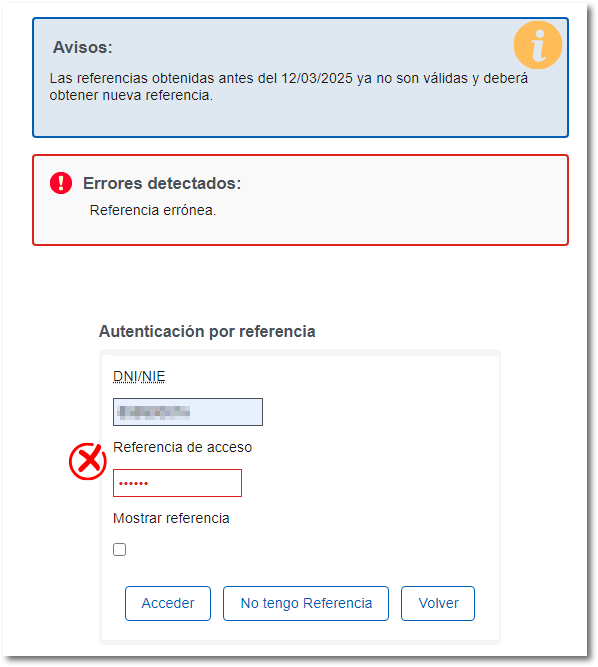

Incorrect reference message

If when accessing Renta WEB with reference, you receive the message "Incorrect reference", check that the characters, letters and numbers are clearly distinguished. We remind you that the reference consists of only 6 alphanumeric characters.

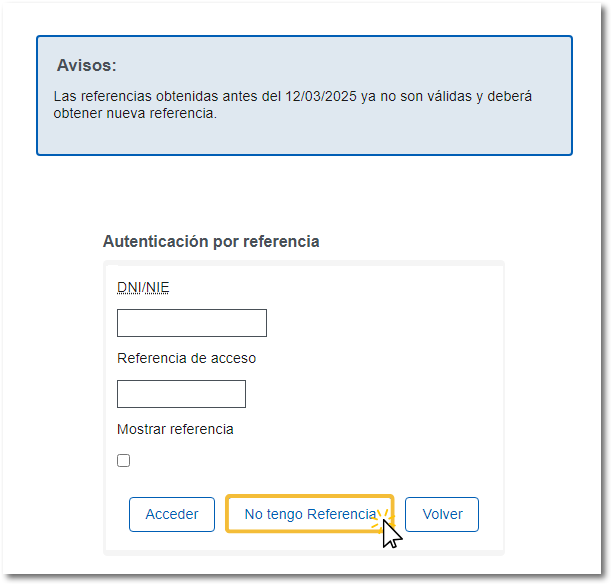

Access the request for a new reference from the "I don't have a reference" button. There is no limit on requests until the following year's campaign and references can be requested for multiple users.

The request for the reference for Income Tax 2024 can be made with the amount from box 505 of the 2023 Income Tax return, which corresponds to the amount of the "General taxable base subject to tax."

To obtain the reference number using Cl@ve , certificate/ DNI electronic or eIDAS (for citizens of the European Union with identification from another country) you must access the option "Obtain your reference number" located in the "Management" section of the Income Tax campaign portal.

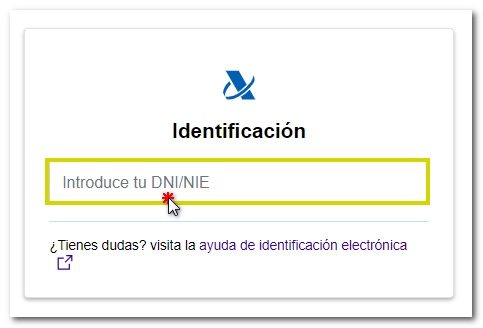

Enter the corresponding data, DNI / NIE and the contrasting data requested by the identification system.

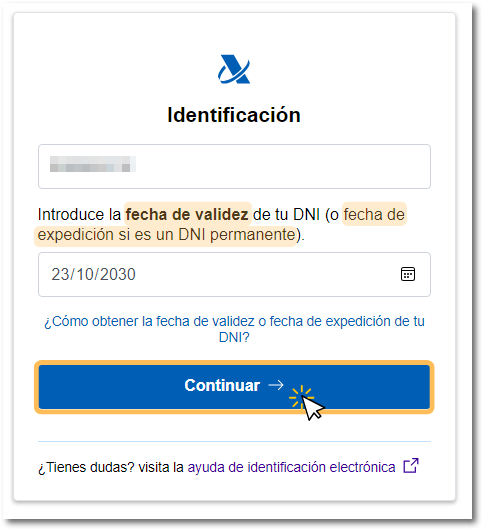

If you enter a NIF , you will have to write the validity date of the DNI in the indicated format, dd-mm-yyyy, day, month and year separated by hyphens (if you do not enter a hyphen, the application will add the hyphens automatically). You can also use the available calendar to select the date. If the DNI is permanent (01/01/9999) , the date that will be requested is the issue of the document. You can use the help link "How to obtain the validity date or date of issue of your DNI ?" which explains how to locate this information on the DNI .

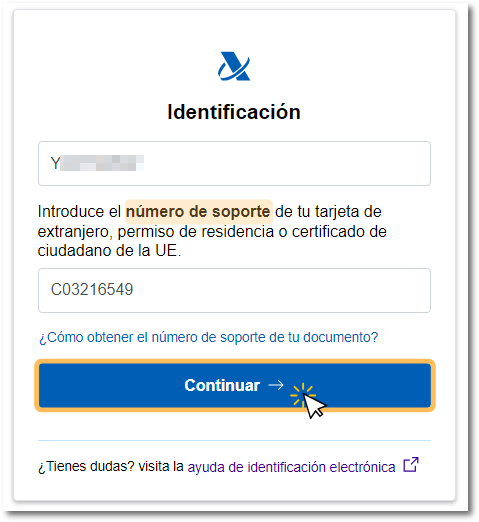

If you indicate a NIE , the information that will be requested will be the support number that appears on the document. You can use the help link "How to obtain the support number of your document?", which explains how to locate this information on the foreigner's card, residence permit or EU citizen certificate and how to enter it correctly on the form. For more information about the support number, you can also refer to the help "Enter valid support" (How to enter the support number).

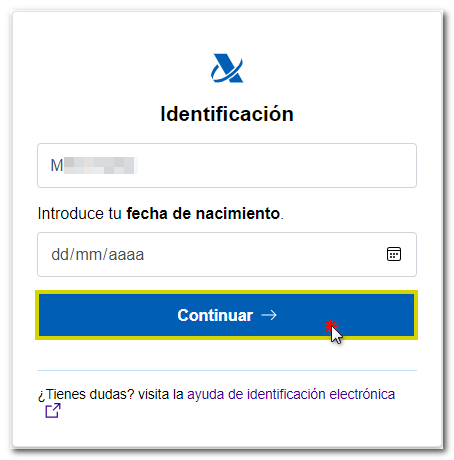

If it is a NIF without a validity date, type K, L, M , the information you will have to provide will be the date of birth that appears on your document.

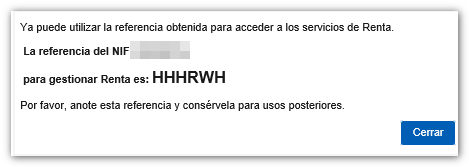

Click "Continue" once you have logged in, either with box 505 of the 2023 Income Tax return or with the last 5 digits of an account IBAN of which you are the owner (if the amount in the box is zero "0" or if you did not file an Income Tax return last year), the reference will appear on the screen. It consists of 6 characters and you can use it for subsequent logins or request a new one whenever you want.