Form 130

Skip information indexFiling Form 130 using data from previous returns

Form 130 has the functionality that allows you to retrieve data from a previously submitted declaration.

You can access by identifying yourself with Cl@ve , certificate or DNIe . If you have questions about how to obtain an electronic certificate or how to register in the Cl@ve system, consult the information available in the related content.

If the declarant does not have an electronic certificate, it is necessary that the person making the submission be authorized to submit declarations on behalf of third parties, either by being registered as a collaborator or by being authorized to carry out this procedure.

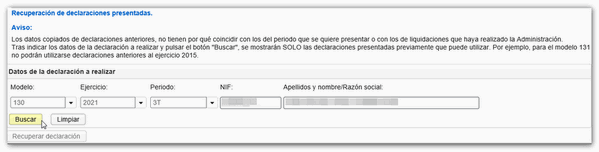

In the "Recovery of submitted returns" window, enter the details of the return you wish to make (Model, Fiscal Year, Period, NIF , Last name and first name or Company name). Data from a previous declaration may only be transferred if it was submitted electronically using a form. If it was submitted in batches or by pre-declaration, the information cannot be obtained.

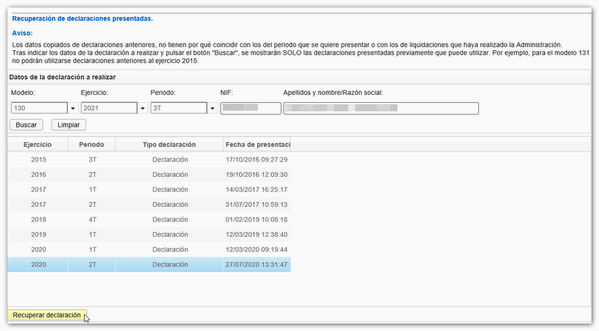

Click "Search" to display the tax returns for the years and periods that can be used based on the year and period indicated in the tax return to be made.

Select the return you wish to recover from the list of available returns and click "Recover return".

The Model 130 form will then open in a new browser window or tab.

The settlement data will appear completed according to the recovered declaration. However, it can be modified and information can be added as appropriate.