How to file a Renta tax return by file generated with an assistance program

You can file your tax return prepared with an application other than the Tax Agency by importing a tax return file with the data adjusted to the registration layout published on the website under "Registration Layouts," "Forms 100 to 199."

Access the presentation from the electronic headquarters, "PIT", then click on "All procedures" in the "Outstanding procedures" block and within "Presentation by file" click "Filing returns using a file generated with a help program".

Identify yourself with digital signature (certificate or ID), with Mobile Cl@ , with a reference number or through EU access (eIDAS .

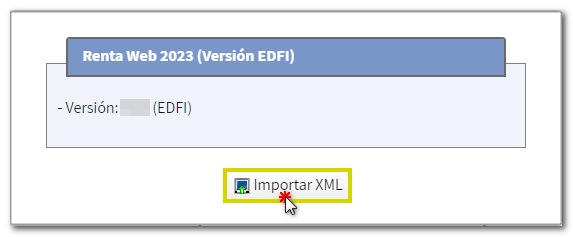

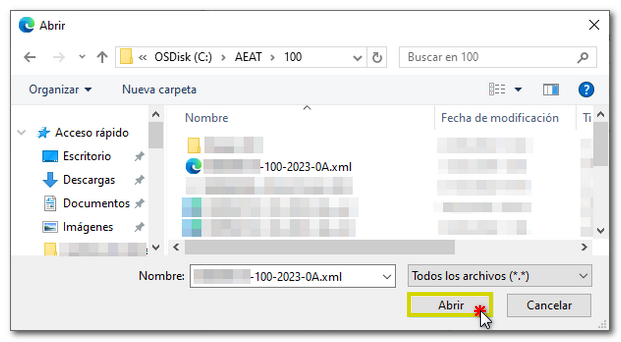

On the next page, click the button "Import XML " and locate the file with the declaration data.

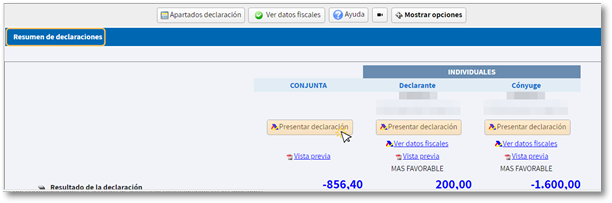

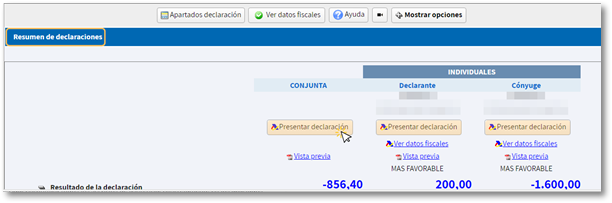

The Declaration Summary will then be displayed with the declaration data of the declarant(s). From this window you can:

- "Submit statement" if you agree with the result.

- "View tax data" to consult the data entered.

- "Preview" of the statement where you get a PDF that serves as a reference but is not suitable for submission.

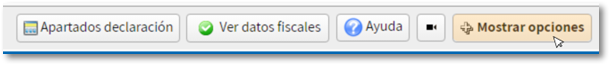

Additionally, using the buttons at the top, you can access the different sections to check all the data, your tax information, the Practical Manual for Income Tax 2024 with the button "Help" and the tutorial videos.

Pressing "Show Options" will display additional buttons that will allow you to view your personal identification information or search for a specific box on your return. You can also save the declaration to the cloud to continue later.

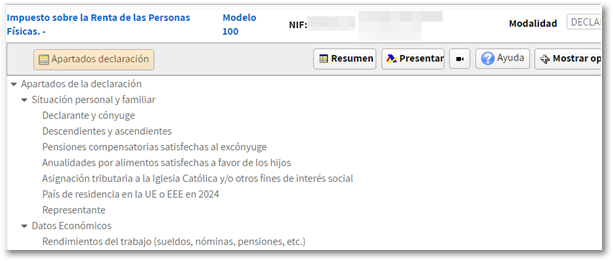

From "Declaration sections" , you can access the different pages to check all the data and continue completing your declaration.

Check for filling errors by pressing the "Validate" button .

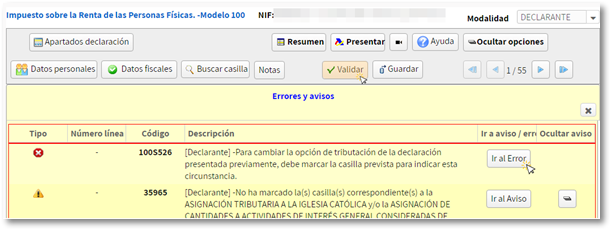

Notices do not prevent you from filing your return and are indicated to review your completion. If the message is an error, you must correct it so that the declaration is considered valid at the time of filing. To review the warnings or errors, press the "Go to Warning" or "Go to Error" button.

Once validated, review the data and if it is correct, press "Submit declaration" from the top button bar or from the declaration summary.

If the return is with result to return , check the code IBAN of the account in which you want the refund to be made. By default, the account IBAN that you indicated in the previous exercise will appear; However, you can modify it on this screen.

You can also select a IBAN from an account opened abroad ( EU/ SEPA ) for the refund.

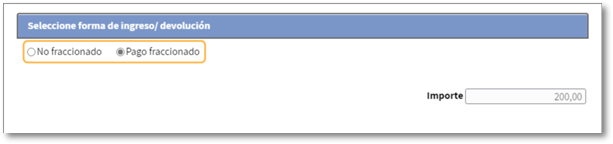

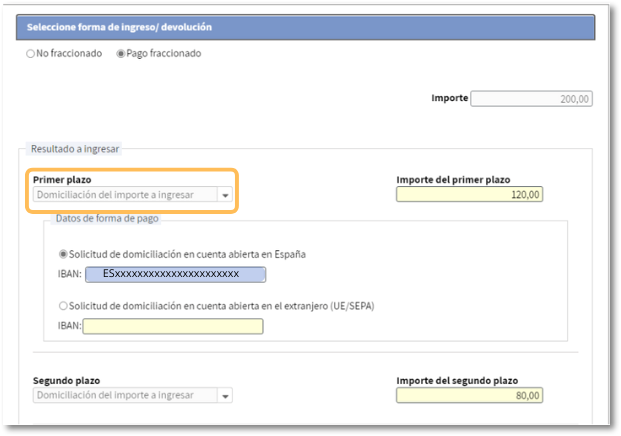

If the declaration results in income ## as , first indicate whether you want to split it into two payments or not. This option will only be available within the deadline for filing income tax returns.

You will then be able to select various payment options.

-

Direct debit of the amount to be paid . Direct debit payments can be made from April 2 to June 25, inclusive. Select the option "Direct debit of the amount to be paid" and enter the IBAN of the account into which you want the refund to be made. If you choose split payments, you can set up direct debits for both payments.

-

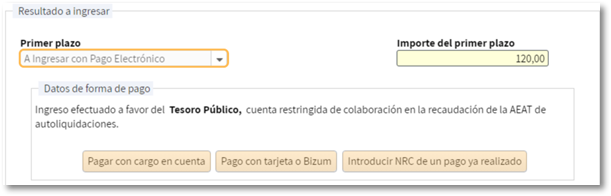

To enter with Electronic Payment . In this case you can choose from three payment methods:

-

Payment by direct debit from account . It will connect you to the payment gateway to obtain the NRC at that time, charging the amount to the account you assign.

-

Payment by credit/debit card or Bizum . It will connect you to the bank's payment gateway to obtain the NRC at that time. It is not necessary for the entity to be a collaborator.

-

Enter NRC of a payment already made . You must make the full payment from your Bank, generating the NRC proof of payment, either at their offices or through electronic banking offered by your bank. You will then need to enter the NRC in the "Reference number NRC " box.

-

-

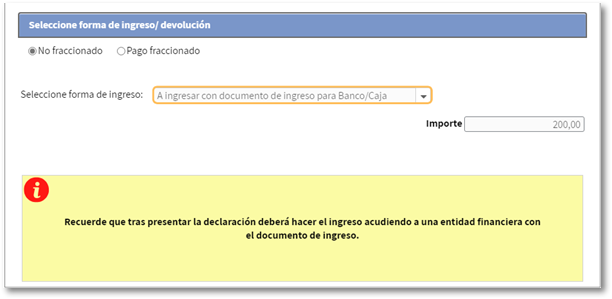

To be entered with Bank/Cashier deposit document . It allows you to obtain the payment document to pay in person at the bank. With this option, the declaration will remain pending payment until it is submitted to your financial institution.

-

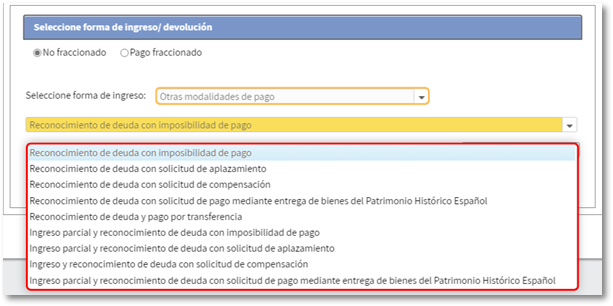

Other payment methods . Partial payments, acknowledgments of debts that cannot be paid, requests for deferrals, or payment by transfer to a non-collaborating entity's account, among others.

After selecting the payment method, press "Accept" to submit the declaration.

Remember that for joint returns, you'll need to provide the reference number or PIN code obtained for your spouse to file the return, regardless of the taxpayer's access type. The reference number is individual for each declarant.

If there are any warnings, you will be informed of them before you proceed with signing and sending the declaration. Click "Continue" if you wish to proceed.

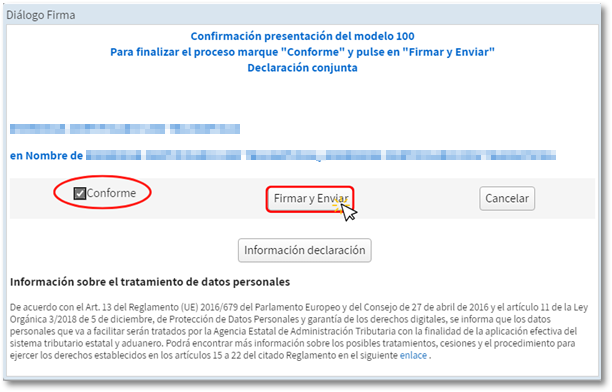

In the new window, check the "I agree" box and press "Sign and Send" to complete the filing of the declaration. The "Declaration information" button will display the encoded data of the declaration.

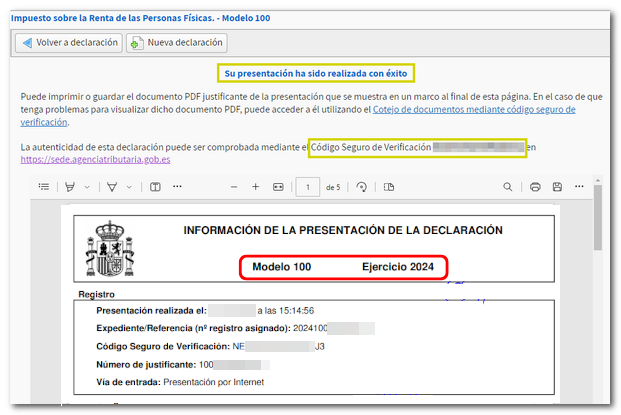

When your return has been submitted, you will see the message "Your submission has been completed successfully" and the assigned secure verification code. A PDF will be displayed containing a first page with the submission information (registration entry number, Secure Verification Code, receipt number, day and time of submission and presenter details) and on subsequent pages, the complete declaration.

You can print or save this page as proof of the information from your online submission. To print the page, right-click it and choose "Print" from the menu or click the printer icon at the top edge. However, you can always check it through the office under "Check submitted returns."

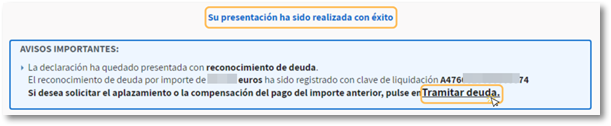

In cases where a debt has been acknowledged, a link to submit a deferral or compensation request will be displayed on the successful submission response sheet.

Press "Process debt" and the settlement details will appear with the debtor's data and the settlement code. You will have to choose between one of the available options: defer, compensate or pay.

If you access "Renta WEB. again Draft/declaration processing service (Renta WEB)" , you will see that in the "File History" section, "Recording of your declaration" appears with the date on which it was made. Also check that the message "Your declaration is being processed" appears at the top.

If you selected "Debt recognition and payment by transfer" the document proving the submission will be displayed with the CSV (Secure Verification Code) along with a list of important notices about the payment, which is still pending entry. This window allows you to generate a PDF with the instructions to carry out the bank transfer.