Form 353 - Technical assistance

The electronic submission of form 353 requires identification with the declarant's electronic certificate. In addition to the holder of the declaration, it may also be submitted by a third party acting on his or her behalf, whether a social collaborator or a representative to carry out the procedure.

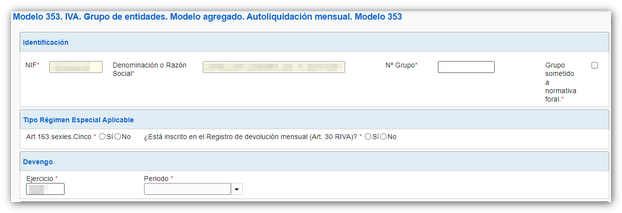

After identifying yourself, you will access the form. Fill in the corresponding data.

The group number field gives the following formats as correct:

-

VATxxxx/yy (VAT – 4 digits – slash – two digits of year): example VAT0006/20

-

xxxx/aaBVA (Four digits – slash – two year digits – letter B – letters VA): example 0006/20BVA

-

xxxx/yyAVA (Four digits – slash – two year digits – letter A – letters VA): example 0006/20AVA

-

xxxx/yyGVA (Four digits – slash – two year digits – letter G – letters VA): example 0006/20GVA

-

31xxxxx (Code 31 – five digits): example 3100006

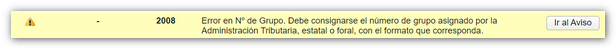

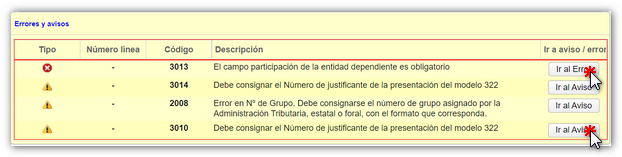

Any other completion returns the following warning:

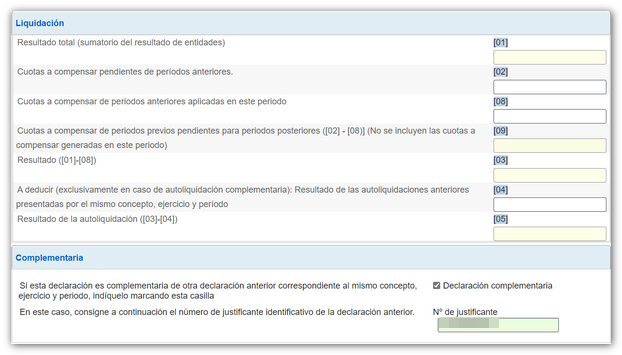

The settlement results are automatically completed depending on the data provided in the other fields. In addition, the form allows the submission of a supplementary declaration corresponding to the same concept, fiscal year and period. In this case, the supporting document number of the previous declaration must be indicated.

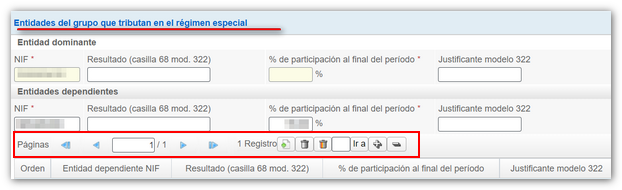

In the section "Group entities that pay taxes under the special regime", you will find a button panel from which you can register, deregister and navigate between records. To create a record, click on the "New record" icon, identified by a blank sheet of paper with a green "+" sign. Fill in the NIF of the dependent entity and the rest of the boxes.

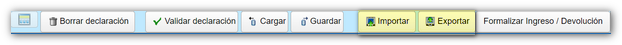

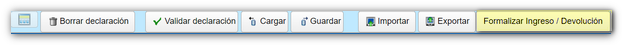

From the bottom button panel you can access the functions to validate the declaration, save and load data, import and export files and formalize payment/refund.

Before filing the declaration, it is advisable to check if there are any warnings or errors. By clicking on the button "Validate declaration " a section will open with the errors and warnings detected. Click "Go to notice" or "Go to error" to access the field or section to be reviewed.

Please remember that notices are for informational purposes only and do not prevent submission. However, errors must be corrected.

At any time, even if there are errors or the declaration has not been completed, the data entered can be saved so that it is stored on the AEAT server, by clicking on the " Save " button. They can then be retrieved using the " Load " button to continue filling them out.

If there are no errors, it is possible to " Export " a file with the declaration in BOE format (extension .353) valid for submission. For its part, the " Import " button allows you to incorporate a file with the declaration in BOE format, exported from the same form or generated from an external program following the specifications of the published registry design.

Once the declaration is complete and validated without errors, press "Formalize Income/Return" to submit the declaration.

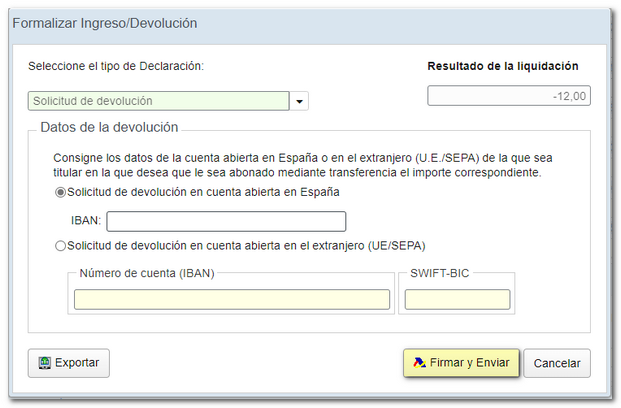

Select the type of declaration based on its outcome. If the result is to be entered, the field will be enabled to include the Reference Number NRC , a 22-character code that serves as proof of payment. Payment can be made in advance or at that time, from the link "Optional: Get NRC ", which will link to the payment gateway to make the payment with the data entered in the form.

If the result is negative, enter the account IBAN of which you are the owner or request the refund to an account opened abroad ( EU /SEPA ).

Click on "Sign and send", in the next window mark "I agree" and press "Sign and send". If everything is correct, a response sheet will open with the message "Your submission has been completed successfully." The embedded PDF contains a first page with the filing information (registration entry number, Secure Verification Code, receipt number, filing date and time, and filer details) and, on the subsequent pages, the full copy of the declaration.