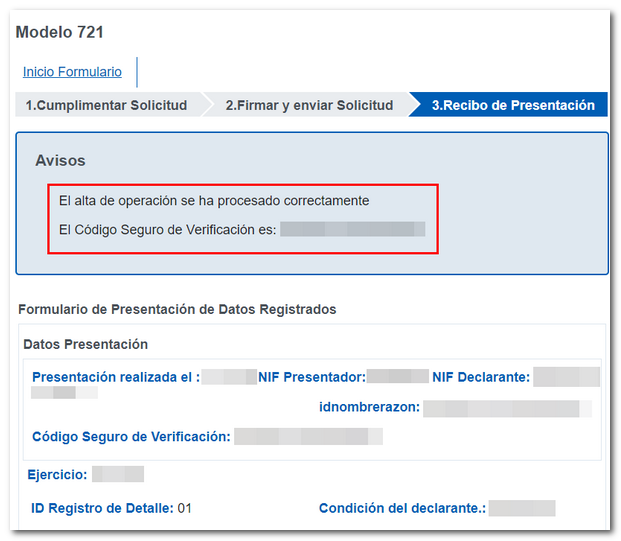

If the presentation is correct, you will go to the " 3. tab. Presentation Receipt " with the following notice: "The operation registration has been processed correctly" and the Secure Verification Code ( CSV ). Below is the "Registered Data Submission Form" that you submitted.