Model 226

Skip information indexPre-declaration Form 226

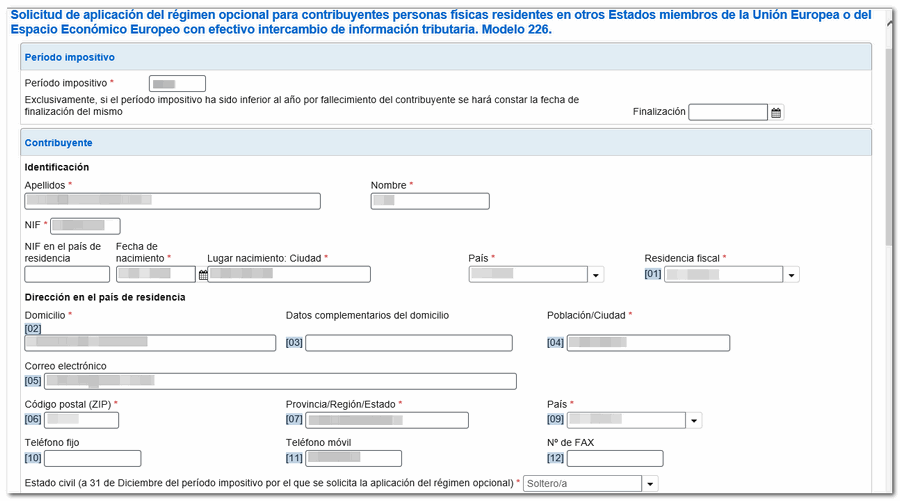

The "Model Application Form for the optional regime for individual taxpayers resident in other Member States of the European Union (pre-declaration)" allows you to obtain the valid application in PDF for printing and presentation.

Fill in the corresponding data in the declaration, taking into account that the fields with an asterisk are mandatory.

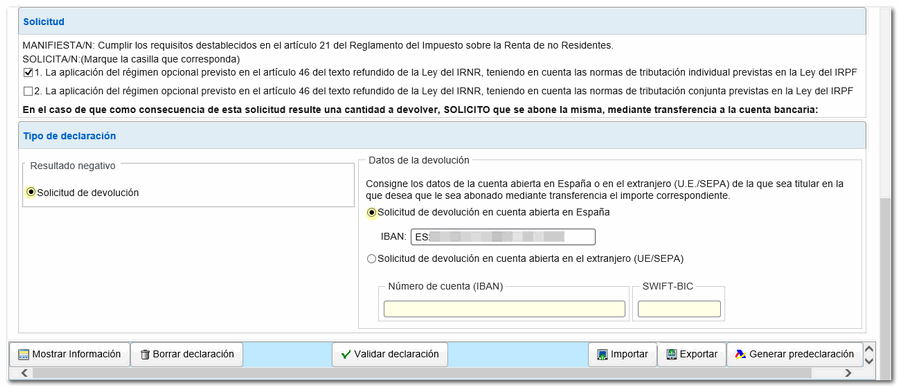

Any refund that may be made will be made by transfer to the bank account of the taxpayer's name indicated in the application and which must be identified by the IBAN code .

Within section "Type of declaration" select option "Refund request" . Next, select "Request for refund on account opened in Spain" or "Request for refund on account opened abroad ( EU / SEPA ) , as appropriate, and enter the required data.

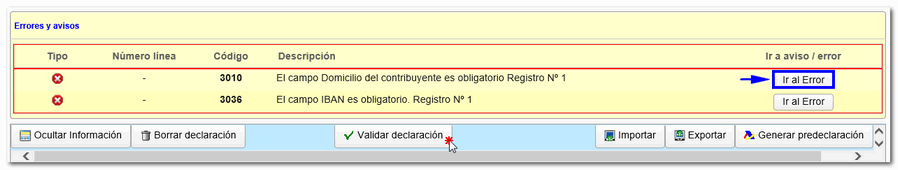

The different functionalities of the form are located in the button bar at the bottom. You can press the "Validate declaration" button to have the application display any pending errors and warnings. The "Go to error" option will direct you to the section or field that you need to review or correct.

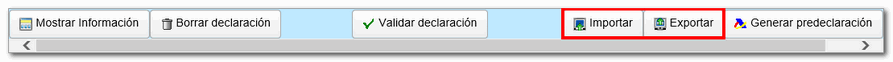

The "Export" button generates the declaration text file. The file name will be the NIF of the holder and the extension will be "226". This file can be imported back into the form using the "Import" button.

If there are no errors, press "Generate pre-declaration" .

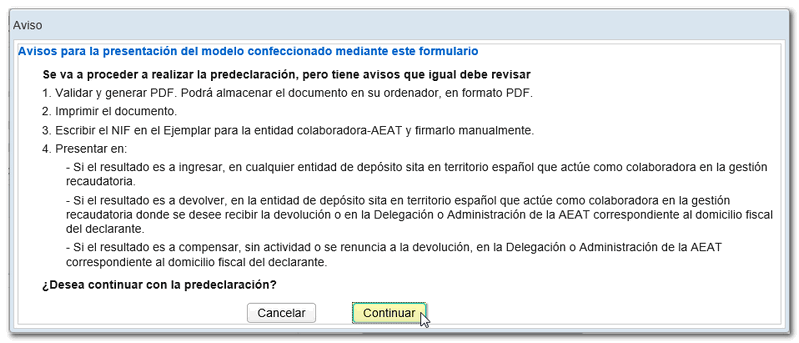

An informational notice will be displayed with submission instructions. Once you have obtained the PDF you must print it and include the NIF of the holder or holders and the signature manually. In the case of joint taxation, the application must be signed by both spouses.

After reading the information carefully, press "Continue" .

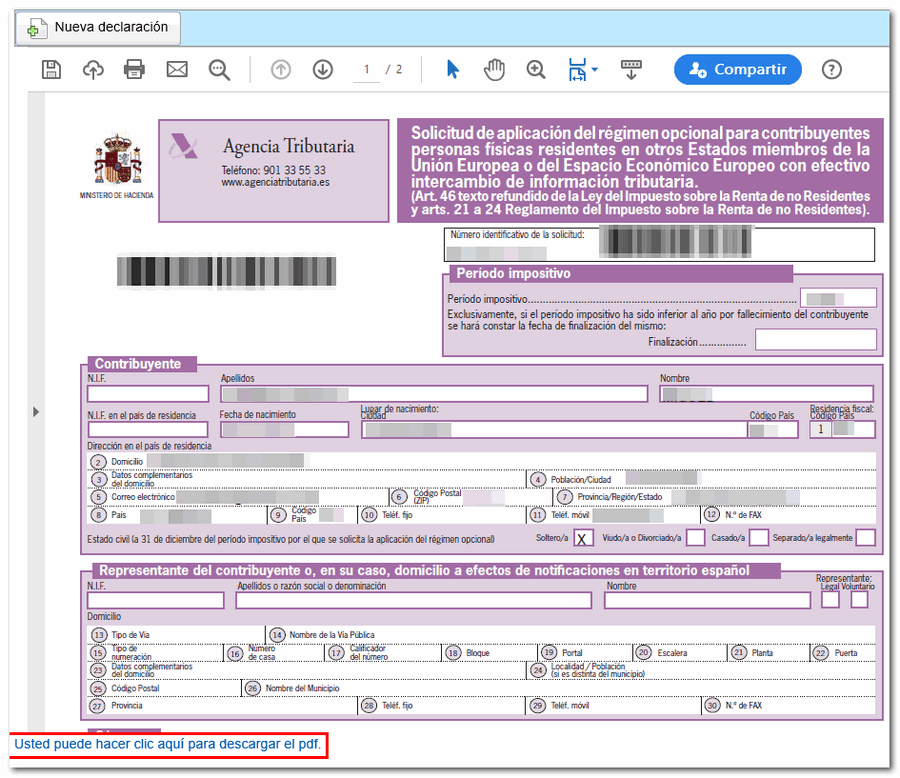

You will receive the PDF of the pre-declaration with the barcode of the label with the identification data of the holder. At the bottom left click the link to download the document.

Obtaining the application in PDF does not imply that said application has been submitted. The printed pre-declaration must be submitted together with the corresponding documentation at the Tax Agency's registration offices, in person or by certified mail.