How to obtain a draft or tax return on Renta WEB with reference number

To access Renta WEB and process your declaration, you can identify yourself with a valid Renta reference number.

Within the "Highlighted Procedures", click on "Draft/declaration processing service (DIRECT Income and WEB Income)" . Select the "Reference Number" option to access.

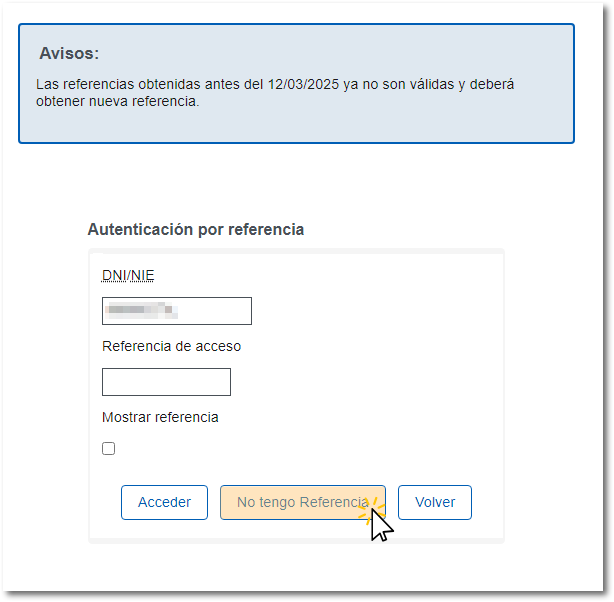

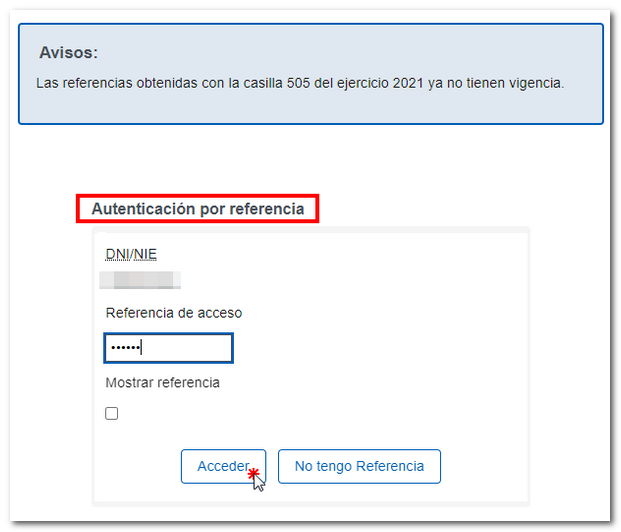

If you already have a reference, indicate your DNI / NIE and said reference. If you don't have one, click "I don't have a reference."

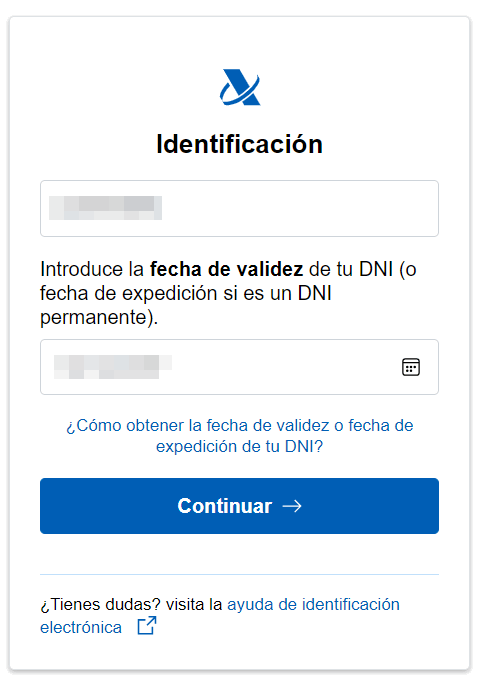

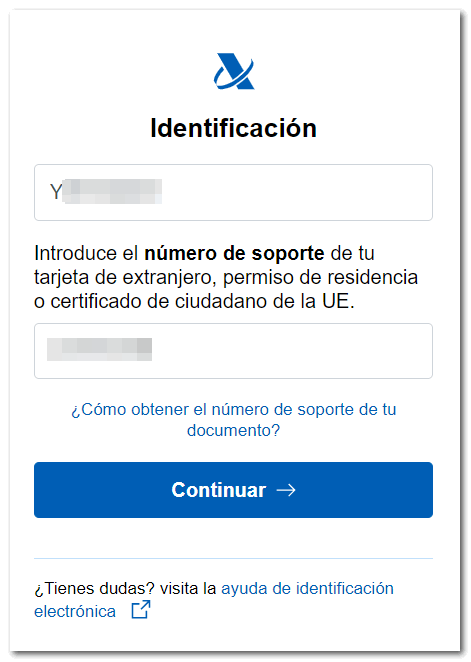

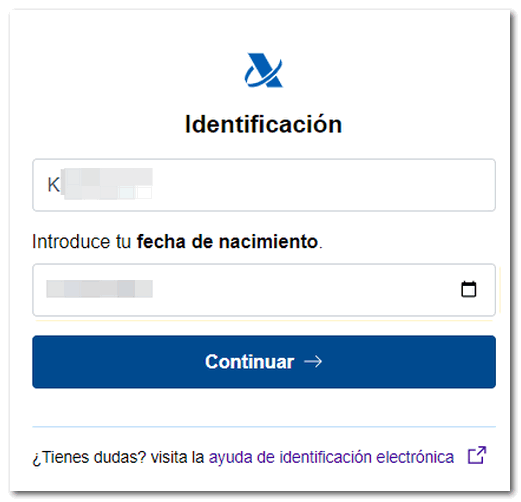

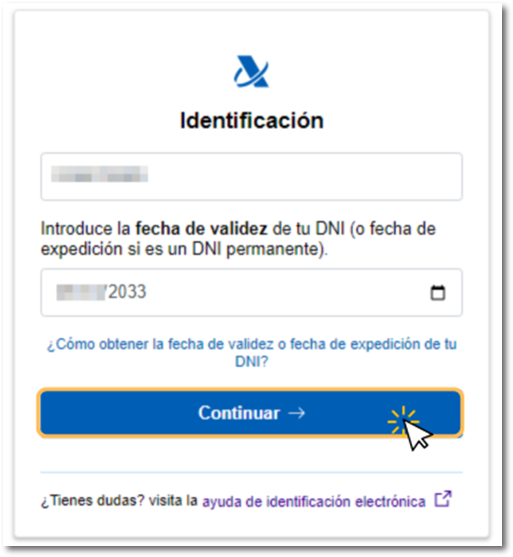

In the next window, you must complete again the DNI / NIE and the required verification data depending on the type of document. Below you will find the corresponding help links to locate the required data on your identity document:

- Validity date , for DNI .

- Date of issue , for ## permanent ID (01-01-9999);

- Support number , if it is a NIE .

- Date of birth , if it is a NIE that begins with the letters L, M and K.

After entering the data correctly, click "Continue".

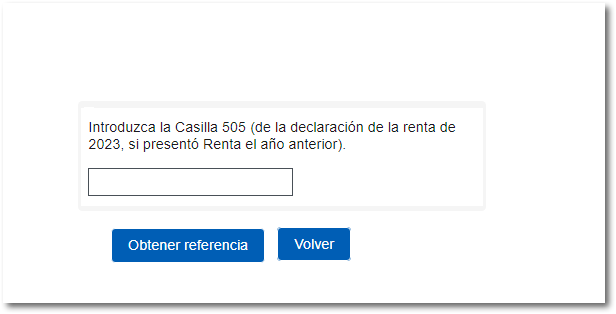

If the system detects that you filed an Income Tax Return for the 2023 tax year, either in an individual or joint return, the field is enabled to provide the data from box 505 of the 2023 Income Tax Return. To enter the amount correctly, do not enter any sign in the whole number and separate the decimals with a comma . Click on "Get Reference".

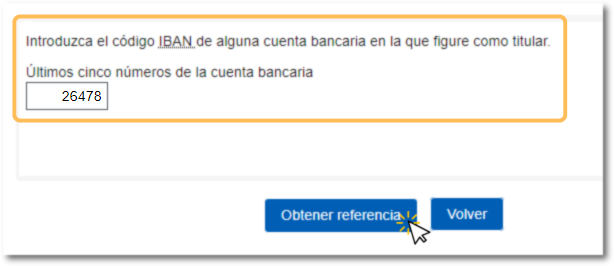

If the system detects that you were not a 2023 Income Tax return declarant or that the amount in box 505 of that declaration is zero, you must indicate the last five positions of the IBAN of a bank account that we know you were the owner of in 2024.

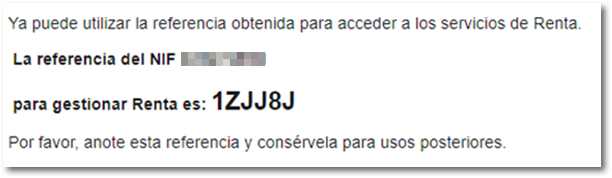

When all the identification data has been validated, the reference will be displayed on the screen. Write it down to identify yourself in the Income services and click "Close".

After closing the obtaining window, enter the reference obtained (remember that you can also obtain it using the APP- AEAT ).

You will access the services available in your file. To consult the draft, modify it or submit the declaration, select "Draft/Declaration (Renta WEB)" .

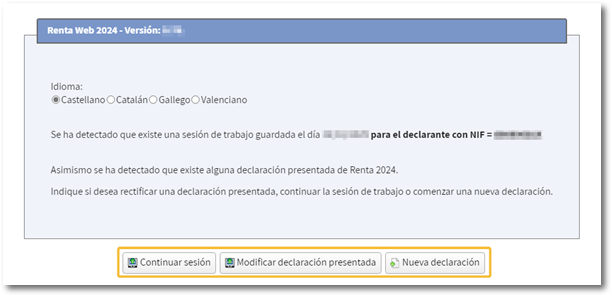

If you have previously accessed Renta WEB and have saved your data, you can "Continue session" to recover it. If a declaration has already been submitted and you wish to modify it, click "Modify submitted declaration". You can also start a "New Declaration", incorporating the tax data.

You can choose the co-official language in which you wish to make the declaration.

Identification details

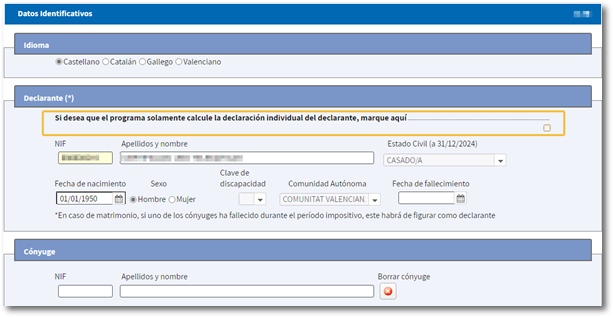

If you make a new declaration, an initial window will appear with the identification data of the declarant and the rest of the declarants of the family unit components. Please review the data and make any necessary changes before continuing. Please note that some data such as marital status or information on minor children or legally incapacitated persons subject to extended or reinstated parental authority cannot be modified later.

If your marital status is "MARRIED" but you do not wish to enter your spouse's tax information, you must check the box for calculating the individual tax return.

Declarations with tax data of the spouse

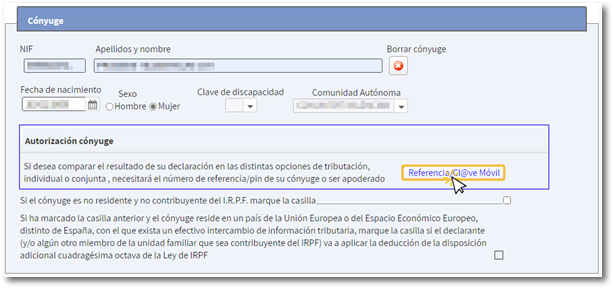

In declarations with a spouse, if you wish to compare the result of the declaration in the different taxation options, individual or joint, you will need authorization using the reference number or through authentication by Cl@ve Mobile of the spouse. In this case, press the "Reference/ Cl@ve Mobile" button in the "Spouse Authorization" section and identify the spouse using one of these systems.

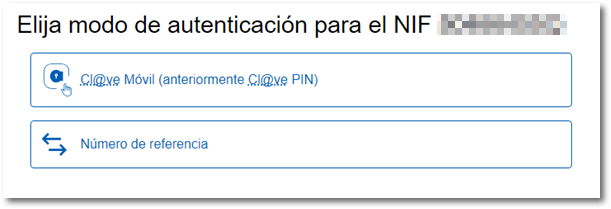

Authentication with Cl@ve Mobile:

Authentication with reference:

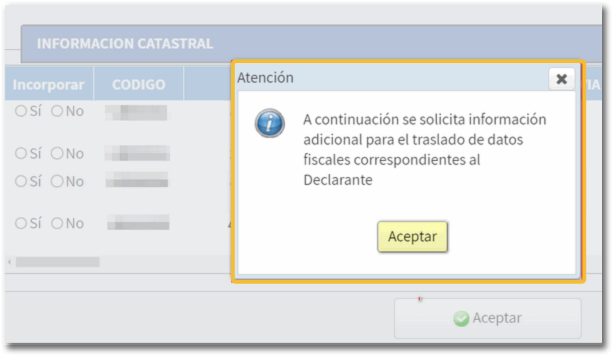

Transfer of tax data

After accepting the identification data screen, the tax data will be transferred. Additional information may be requested for data entry.

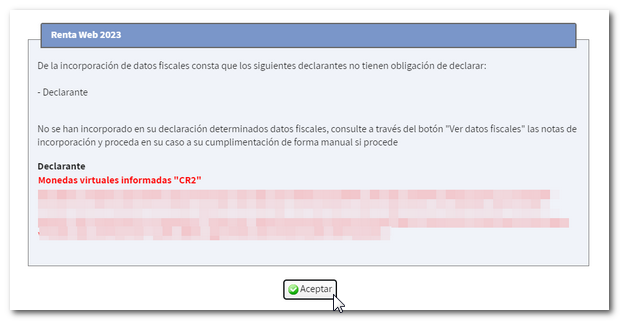

If you do not need to enter additional information to generate the declaration, the corresponding notice will be displayed and you will directly access the Declaration Summary, from where you can check the result of the declaration for each type and complete the declaration, if necessary.

If there is any data not included in the declaration, a window will be displayed beforehand informing each taxpayer individually about the specific data not included, so that they can complete it in the corresponding section of the declaration. You can consult the incorporation notes, with more detailed information, through the "View tax data" button, located at the top, and fill in the data later in the corresponding section.

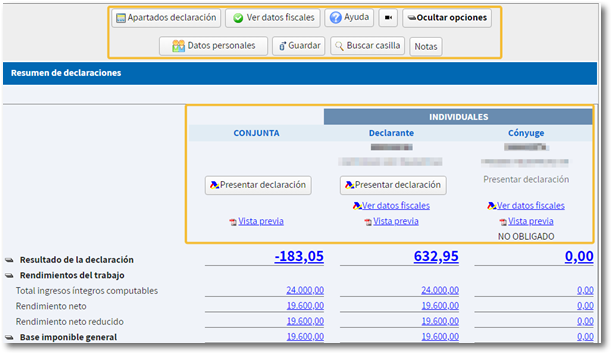

Summary of statements

At the top of the declaration summary is the "Declaration sections" menu, which gives access to all sections of the declaration. Click the "Show Options" button to enable the rest of the features on this page. Among them, you'll also find a "Save" button to save your session in the cloud and retrieve the return at any time, options to view tax and personal information, a search box or item search, and access to "Notes" to add your own notes. You also have links to explanatory videos and the help manual for filing your Income Tax return.

Within each modality, you can obtain a "Preview" in PDF , check the tax data or file the return.