Model 368 - Technical assistance

Skip information indexElectronic submission of form 368. Union regime and external regime of the Union

You can access by identifying yourself with Cl@ve , certificate or DNI electronic. If you have questions about how to obtain an electronic certificate or how to register in the Cl@ve system, consult the information available in the related content.

If the declarant does not have an electronic certificate, it is necessary that the person making the submission be authorized to submit declarations on behalf of third parties, either by being registered as a collaborator or by being authorized to carry out this procedure.

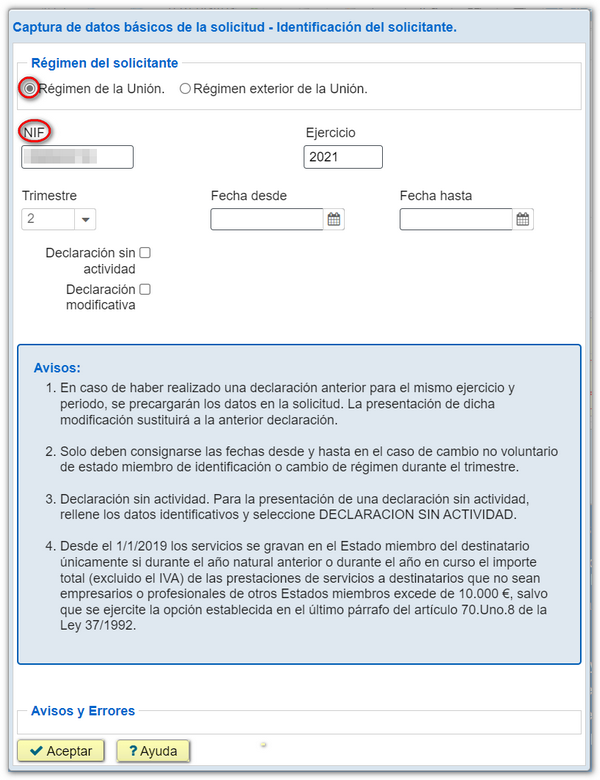

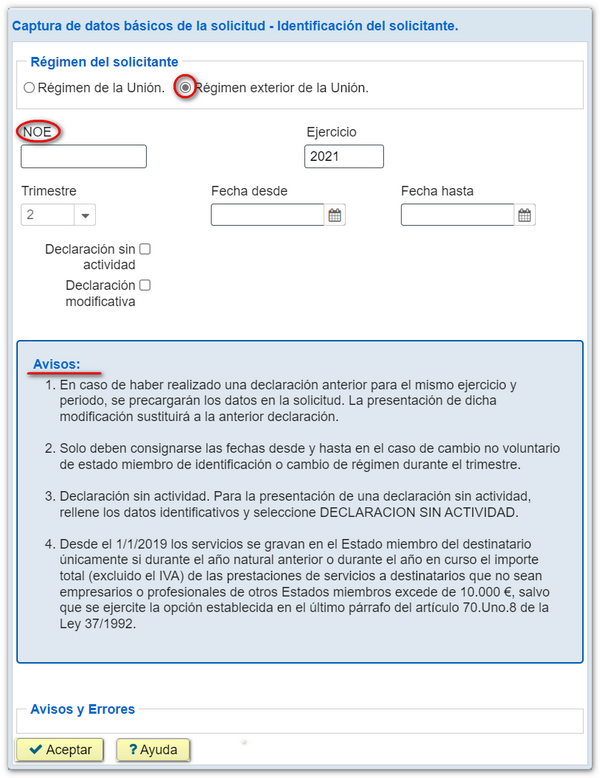

First, a window will appear to capture the basic data of the declaration. Select one of the two available options, depending on the applicant's regime:

- Regime of the Union

- Non-EU System

For more information, it is recommended to consult the regulations and instructions for the model available in the information and help section.

- If you select the option " Union Regime ", fill in the NIF of the declarant businessman or professional established in the Community but not in the Member State of consumption, covered by the special regime applicable to radio or television broadcasting telecommunications services and those provided electronically, whose Member State of identification is Spain.

It is recommended that you consult the notices when completing this window and, if you have any questions, use the "Help" button located at the bottom of the window.

- If you select " External regime of the Union ", complete the NOE of the declarant businessman or professional not established in the Community, covered by the special regime applicable to radio or television broadcasting telecommunications services and those provided electronically, whose Member State of identification is Spain.

It is recommended that you consult the notices to complete this window. If you have any questions, click on the "Help" button.

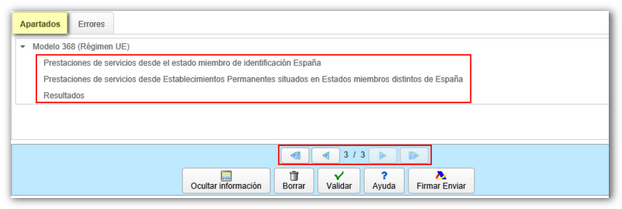

Then, click "Accept" to complete the rest of the declaration data. From this button panel you can register, cancel and navigate between the registered services.

At the bottom of the form, you have the options to navigate through the pages of the declaration or to access the different sections of it.

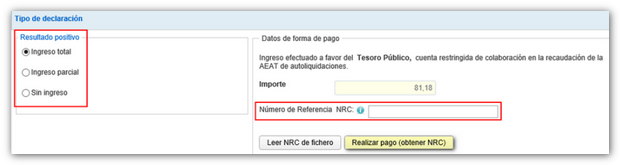

On the "Results" page, you can select the type of declaration and the payment method. If you select "Total income", next to the income amount you will have the field to include the NRC proof of payment. It is possible to link to the payment gateway to obtain the NRC from the "Make Payment (Get NRC )" button. Declarants who have marked the option "External regime of the Union" with a positive result can also mark the option "Income by transfer from abroad"

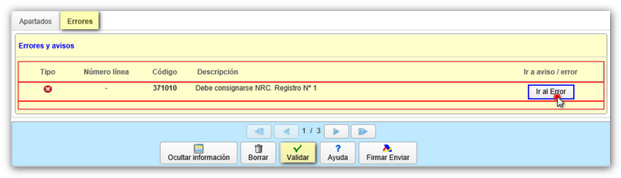

Before proceeding with the submission, you can validate the content of the declaration from the "Validate" button. If there are errors that need to be corrected in order to submit the declaration, the "Errors" tab indicates the description of the error, and the "Go to Error" or "Go to Notice" button leads to the corresponding box.

If the declaration is correct, the message will be "No errors". Click "Sign and Submit" to begin the submission process.

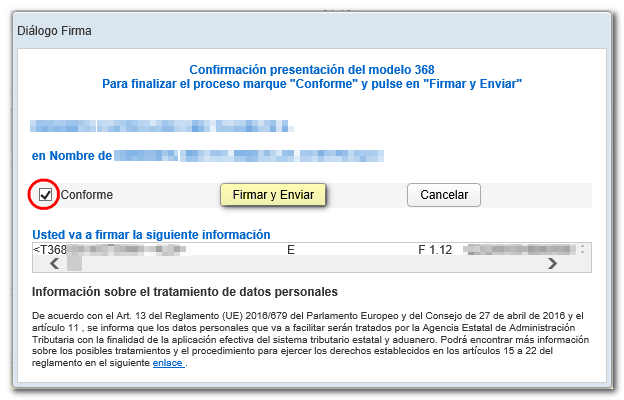

In the new window, check the "Accept" box to confirm the filing of the declaration. The text box will display the encoded content of the declaration. You can continue filing the return by clicking "Sign and Submit."

If everything is correct, you will get the response sheet with the message "Your submission has been successfully completed" and an embedded PDF containing a first page with the submission information (registration entry number, Secure Verification Code, receipt number, day and time of submission and presenter details) and, on the subsequent pages, the complete copy of the declaration.