How to ratify the tax domicile

When you access different Income Tax services for the first time, the application to confirm your tax address will be displayed, since it is essential to review and confirm the address details before accessing the corresponding procedure. Access is enabled with Cl@ve Mobile, certificate/ DNI electronic, Reference number or eIDAS .

The services that have this prior application are the following:

- Renta WEB

- Mobile app Tax Agency

- 2024 Tax Data Query

- Appointment

- Personalized service portals for Income Tax 2024

- My files - PIT

Once the address has been confirmed, this application will no longer be displayed in subsequent accesses, giving way to the corresponding Income Tax application.

In addition, the standalone "Tax Address Confirmation" application will also be available on the e-Office, allowing users to check and modify a previously confirmed tax address. In this case, access will be available with an electronic certificate, DNIe, Key Mobile Cl@ve or EU citizens access (eIDAS).

If you access the ratification of the tax address independently using the APP AEAT , you will only be able to access it with Cl@ve , electronic certificate or DNIe (only for devices with Android system).

In Renta WEB, the ratification of the domicile of the spouse and children is also implemented. Therefore, in declarations with a spouse and descendants, once the spouse and descendants have been identified, you will be connected to the Ratification application so that you can ratify their address.

Access the corresponding Income service and identify yourself with Cl@ve , reference number, certificate/ electronic DNI or eIDAS for citizens of the EU.

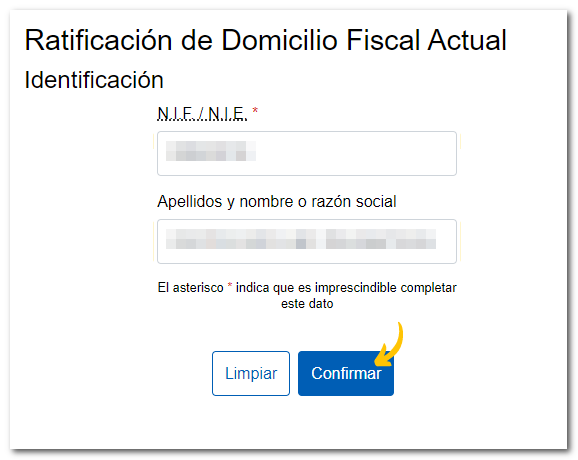

First, enter your DNI or NIE , then your last name and first name, then press "Confirm".

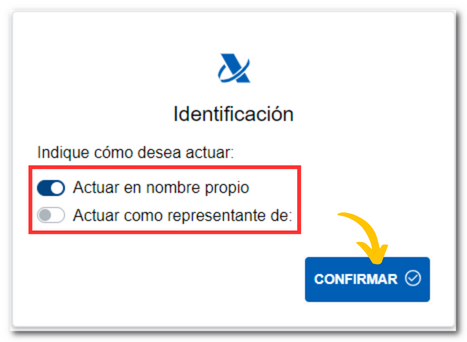

Next, select the type of action: on his/her own behalf or as a representative. If you act as a representative, you must access with a certificate/ electronic DNI or Cl@ve ; If you log in as a social collaborator, you will then need to enter the reference number of the holder.

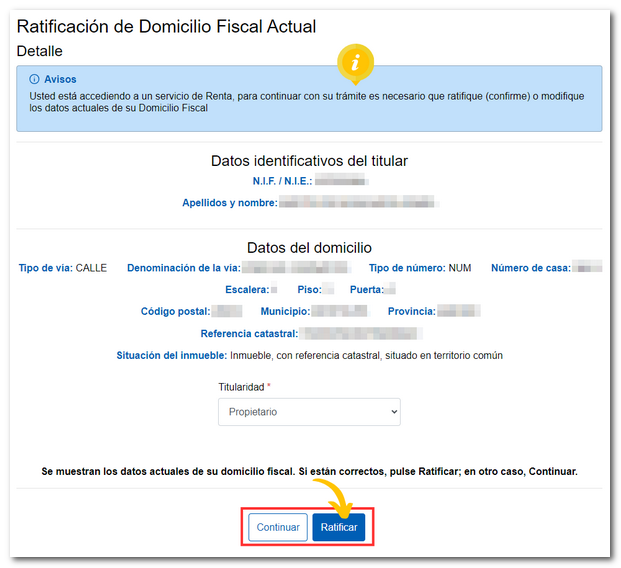

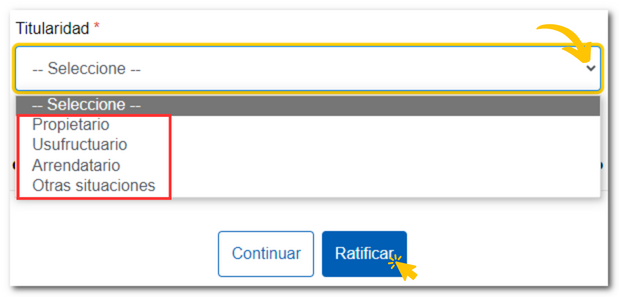

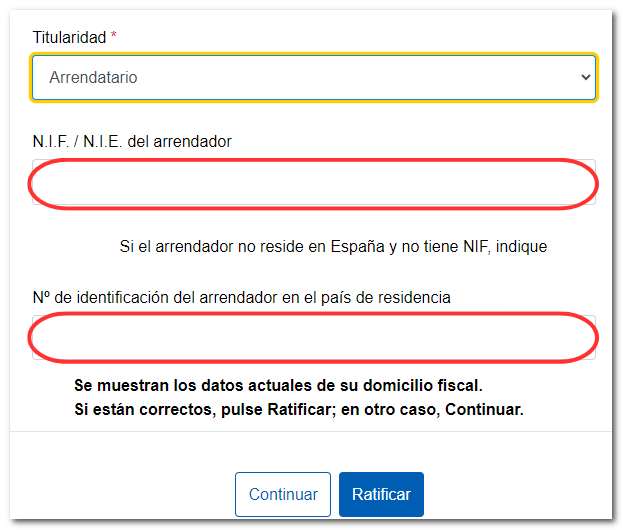

The tax address information listed in the Tax Agency's census will be displayed on the screen, including the property's ownership, unless you have changed the tax address after the last confirmation, in which case we will ask you to select it again from the "Ownership" drop-down menu.

-

If the data is correct , press " Ratify ".

If you select the "Tenant" title, you must provide the landlord's tax identification number. If the person does not reside in Spain and does not have NIF , indicate their identification number in their country of residence.

-

If the data is not correct press "Continue" .

-

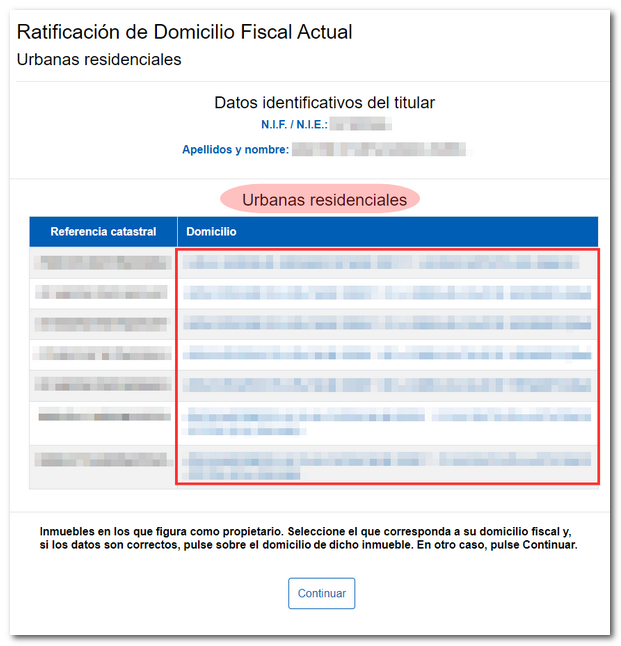

It will be checked if the taxpayer is owner of residential urban properties and the list of them will be displayed. In this case, click on the link for your current address to display its details and click on "Confirm".

-

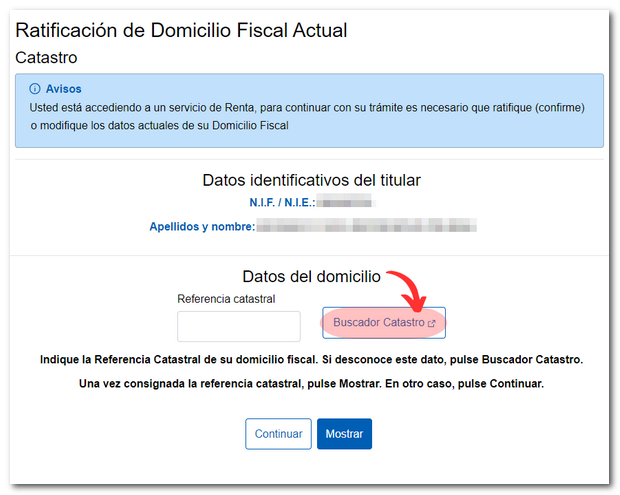

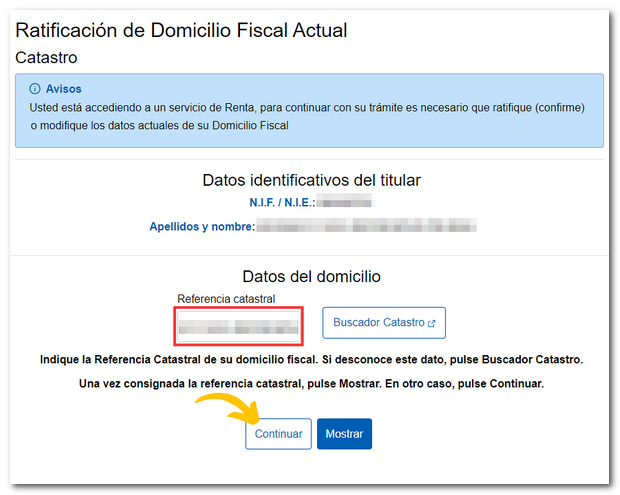

If you do not own any urban residential properties or you do but do not ratify any, press "Continue" . Next, enter the cadastral reference of your habitual residence to continue with the ratification. If you do not know it, you can obtain it by clicking on "Cadastre Search".

In the "STREET / NUMBER" tab, enter the information about the property and click "DATA". You will see the complete details of the property on the screen. Write down or copy the cadastral reference to continue with the ratification process.

Include the cadastral reference and press "Show" to review and update the data first.

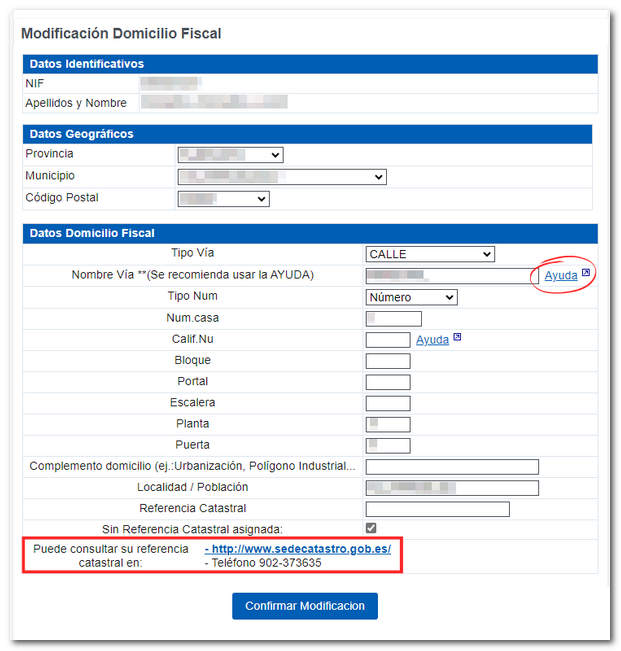

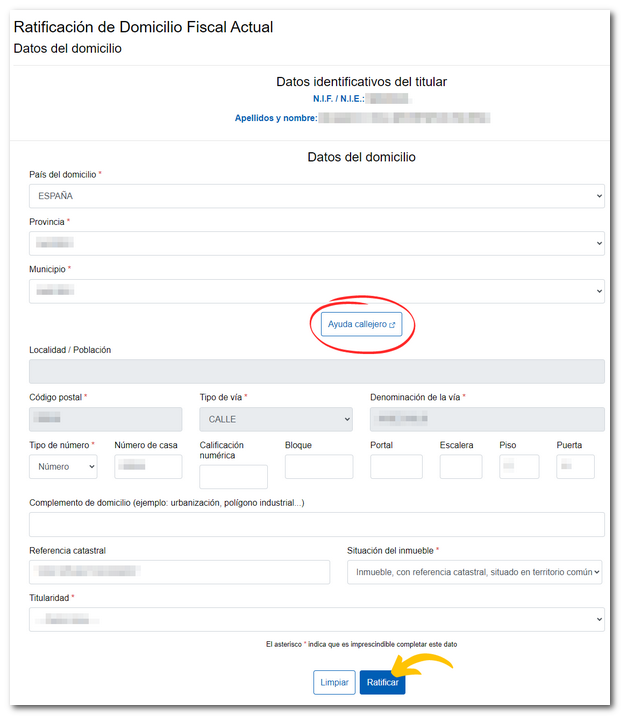

If you click "Continue," you can also manually edit all of the address information. You can press the "Clear" button to leave the form blank and fill it out again.

The "Street Help" button makes it easier to locate the property's details. Once you have entered all the necessary data, click "Ratify". Remember that fields with an asterisk are required.

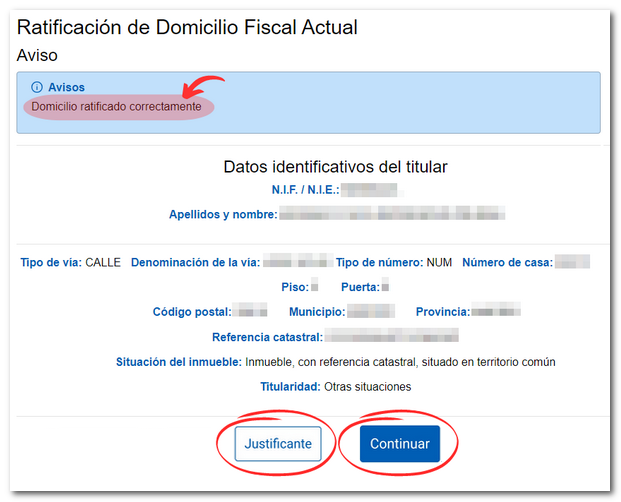

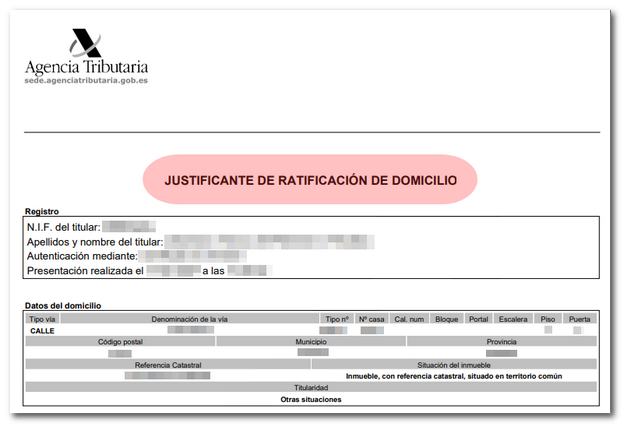

You will receive confirmation of the ratification of the tax domicile on the screen and you will be able to download the receipt in PDF .

-

NOTE - Starting with the 2024 Income Tax campaign, if you try to ratify an address located in the Foral territory, the Basque Country or Navarre, you will receive the message "You are ratifying an address in the Basque Country/Navarre. Remember that if you had your tax domicile in that territory for more than 183 days in the 2024 fiscal year, you must file your personal income tax return in the corresponding Foral territory.

If the ratification application opened automatically when accessing a Income Tax procedure, you will have a "Continue" button that you can click to access said procedure.

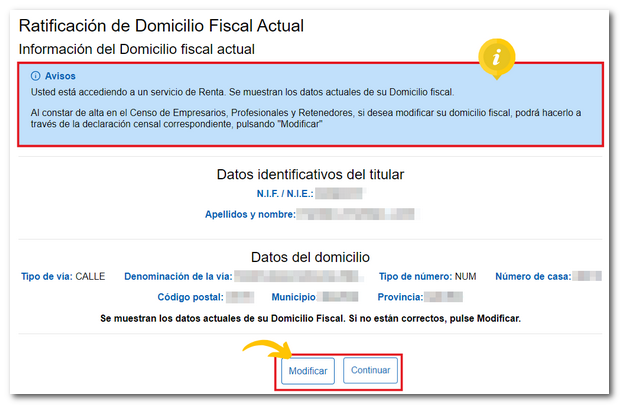

Businessmen

If you are registered in the Census of Business Owners, Professionals and Tax Withholders, to modify your tax address, you must do so through the corresponding census declaration, by clicking on "Modify". If you access the application through an Income Tax procedure and not specifically through "Changed Tax Address," a "Continue" button will also appear.

If you click the "Modify" button you will access the "My census data" section so that you can make the modification via this route (or, failing that, by submitting form 030/036/037). Once the correct data has been entered, you must click "Confirm Modification".

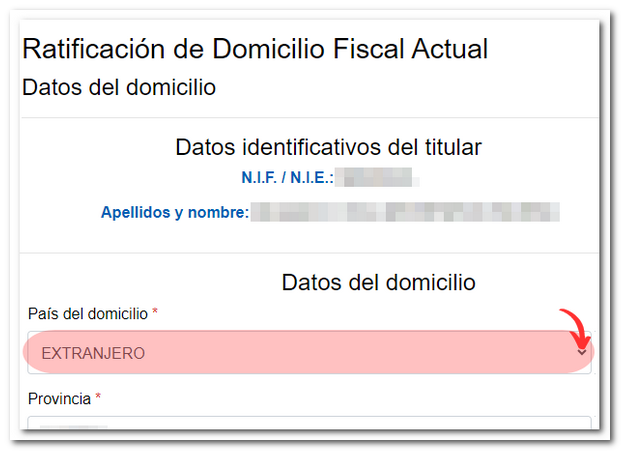

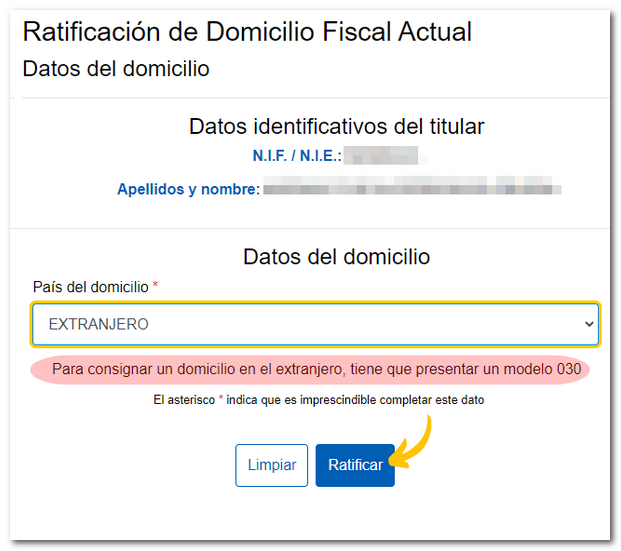

Change of address in Spain to Abroad

Depending on your census status, you may be able to modify or confirm your tax domicile abroad.

-

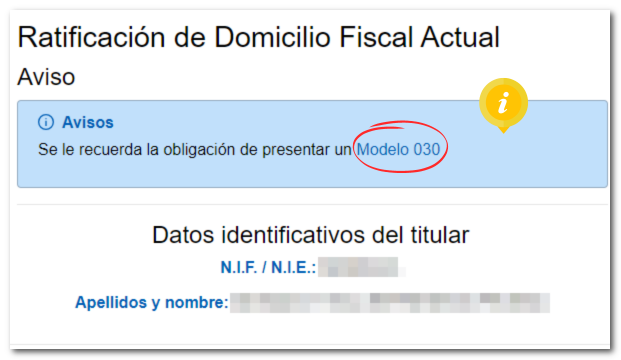

If the person trying to change their country of residence to "Foreign", NOT is listed as "Non-Resident" in the census, a message appears requiring them to submit form 030 to report this fact and they are not allowed to proceed.

If you click "Ratify", in the notice you will get a link to form 030 to submit it electronically using an electronic certificate, DNIe or Cl@ve .

-

If the person trying to change the country of residence to "Foreign", YES which is listed as "Non-Resident", clicking "Modify" allows them to proceed.