Payment of self assessments in the name of a third party

If payment is made on behalf of a third party, the holder of the electronic identification and the account holder must be the same, although at the time of payment the NIF of the declarant or debtor will be provided.

You can also make the payment at any branch of your bank, providing all the required details. It is not necessary to provide any model, only the data used to generate the NRC and which are the same as those requested to make the payment through the Tax Agency website (model, fiscal year, period, NIF declarant, surname and exact amount of the income).

Therefore, if you are making the payment on behalf of another person, you must bear in mind that in order to obtain the NRC through the AEAT payment gateway, the certificate holder and the account holder must coincide as the payers, but the NIF provided to the Collaborating Entity to obtain the NRC will always be that of the declarant or taxpayer.

Payment on behalf of third parties from the account owned by the taxpayer

Since the entry into force of the Resolution of June 3, 2009, it is possible to make the payment by direct debit through the website of the AEAT in an account owned by the taxpayer and that the debit order is made by a person other than the taxpayer.

If the payment is being made on behalf of a third party, using the tax return holder's bank account, the payment originator must be authorised to carry out this operation.

This authorisation can be done online as long as the authorising party (who must be the taxpayer) has a digital certificate and is a private individual. The specific authority to carry out this type of procedure is "PAGOAPODECCC - Payment by direct debit".

To make the payment on behalf of a third party, you must select the box "Payment with power of attorney from the taxpayer's account” in the form, under the details of the financial institution.

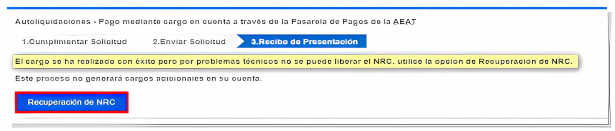

If on any occasion you have not been able to obtain the Reference Number NRC due to a specific incident, you can recover it by accessing the payment gateway again, a window will be displayed with the button "Recovery of NRC " next to the text " The charge has been made successfully but due to technical problems the NRC cannot be released, use the Recovery of NRC option. This process will not generate additional charges to your account ". This text indicates that the operation was successful and the charge exists.

This button allows you to obtain the NRC immediately and does not generate new charges .

For the " NRC Recovery" button to be displayed, these requirements must be met:

-

That you are accessing the payment or linking from a form, with the Payment Gateway of the AEAT and you are not accessing the option to consult a previous payment.

-

That you have made the payment correctly and there is a charge in the Financial Institution .

-

You have not obtained the NRC on the screen due to an incident, possibly very specific.

Information on how to arrange an authorisation for online filing

For further information on power of attorney, go to the "Registration of power of attorney" section.

The power of attorney option allows you to provide authorisation to a third party (natural person or legal entity) so that they (the proxy), using electronic identification, can perform any of the tax procedures and actions established for the appointing person.

In the event that registration is carried out online, the grantor may be either a natural person or a legal person or one lacking legal personality. With this option, it is the appointing person who must register the power of attorney using electronic identification.

If the principal does not have an electronic certificate or is not registered in Cl@ve, the possibility of presenting the power of attorney in the Electronic Registry of the Tax Agency has been provided to generate the power of attorney using the procedure "Request registration of power of attorney for tax procedures" within "Request registration of power of attorney through public document". In this type of request for incorporation of powers into the Registry of Powers of Attorney, it is not necessary for the grantor to participate at any time, since he or she already granted the power before the Notary. Another option is to request authorizations and revocations for your representatives by appearing in person before the Delegations and Administrations of the AEAT by appointment, attaching the corresponding "Power of attorney templates for online procedures."