Model 226

Skip information indexForm 226. Empowerment between spouses

The holder who identifies himself with his certificate / DNI electronic to present the model 226 in joint mode must have been previously authorized by the spouse to present the declaration.

The granting of power is carried out from management "Power of attorney between spouses for the presentation of joint applications for the application of the optional regime". Supports identification with certificate / electronic DNI and also with Cl@ve PIN.

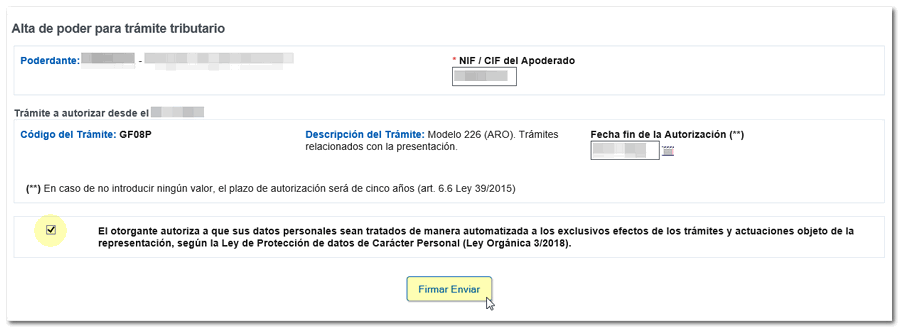

Enter the NIF of the representative (the person you authorize to submit the joint Form 226) and indicate the end date of the authorization.

Note: If the "Authorization end date" field is left blank, the power of attorney will be effective for 5 years.

Next, check the box authorizing the processing of personal data for the purposes of the procedures subject to the representation and press "Sign Send" .

Check the "I agree" box and press "Sign and Send."

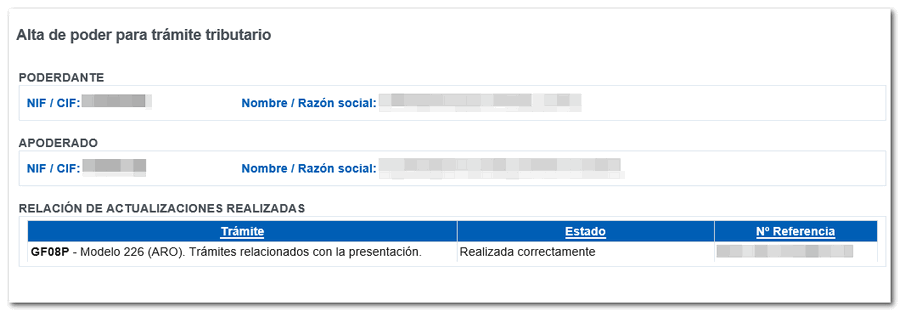

You will receive the receipt with the NIF of the grantor, the NIF of the agent, the procedure subject to the power of attorney and the reference number.

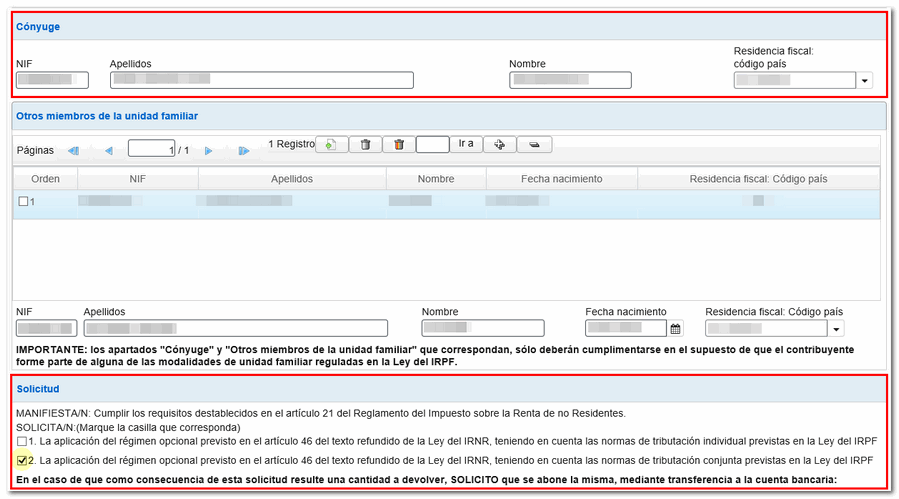

Once the power of attorney has been made effective, Form 226 can be submitted jointly, including the spouse's details and marking the corresponding options for this tax option.