Requirements for processing VAT refund requests - Form 360

The management of returns VAT By submitting Form 360 you must meet these requirements:

-

The request for the return of the VAT It is carried out compulsorily by telematic means.

The refund request is made exclusively through the procedure enabled in the Electronic Office of the Tax Agency and requires identification with a digital signature (electronic certificate or electronic DNI ).

If a digital signature is not available, please note that the application and obtaining of said certificate is done through the online services of any authorized certifying entity.

-

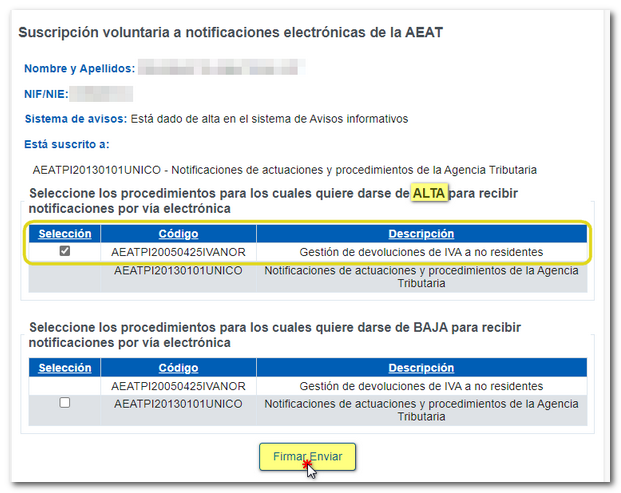

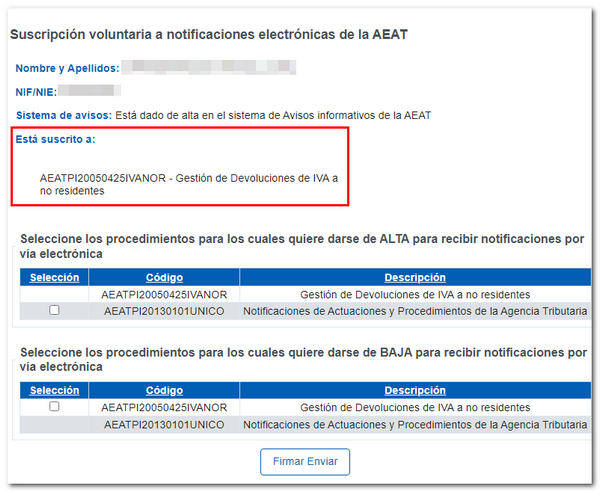

The presenter must be subscribed to the AEATPI20050425IVANOR procedure.

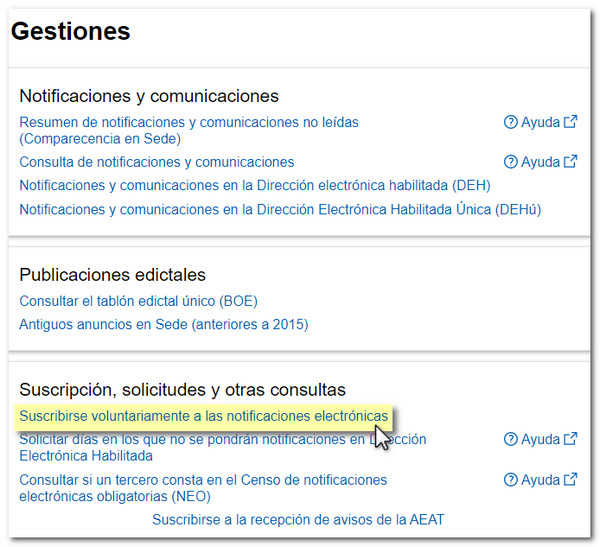

Subscription to the AEATPI20050425IVANOR procedure is done from the "Voluntarily subscribe to electronic notifications" option located in the "Electronic Notifications" section of the AEAT Electronic Office.

From the same option you can check if the subscription is already registered and cancel it.

-

Register the corresponding power of attorney in the event that the applicant wishes to carry out the procedure through a representative.

If the applicant acts through a third party (representative), he/she must authorize the representative in procedure 360P and NOTIVANOR (specific power of attorney ) or in GENERALNOT (general power of attorney) so that the latter can receive notifications from the represented party.

The power of attorney can be processed online with an electronic certificate. Such power of attorney requires that after granting the power, the agent confirms receipt of the same. Once the power of attorney is accepted, registration is immediate.

-

For shipments with a large volume of operations (more than 202 operations and with a maximum of 3000), the presentation of model 360 must be done from option "Presentation of model 360 by file" . The file must meet the criteria indicated in the approved logical design.

For up to 202 transactions, it is possible to use the general filing option "Filing of model 360" using the online form.

Note: If you have any questions about how to complete the form, you can consult the help for Form 360. You can also ask your questions about the 360 form and the questions about the refund procedure. VAT not established in the virtual assistant of the VAT.