How to obtain a copy of your tax return filed the previous year

You can access your 2023 Income Tax return file from the following options:

-

"Query of submitted declarations" : Within the procedures for Form 100, you can obtain a copy of your 2023 Income Tax return by identifying yourself using a signature (certificate electronic ID), the @ve system, the reference for the current campaign, or with the identification system for citizens of the European Union ( ) using country's identification.

-

"Rental Services" : by accessing the procedures for Form 100 in the "Previous Years" section, with digital signature (certificate or electronic ), Cl@ system or the current campaign reference.

-

"Personal Area”, "My Files" : accessing with digital signature (certificate or DNI electronic) or Cl@ve .

-

"Document verification using secure verification code ( CSV )" : From this option you can obtain a copy of the declaration submitted using the Secure Verification Code that you obtain on the receipt when submitting electronically, along with the date and time of submission.

If you have questions about how to obtain an electronic certificate, how the DNIe works, how to register in the Cl@ve system or how to obtain the reference, consult the available help.

We provide instructions for obtaining a copy of the 2023 Income Tax Return, depending on the access option you use:

"Consult submitted declarations" from the Income procedures

Access the Income Tax procedures page (form 100) and in "Highlighted procedures", click on "All procedures" to use the link "Check submitted returns". Then choose how you are going to identify yourself.

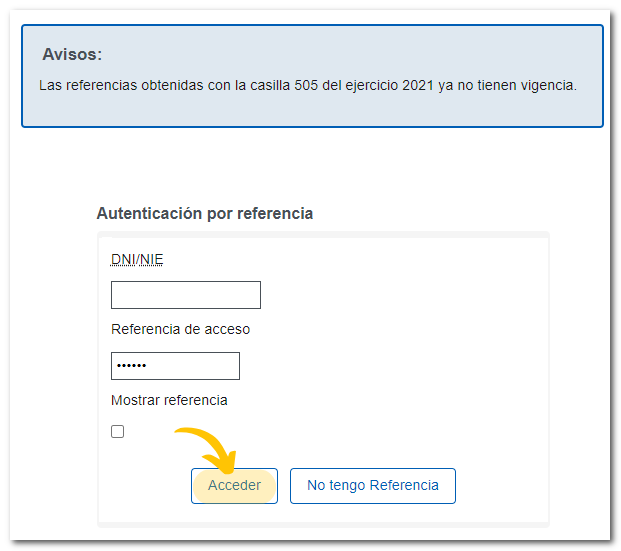

When accessing with a reference, if you have already obtained one, enter your DNI / NIE and enter the reference below. If you need to request it again, click the "I don't have a reference" button to link to the service. Enter your DNI or NIE and the verification information (date for DNI and support number for NIE ), then click "Continue." The system will detect whether or not you filed a tax return last year. If you filed an Income Tax return for the 2023 tax year, the field is enabled to provide the data from box 505 of the 2023 Income Tax return. If you were not a 2023 Income Tax return declarant, the last five positions of the IBAN of a bank account that we know you were the owner of in 2024 will be requested.

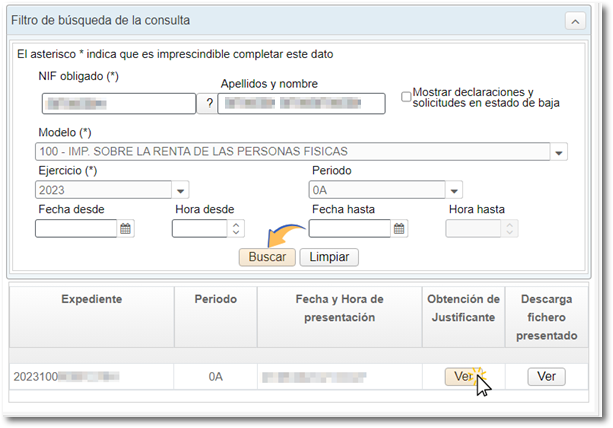

On the next page, a drop-down menu will appear with the boxes " NIF required" and "Model" (model 100) completed and the "Fiscal Year" box with the last fiscal year of Available Income selected by default, modify it and indicate the fiscal year 2023; However, you can also set other search criteria. Next, click "Search" in the list of returns and click the "View" button in the "Get Proof" column for the return you want to view to download the proof and the full copy of the 2023 Income Tax Return you filed.

"Revenue Services" from the "Previous years" section

Once the current campaign has begun, it will be possible to access the 2023 Income Tax return file under "Previous Years" from Form 100 procedures.

In "Specific Procedures," click on "All Procedures," find the "Previous Years" section and access "Year 2023," then click on "Draft/Return Processing Service (Renta WEB) 2023." You can identify yourself using digital signature (certificate or electronic ID), @ system, the current campaign reference, or the European Union Citizen Identification System (eIDAS) using another country's identification. In this case, to access a copy of the declaration, select the link "Recording declaration 2023100... (Consult / Copy)" within "File History".

"My Files"

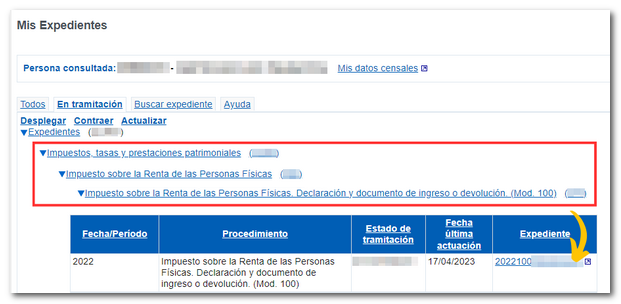

By accessing "Personal Area", "My Files" and identifying yourself with your electronic certificate, DNIe or Cl@ve you can view information about your Income Tax files by clicking on the "In Processing" or "All" tab, depending on the status of your declaration.

Once you access the corresponding tab, you will see the Income files in the sections "Taxes, fees and property benefits", "Personal Income Tax", "Personal Income Tax. Declaration and income or refund document (Form 100)" by accessing the link to the 2023 fiscal year file. To obtain a copy, click on the file number and then click on the link "Recording of statement 2023100... (Consult / Copy)".

Obtaining the copy indicating the Secure Verification Code ( CSV )

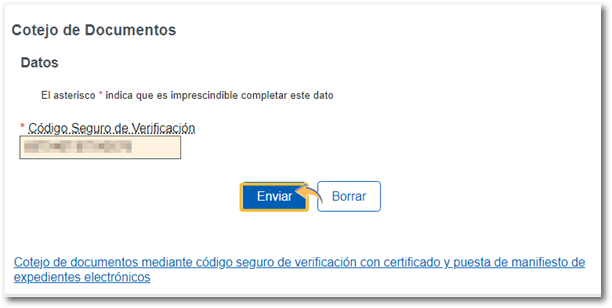

If you keep the CSV associated with the filing, you can also retrieve the copy of the declaration through the "Document verification using secure verification code" option that you will find on the Home page in the highlighted block "Notifications and document verification".

Enter the CSV of the presentation into the corresponding field and press "Submit".

If you do not have the data to obtain a copy of the declaration via the Internet, we recommend that you consult the help links to register in Cl@ve , obtain an electronic certificate or consult the operation of DNIe ; These systems will allow you to carry out this and other procedures through the Electronic Office.