WEB Societies: Access, processing of model 200 and WEB Open Companies version

Skip information indexHow to modify a previously filed return - Corrective self-assessment - Lower income

If you have submitted a Form 200 declaration with a result to be entered and you want to correct it to declare a lower income, you must submit a corrective declaration.

Access the services of 2024 Partnership Campaign to rectify, complete or modify a previously submitted self-assessment. It incorporates the data included in the previously submitted self-assessment that is not subject to modification, those that are subject to modification, and those newly included.

When accessing it is necessary to choose the electronic certificate or Key of the holder (only for natural persons), if the presentation is made in his/her own name. Identification with is also possible eIDAS for citizens of the . EU

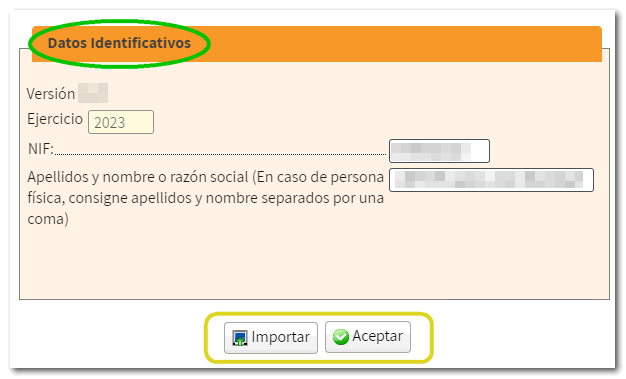

Fill in your identification details, select the fiscal year for which you want to submit the corrective self-assessment and click on "Accept".

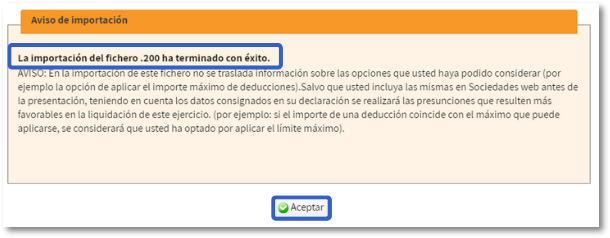

If you have generated a .200 file with the correct record layout, use the option "Matter"

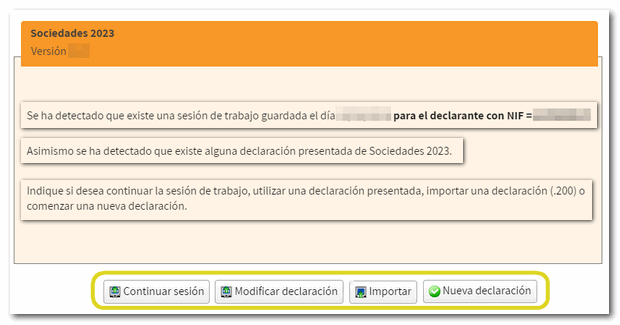

It will be detected that a return has already been filed and the "" button will be displayed. Modify statement".

If there is more than one previous declaration submitted, you must choose which one you want to recover.

Once you've logged in, the screen will show you the self-assessment you submitted.

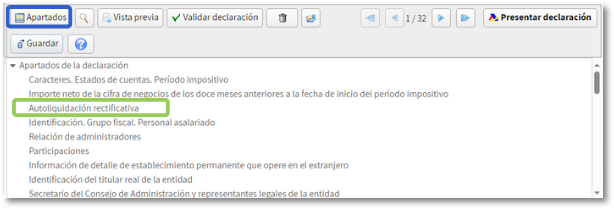

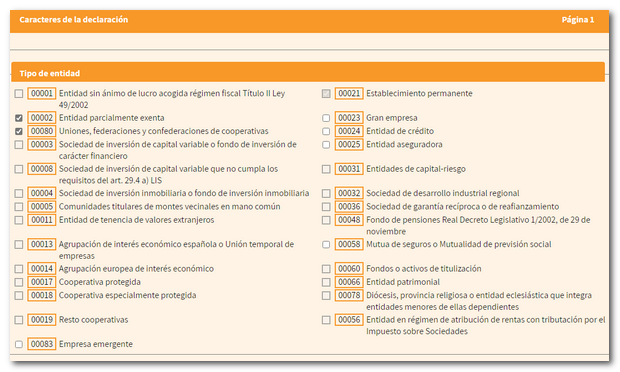

Locate in the tool button panel "Sections" and select "Correcting self-assessment".

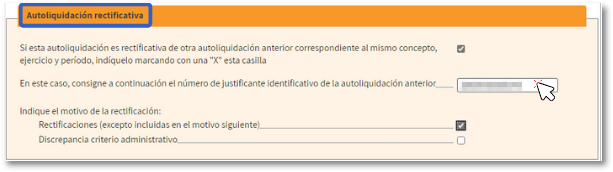

In this section, you must select the corrective self-assessment option, enter the receipt number for the previous self-assessment, and indicate at least one of the reasons for the correction.

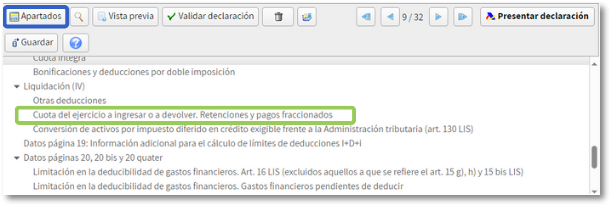

Correct the data you consider and when you have finished, locate it again in "Sections" the option “Amount of the fiscal year to be paid or returned. Withholdings and fractional payments”.

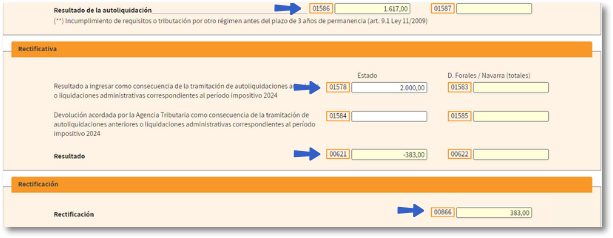

In the section of “Rectificative” You must enter in box 01578 the positive amount from box 01586 of the self-assessment being corrected.

The result of the correction will be automatically calculated in box 00621.

The amount that may be due as a result of the corrective self-assessment will appear in box 00866.

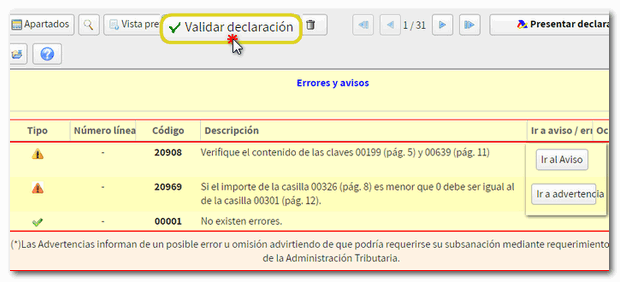

Click on "Validate declaration" to check if there are any errors, warnings and/or notices and if everything is correct, click "File a statement".

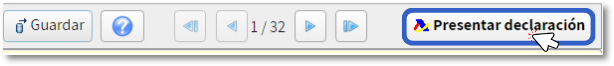

If everything is correct press "File a statement".

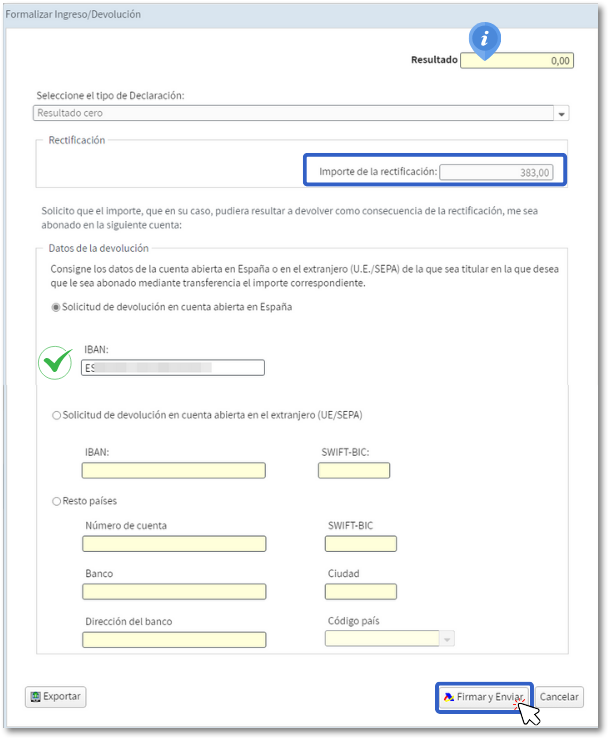

You must enter the account number where you want to receive the refund or indicate if you wish to opt out.

The result is considered a refund of undue income that is declared in the aforementioned box 00866 and therefore in the type of declaration it will appear as "Zero result" and the associated return. Please provide a bank account that you own and that is reported to the AEAT conveniently and if your entity is not a collaborator, use the option of accounts abroad.

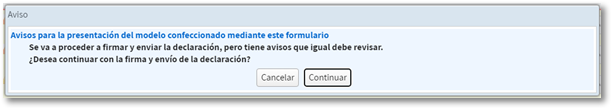

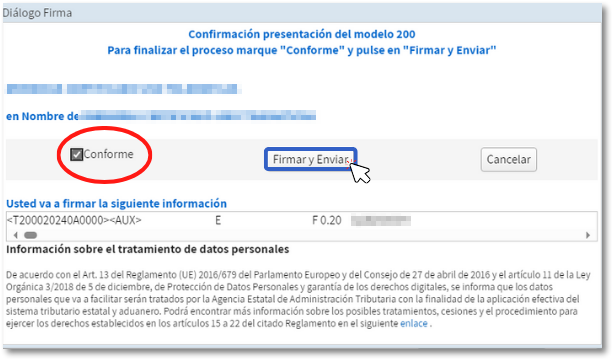

A screen will appear if you have any pending notifications so you can review them if you wish and continue with the presentation.

Press "According" and "Sign and Send" to conclude the presentation.

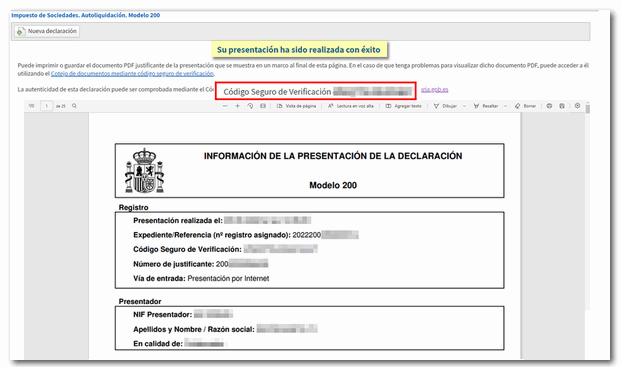

The report of the submitted declaration is displayed on the screen in format PDF with the CSV of the statement.

Don't forget to print or save the proof of submission.