Debt deferral and installment payments

Skip information indexRequest for deferrals and installments

Debts, whether voluntary or executive, may be deferred or paid in installments under the terms established by regulation, upon request of the taxpayer, when his/her economic-financial situation temporarily prevents him/her from making payment within the established deadlines.

Applications for deferral of debts may be submitted on your own behalf, as a social collaborator or as an agent to carry out this procedure.

To access the submission of the deferral request, it is necessary to have an electronic certificate, electronic DNI , Cl@ve or eIDAS .

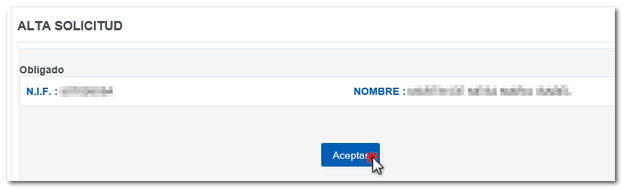

Access with Cl@ve only allows you to process your own debts. If you access as the person required to submit the application, either with an electronic certificate, DNIe , eIDAS or Cl@ve , the following screen will be displayed for "Accept".

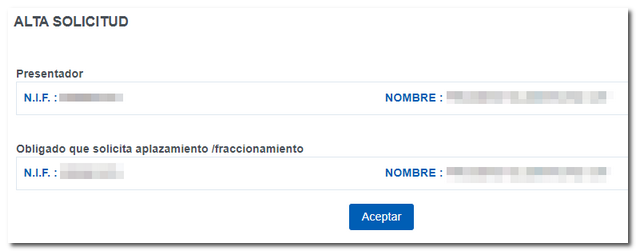

If you are accessing as a social collaborator or have a power of attorney, fill in the box for NIF of the person obliged to request deferral/partition payment and click "Accept".

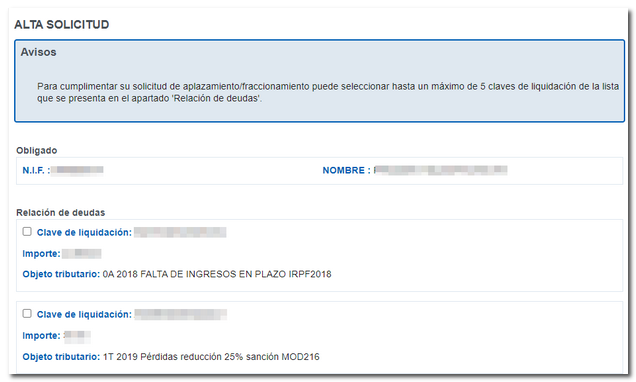

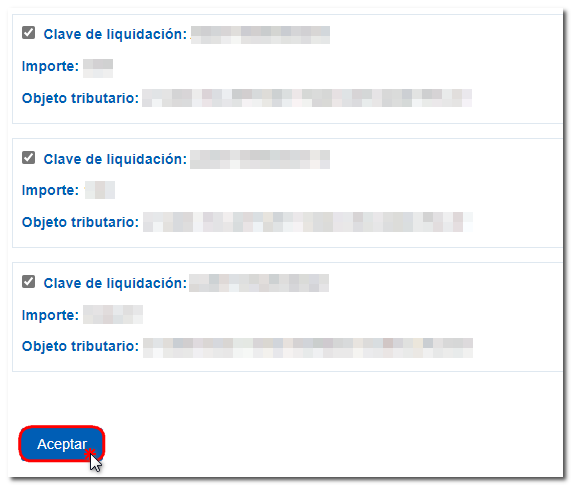

In one submission, it is possible to manage the request for up to 5 debts by filling in the settlement code (code that begins with the letter A followed by 16 numbers) in the "Debt..." box. Select those you want to process and click "Accept."

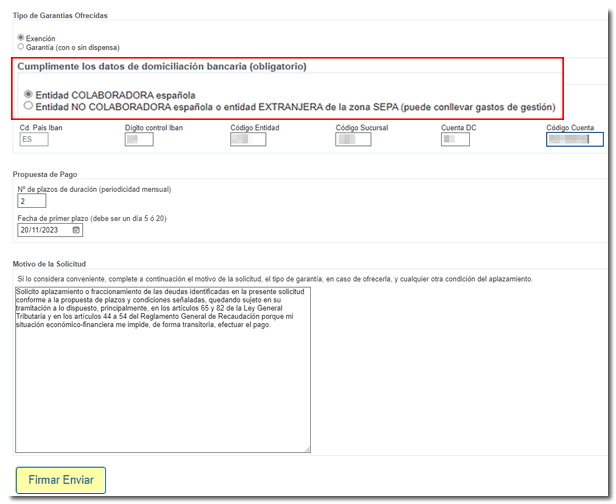

The requested information is: settlement key, amount, type of guarantees (if necessary), details of the direct debit bank account, number of installments, frequency, date of the first installment and reason for the request.

The payment method is direct debit, except for NIF that begin with the letters E, H and U, for these NIF leave the bank account details blank.

The date of the first installment will be the 5th or 20th of the month corresponding to the expiration of the term or fraction or the next business day.

Once you have completed the data, by clicking "Accept" you continue with the process.

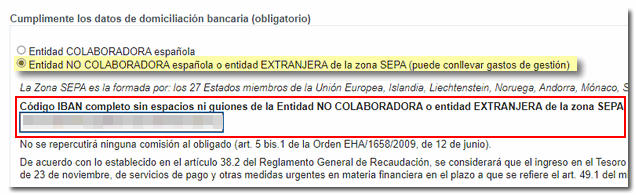

Furthermore, according to Order HFP/387/2023, of April 18, direct debit is made possible in accounts of entities that do not collaborate in state tax collection management, provided that they are located within the Single Euro Payments Area (SEPA). If this is the case, select the corresponding option in the direct debit details.

On this screen you can "Sign and Send" and finally obtain confirmation of the submission of the deferral.

Once the application has been submitted, it is necessary to wait for the deferral to be processed.

The taxpayer who has submitted the request for deferral of a debt can consult the deferral request document and the processing status by accessing the option "Manage deferrals as a Taxpayer" or in the "Collection" procedures.

If the deferral request has been submitted for a third party, you will only be able to consult and download the submitted deferral request document if you have a specific representation for this or have a power of attorney from the person obliged and access the option "Manage deferral as Representative..." or in the "Collection" procedures.