How to file a supplementary declaration in Renta WEB

If after filing your 2023 Income Tax Return you notice errors or omissions that result in a higher income than that made in the initial return, or a lower refund, you can file a supplementary return using the Renta WEB services. The new self-assessment will include all the data that must be declared, incorporating, together with those correctly reflected in the original self-assessment, those that have been newly included or modified.

Access the file again from "Draft/declaration processing service (Renta WEB)" of the Renta 2023 portal.

After identifying yourself with an electronic certificate, DNIe , Cl@ve , reference or through access to EU citizens (eIDAS) you will access personalized services of Income.

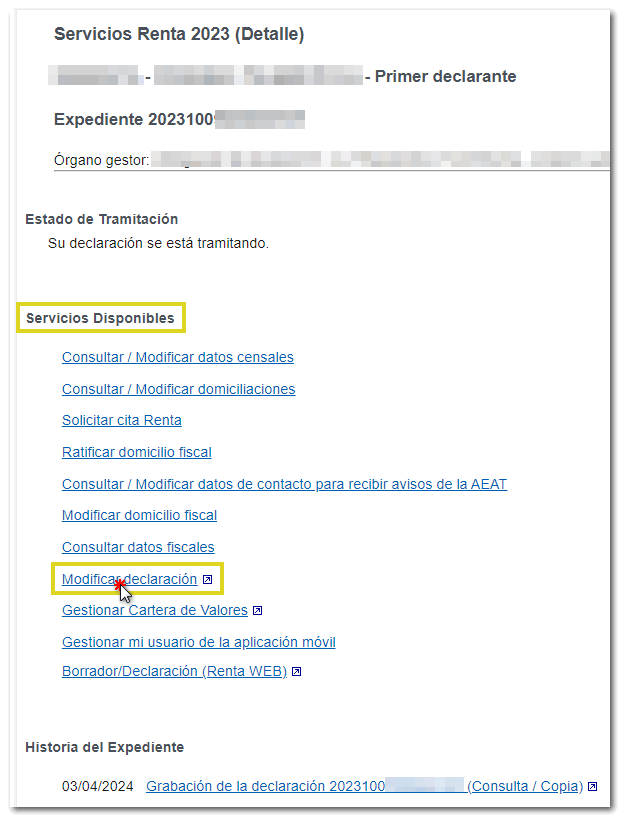

Check that your return is filed; In "Processing Status" the message "Your declaration is being processed" may appear and in "File History" you will find "Recording of declaration 2023100...(Consult/Copy)".

As NEW , in "Processing Status", certain taxpayers may find the message "Some of the data included in your declaration does not match those available to the Tax Agency. You can correct these discrepancies by submitting a supplementary declaration through Renta Web."

In section "Available Services" click on "Modify declaration" .

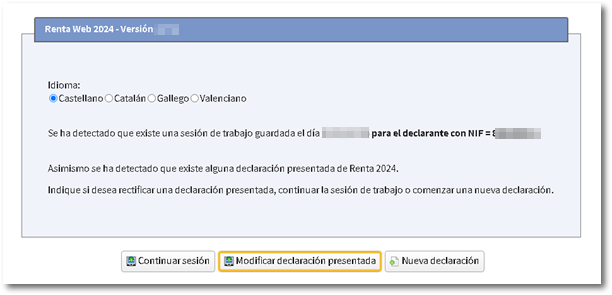

From the available options, press "Modify submitted declaration" .

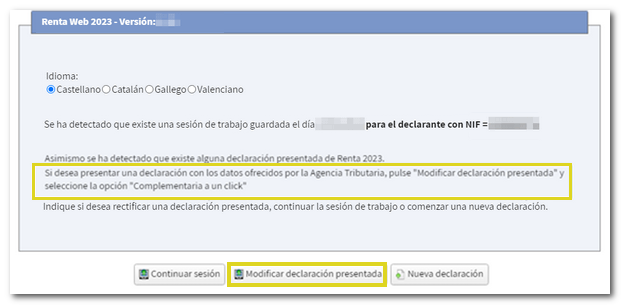

If you are in the group of taxpayers in which the AEAT has informed you of discrepancies in certain boxes, in the Renta Web window you will find the message "If you wish to submit a declaration with the data provided by the Tax Agency, click "Modify submitted declaration" and select the option " Complementary with one click ".

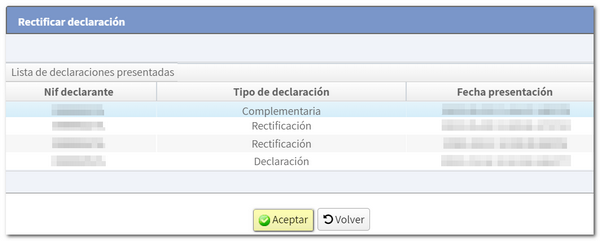

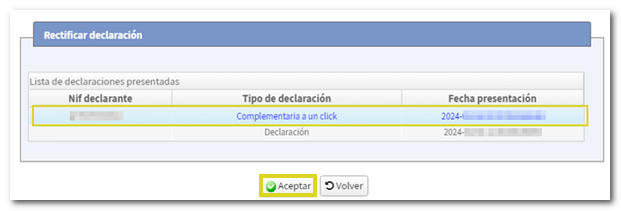

If several returns have been submitted since that session, for example the individual returns of both spouses, then a window appears to select the one you wish to modify.

For taxpayers who have been offered the "One-Click Supplementary" option, this type of return can be found in the selector of submitted returns, which they can select voluntarily.

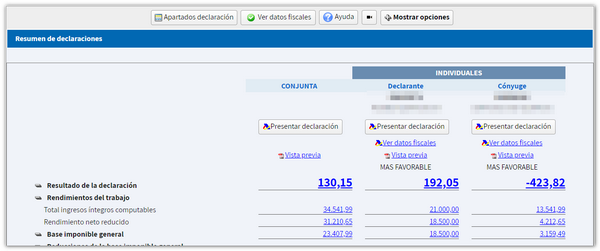

You will access "Declaration summary" from where you can make the relevant changes, from the summary concepts by clicking on the numerical hyperlink or from "Declaration sections".

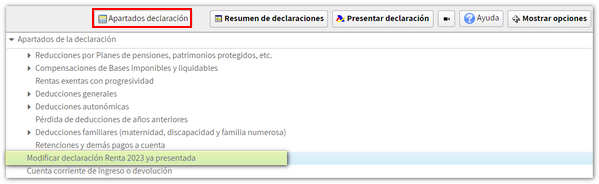

Once you have made the relevant changes, press "Declaration sections" and locate "Modify 2023 Income tax return already submitted".

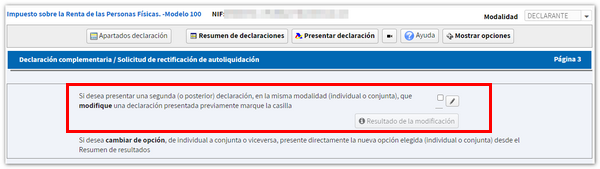

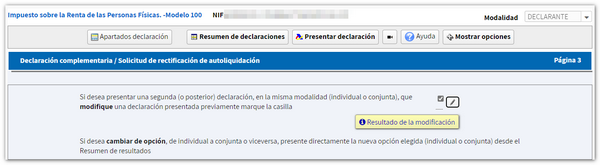

You will access page 3 of the declaration, check the box next to the pencil icon if you are going to submit a second (or subsequent) declaration, in the same modality (individual or joint), that modifies a previously submitted declaration. Otherwise, and as indicated in the notice below, if you wish to change the modality, submit directly from "Summary of declarations"

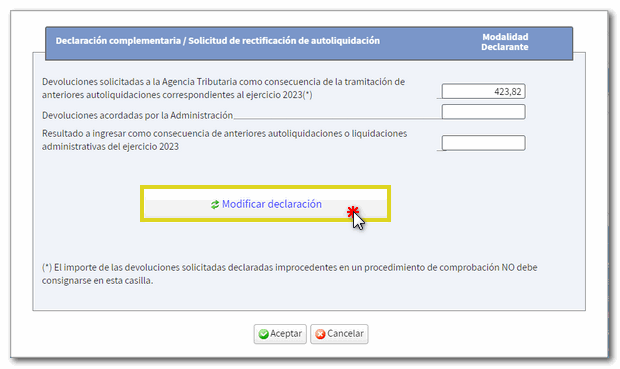

The pop-up window will then display the amount of the income or refund from your submitted return. If this amount does not appear, fill it in directly in the corresponding box. Then press "Modify declaration".

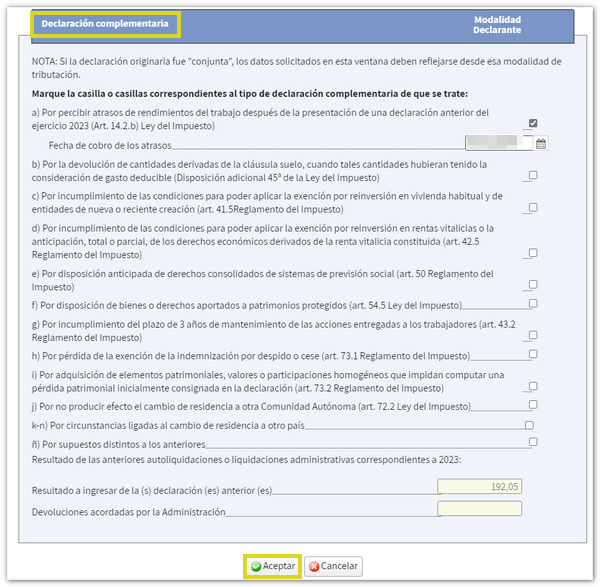

In the pop-up window you must check the box corresponding to the type of supplementary declaration and complete the amount to be paid or refunded from the previously submitted declaration.

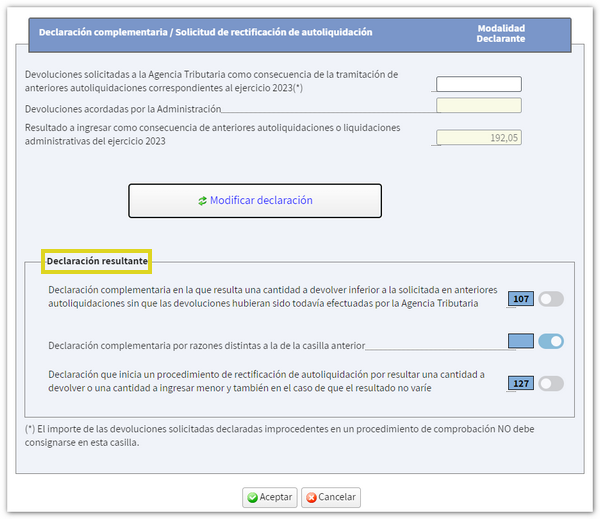

By accepting, you will receive the resulting declaration, with the box marked according to the reason indicated for the supplementary declaration. Click "Accept".

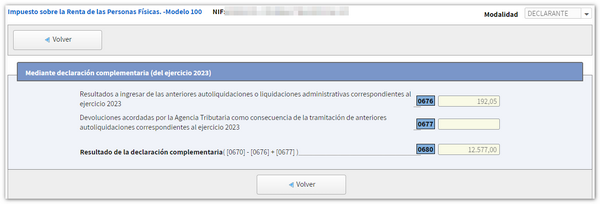

By pressing the button "Modification result" you will access the window with the result of the supplementary declaration.

Filing the modified return

Next, go back to the declaration and verify the data using the "Validate" button, confirm that there are no errors and check the notices and/or warnings. Finally, press the button "Submit declaration" to complete the procedure.

NOTE : The payment of supplementary self-assessments, regardless of the year being regularised, may never be split into two instalments.

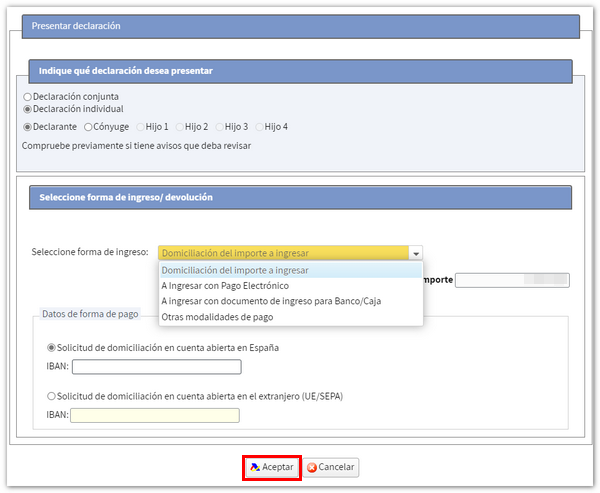

The payment options for a supplementary declaration are:

-

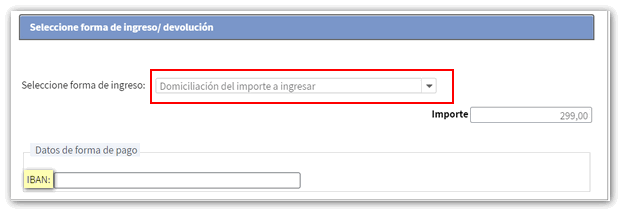

Direct debit of the amount to be paid . This option will only be available if the supplementary declaration is submitted before June 26, 2023. You must indicate the code of an account IBAN whose entity collaborates with the AEAT .

-

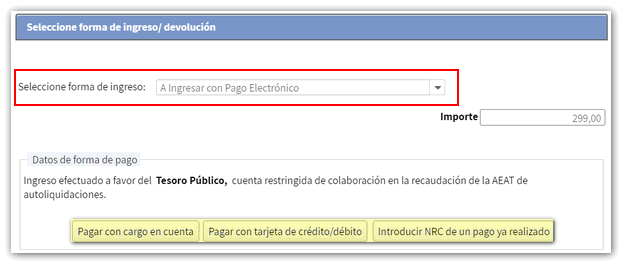

Electronic payment . You must make the full payment by generating the NRC proof of payment. If you accessed your declaration with a certificate, DNIe or Cl@ve , you can link to the payment gateway available on our website from the buttons "Payment by direct debit" or "Payment by credit/debit card" or from "Pay, defer and consult", "All procedures", "Pay self-assessments". Another option is to make the payment directly to your bank, either at its offices or through electronic or internet banking offered by your bank. You will then need to enter the NRC in the "Enter NRC of a payment already made" box if you have paid via online banking.

-

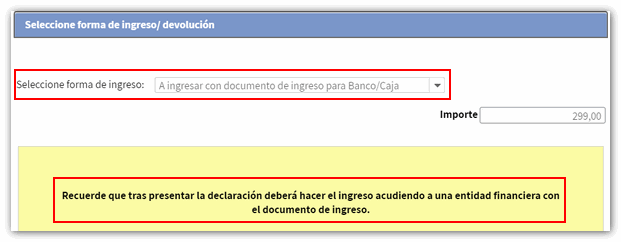

Document to be deposited in bank or cash register . It allows you to obtain the payment document to pay it at the Bank or Cash Office of a collaborating entity. With this option, the declaration will be submitted electronically but pending payment at your financial institution.

-

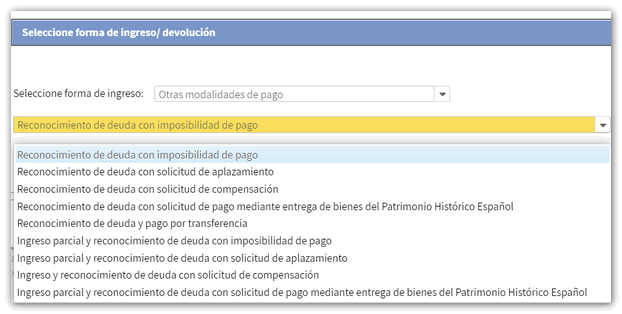

Other payment methods . For example, the recognition of debt with impossibility of payment, request for deferment or payment by transfer to an account of a Non-Collaborating Entity, among others.

Remember that in joint declarations it will be necessary to indicate the reference or Cl@ve of the spouse, to file the declaration regardless of the type of access of the declarant. The reference number is individual for each declarant.

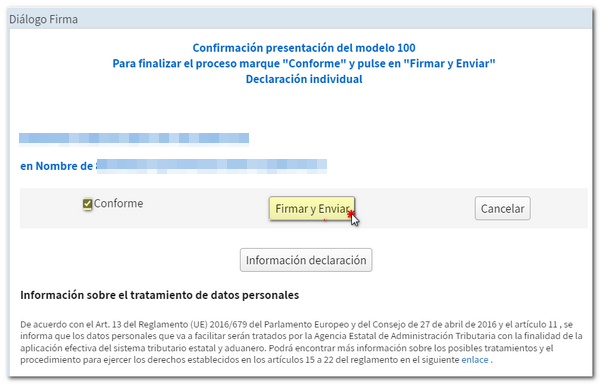

If there are any warnings, you will be informed of them before you proceed with signing and sending the declaration.

In the new window, check the "I agree" box and click "Sign and Send" to complete the filing of the declaration. The "Declaration information" button will display the encoded data of the declaration.

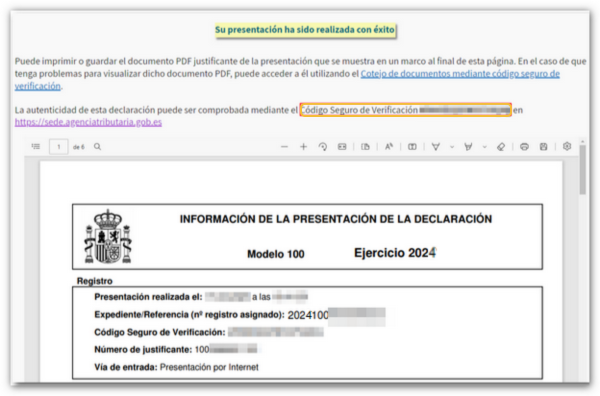

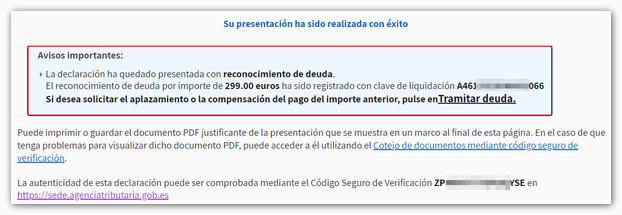

When your return has been submitted, you will see the message "Your submission has been completed successfully" and the assigned secure verification code. In addition, a PDF will be displayed containing a first page with the submission information (registration entry number, Secure Verification Code, receipt number, day and time of submission and presenter data) and on the subsequent pages, the submitted declaration.

You can print or save this page as proof of the information from your online submission. To print the page, right-click it and choose "Print" from the menu or click the printer icon at the top edge.

In cases where there is recognition of debt, a link to submit the deferral or compensation request will be displayed on the response sheet for successfully submitting the request. Press "Process debt" and the settlement details will appear with the debtor's data and the settlement code. You will have to choose between one of the available options: defer, compensate or pay.

By accessing your file again, you will be able to view the declaration submitted in the first instance and the subsequent supplementary declaration.