Debt deferral and installment payments

Skip information indexManagement of deferrals and installments

Depending on the status of the deferral request, you may be able to send a request, view the agreement that informs you of the granting or denial of the request, access the payment letter, the payment itself, and find out whether the request has been finalized.

To access it is necessary to identify yourself with the electronic certificate, DNIe , eIDAS or Cl@ve of the taxpayer. If you access as a representative, you will need to use an electronic certificate.

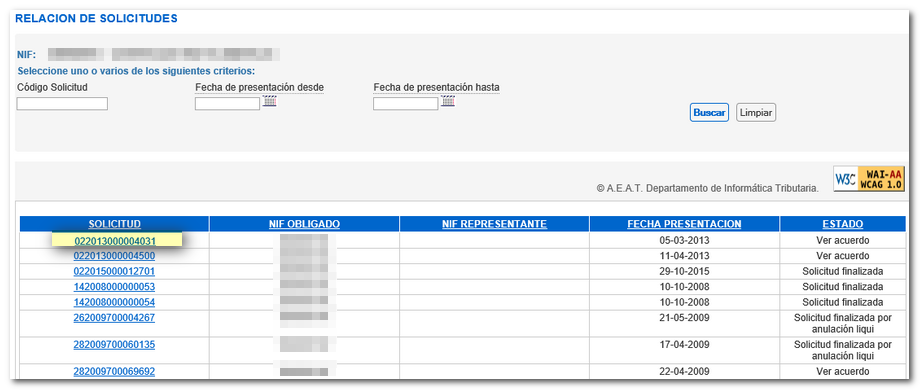

It is possible to filter the search for deferral requests by application code and/or submission date.

All requests for deferral by the party liable for payment that are in a position where the form can be submitted online are listed.

If there are several deferrals for a holder, a list of all of them is displayed.

The possible statuses of the deferral request are:

- Application in process. This status means that it is pending various checks. "Application in process" is also displayed if an agreement has already been issued but has not been notified.

- See agreement. In this case there are two possible options:

- Denial. Agreement terminated due to denial. The "Resolution" includes the payment letter (form 010).

- Concession. Allows you to generate payment letters from the application (top bar).

- Application completed.

- Application terminated due to cancellation.

- Application terminated by withdrawal.

- Request completed by file.

For more information about the deferral request, click on the request number.

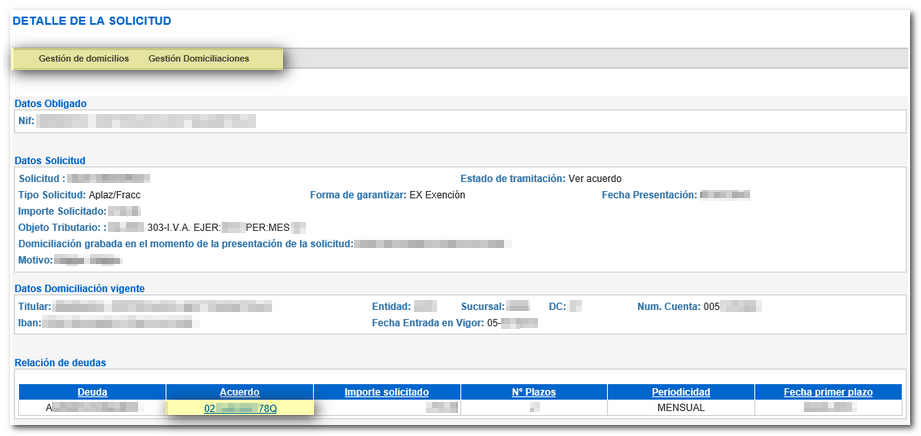

Below is the "Request Detail" which allows you to see:

- Detailed consultation of the status of the deferral process.

- Check the deadlines granted.

- Consultation of the deferral agreement.

- Payment in installments.

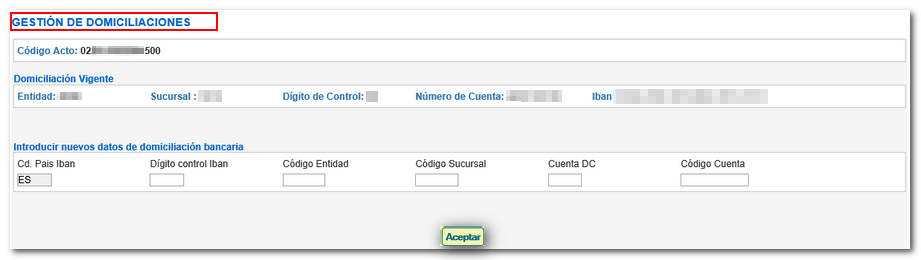

Depending on the status of the request, two options will be displayed in the top bar: "Home management" and "Direct Debit Management".

Direct Debit Management, allows you to change the direct debit account number.

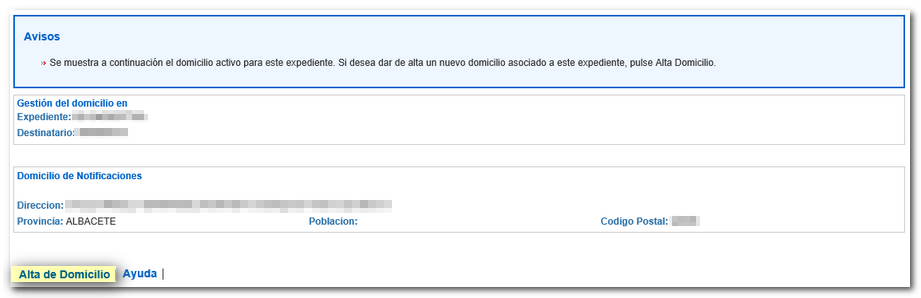

To register another address, there is the "Address Registration" option, which is found at the bottom of the screen.

For those applications for which an agreement has been issued and notified, clicking on the agreement number displays other available options that depend on the outcome of the agreement:

- Agreement granted: allows at least "View resolution" and "Pay".

- Agreement denied: allows "View resolution" and "Address management". The resolution includes a payment letter (010) to make the payment.

It is important to note that from "Management of deferrals as a taxpayer / Representative" it is only possible to generate payment letters for those applications in which a deferral granting agreement has already been issued and notified.

It is not possible to view previously generated payment letters.

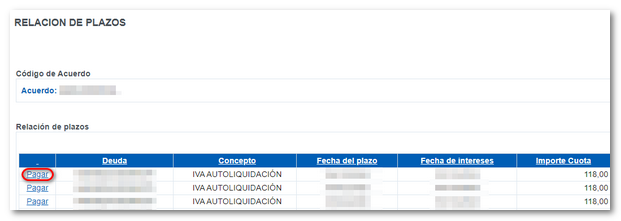

Once inside the Agreement, click "Pay" at the top, and then "Payment in terms" to display the list of granted terms. Find the term that interests you and click on "Pay".

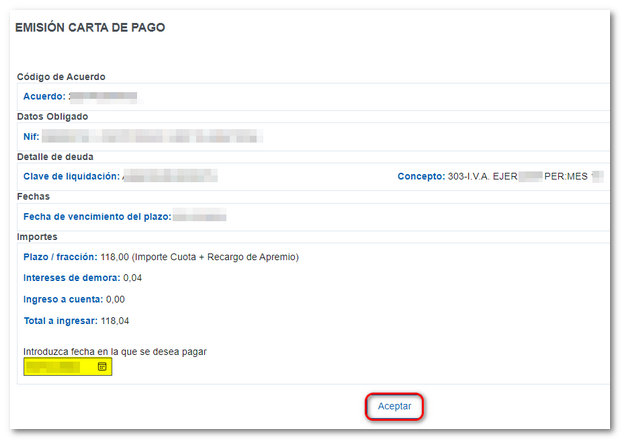

A summary will appear with the data for issuing the receipt of payment. Enter the date you wish to make the payment and then press "Accept".

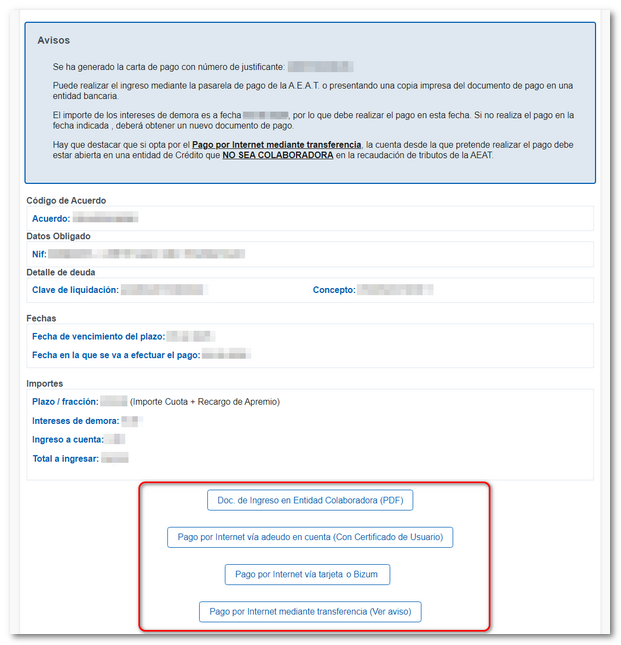

You obtain the information related to the receipt of payment and the options to generate the document PDF or make the payment online.

The available options are:

- payment document to Collaborating Entity (PDF)

- Payment via online direct debit

- Pay online via card or Bizum

- Payment via Internet bank transfer (See notice)

Remember that the consultation of the submitted deferrals can be carried out, either in your own name or as a representative (attorney to the GENERALLEY58 formality or to the specific RB01011). As a social collaborator, without power of attorney, it is not possible to consult the submitted deferral.