"The bank account does not appear in our database" when requesting the reference number

If you did not file a return in the previous fiscal year or the amount in box 505 of Income Tax 2023 is zero (0.00), it is essential that we identify you with the last 5 digits of the code IBAN of a bank account that your Bank informed us that you are the owner of.

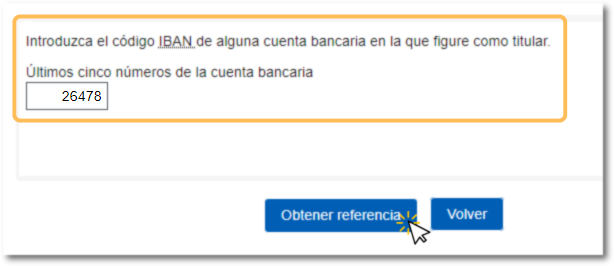

The system will automatically detect if this is your situation by your NIF / NIE and will ask you for the last 5 digits of your IBAN :

If the account you provide us has not been reported by the Bank in its annual information declaration, you will not be able to request the reference number online using this method. In that case, consult with the entity itself so that it reports the data to the AEAT .

The alternatives in this case are:

- Register at Cl@ve . You can do this online by requesting an invitation letter from the system. After receiving it, from the Electronic Headquarters of the AEAT you have the option to register by indicating the CSV provided in the letter.

- Request an electronic certificate to carry out online procedures that require identification. It will be necessary to prove your identity at registration offices.

- Make an appointment with your local government to receive your 2024 Income Tax reference number. It will be available starting March 12th and will be available in-office on March 13th. You will be able to access this service until June 30, 2025 (end of the campaign period).