Model 216

Skip information indexSubmission of form 216. Exercises 2018 to 2023

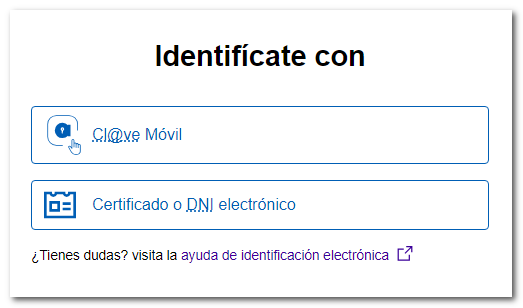

You can access by identifying yourself with Cl@ve , certificate or DNIe . If you have questions about how to obtain an electronic certificate or how to register in the Cl@ve system, consult the information available in the related content.

If the declarant does not have an electronic certificate, it is necessary that the person making the submission be authorized to submit declarations on behalf of third parties, either by being registered as a collaborator or by being authorized to carry out this procedure.

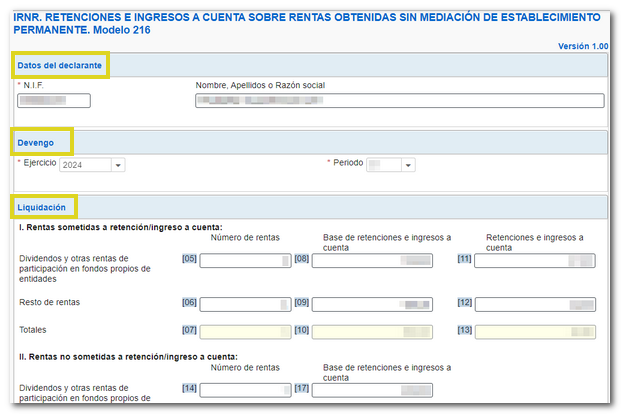

Once in the form, proceed to fill out the declaration, making sure to include data in the fields marked with an asterisk, which are mandatory. The surname, first name and occupation are automatically filled in. Select the period from the drop-down menu.

If there are financial data to be declared, they are included in the "Settlement" section. The program itself calculates the result.

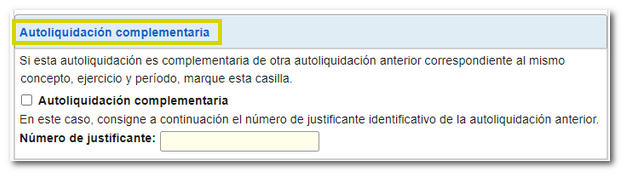

If this is a supplementary declaration, fill in the relevant information and check the corresponding box; in this case you must enter the proof of the previous declaration.

To check if there are errors in the declaration, click on "Validate".

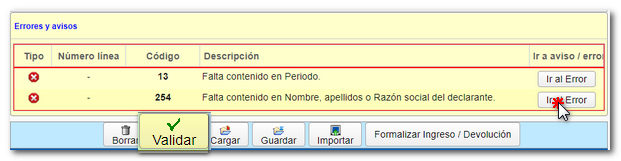

If it contains errors or warnings, the "Errors and warnings" tab will be enabled with the description of the error or warning and the "Go to Error" or "Go to Warning" button, as appropriate, which will lead to the box to modify or complete. If the statement contains no errors you will get the message "No errors exist".

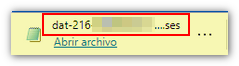

The "Save" button allows you to save the completed declaration on the servers of the AEAT in dat-216 format- NIF -ddmmaaaa.ses.

You can retrieve this statement using the "Load" button from the folder where it was saved.

Using the "Import" button, you can retrieve in the form the file with the .216 extension that you have previously exported, or any other file created with an external program that complies with the record design for model 216 of the corresponding year.

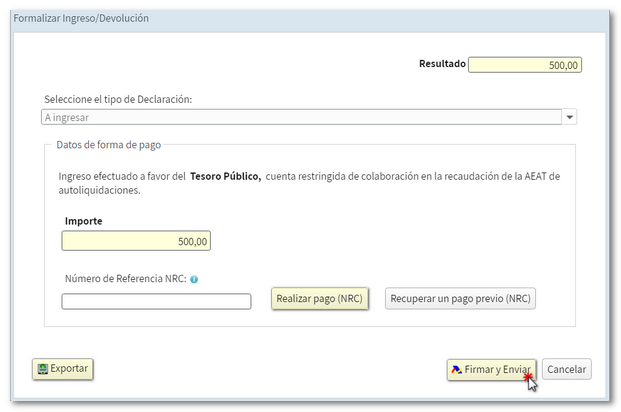

If the data is correct, click "Formalize deposit/refund"

If the result of the tax return shows a payment due and you do not choose direct debit as your payment method, you will need to obtain a NRC proof of payment. The NRC is the Complete Reference Number, a 22-character code that serves as proof of payment and in which the information of the NIF of the declarant, amount, model, fiscal year and period is incorporated in an encrypted form.

You have several ways to make the payment and obtain the NRC :

- By contacting the Bank directly or through its website if it offers this service.

- Through the Tax Agency's payment gateway, from the "Pay, defer and check debts" option or from the "Make payment" button (NRC)"within the form itself."

Using the "Export" button, you will obtain a file in BOE format that you can save and that is valid for submission. The file name consists of the declarant's tax identification number, the year, the period, and the extension .216.

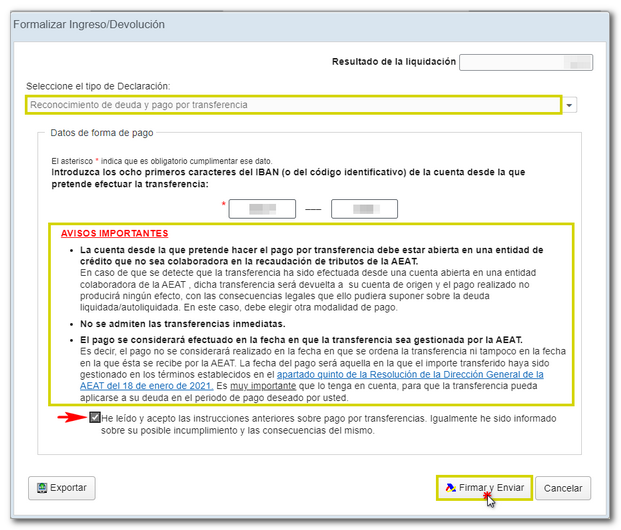

To continue with the presentation, click "Sign and Send."

New this year is the option of "Debt Acknowledgment and Payment by Transfer" provided the account is opened with a credit institution that DOES NOT COLLABORATE in the collection of taxes of the AEAT. The program itself provides you with payment instructions.

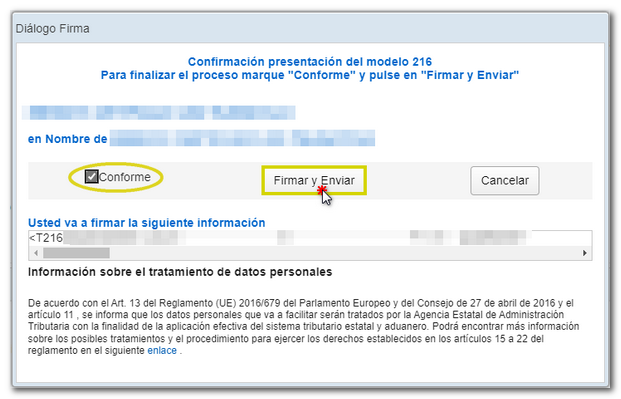

After signing and sending, the compliance window appears. Click "Agree" and then "Sign and Send"

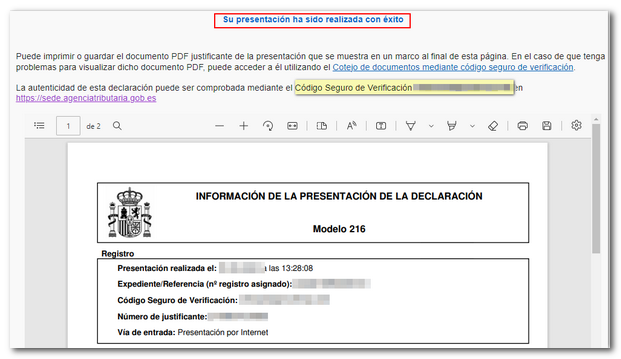

The result of a successful submission will in any case be the response page showing "Your submission has been successfully completed" with an embedded PDF containing a first page with the submission information (registration entry number, Secure Verification Code, receipt number, day and time of submission and details of the submitter) and, on the subsequent pages, the complete copy of the declaration.