Free VERI*FACTU application from the AEAT

Skip information indexAccess, identification and application features

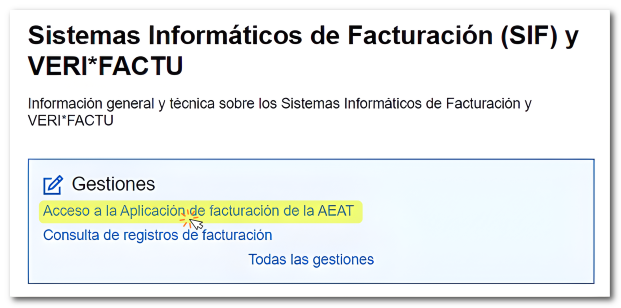

The free billing app from the AEAT It is available on the Electronic Office, under "Information and procedures", "VAT", "Billing Computer Systems (SIF) and VERI*FACTU", in the link "Access to the Billing Application AEAT".

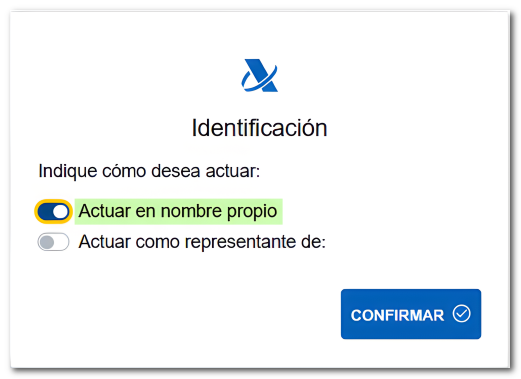

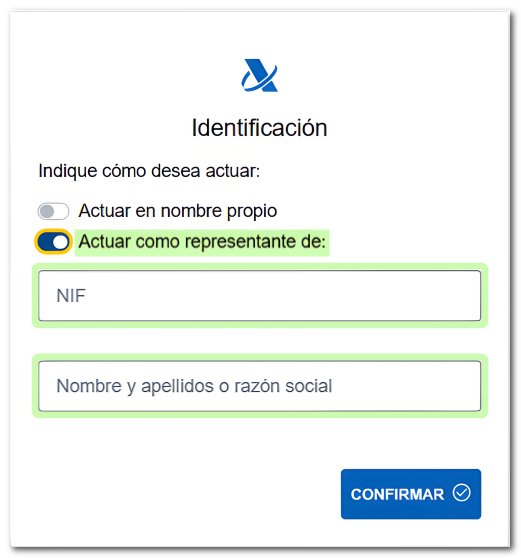

Identify yourself with Cl@ve Mobile Cl@ve, certified or DNI electronic.

Next, please indicate whether you are acting on your own behalf or as a representative. Please note that it is only possible to issue invoices in your own name or through a third party who has registered the specific powers of attorney IZ862 and IZ863, or the general power of attorney Law 58/2003, which includes the two above.

Once you've logged in, the application's access menu appears, where you can access the various functions and services offered by the program.

It is recommended that the first time you enter the application, you enter your information in the "Issuer Modification Form", from the option "My data", so that every time you generate a new invoice, this data appears automatically, making it easier to complete.

The free billing application provided by the AEAT It allows taxpayers to generate electronic invoices and send billing records directly to the Tax Agency, thereby complying with the VERI*FACTU regulations.

The application is primarily aimed at professionals, freelancers, and low-revenue companies that don't have their own software or prefer a free alternative. These are some of the features of the application that you should keep in mind before starting to use it:

- There is no invoice limit, neither annual, nor monthly, nor weekly.

- Invoices can only be issued in your own name or through an authorized representative.

- All invoices must include a recipient Therefore, it is not possible to issue simplified invoices (tickets). Invoices with regime codes 03 (special regime for used goods, works of art, antiques and collectibles), 05 (special regime for travel agencies), 06 (special regime for groups of entities in VAT - Advanced Level) and 09 (invoicing for the provision of services by travel agencies acting as mediators on behalf of and for the account of others) are also not accepted.

- Multiple recipients are not allowed.

- Exclusive management in the application: Invoices and records generated can only be managed from this same application. It is not possible to export records to continue billing in another billing computer system (SIF).

The application therefore offers the following advantages:

- Simplicity in management, as it does not require advanced technical knowledge or additional software.

- Regulatory compliance by ensuring that the invoices issued comply with the security and traceability standards established by the AEAT .

- Integration with the AEAT, as it facilitates direct communication with the Tax Agency, ensuring the correct registration and storage of invoices.