Model 226

Skip information indexForm 226. Electronic filing

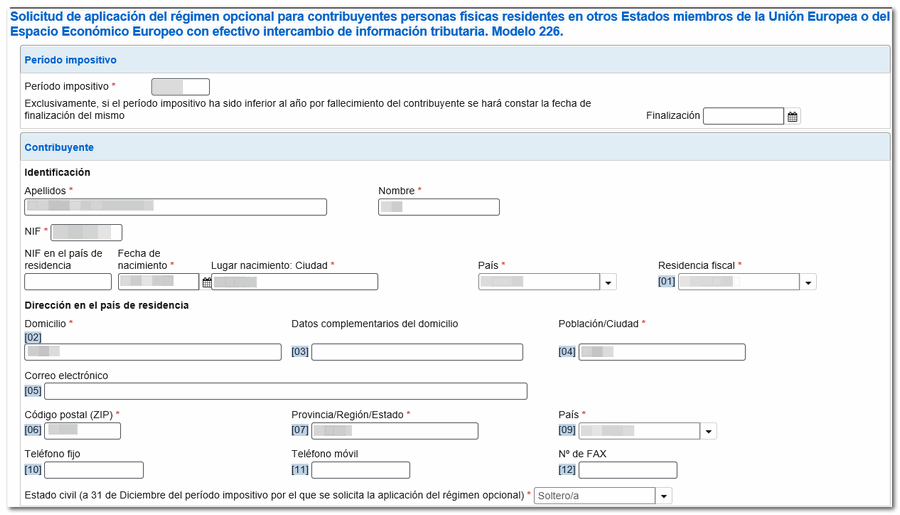

Access to "Model 226. Application for the optional regime for taxpayers who are natural persons resident in other Member States of the European Union or the European Economic Area with effective exchange of tax information" requires identification with a certificate or electronic ID .

The declaration may be submitted by the taxpayer or by persons or entities empowered or having the status of social collaborators in the application of taxes.

In the case of joint taxation formulated by both spouses, one of the holders must be identified, who must have been previously authorized by the other from management "Power of attorney between spouses for the presentation of joint applications for application of the optional regime" .

Fill in the corresponding data in the declaration, taking into account that the fields with an asterisk are mandatory.

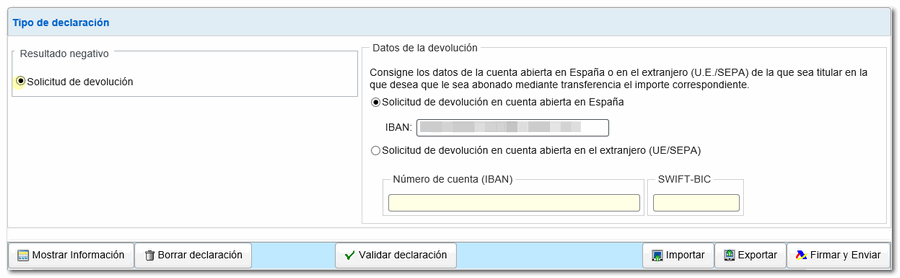

Any refund that may be made will be made by transfer to the bank account of the taxpayer's name indicated in the application and which must be identified by the IBAN code .

Within section "Type of declaration" select option "Refund request" . Next, select "Request for refund on account opened in Spain" or "Request for refund on account opened abroad ( EU / SEPA ) , as appropriate, and enter the required data.

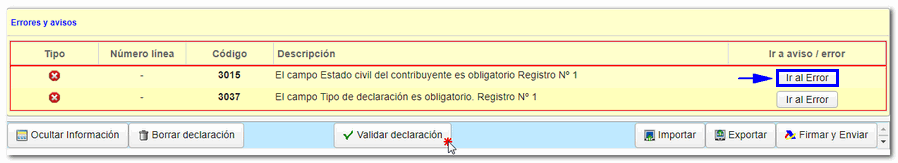

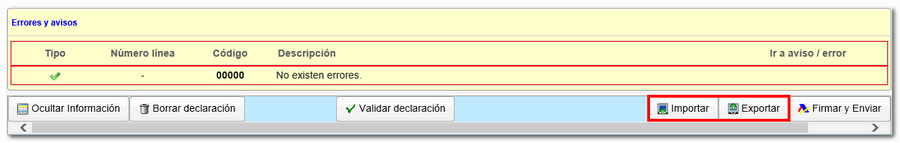

The different functionalities of the form are located in the button bar at the bottom. You can press the "Validate declaration" button to have the application display any pending errors and warnings. The option "Go to error" will direct you to the section or field that you need to review or correct.

Once the declaration has been validated without errors, you can press the "Export" button to obtain the declaration text file. The file name will be the NIF of the holder and the extension will be "226". This file can be imported back into the form using the "Import" button.

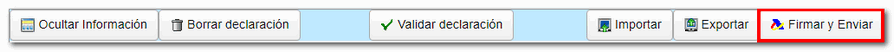

Press the "Sign and Submit" button to submit the application.

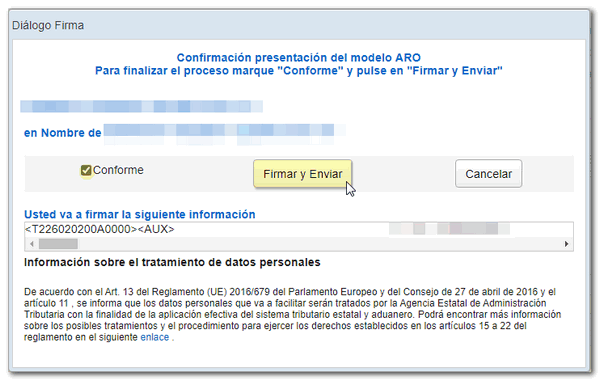

In the next window, check the box "I agree" and press again "Sign and send" .

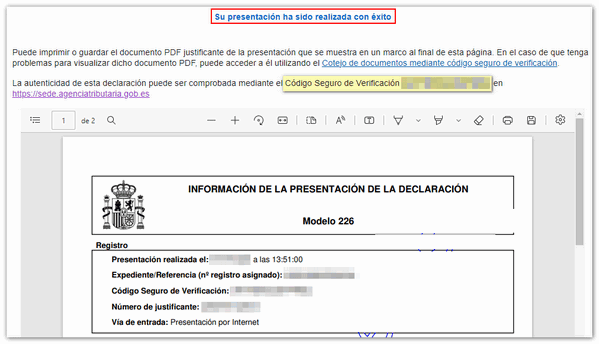

If the submission is correct, you will receive a receipt with a secure 16-character verification code, as well as the date and time of submission.

In the case of electronic submission of the application, the additional documentation must also be submitted electronically, from the management "Provide additional documentation" specific to this procedure.