Methods of payment and filing Form 200

Skip information indexSubmission of Form 200 of 2024 with direct debit payment

Taxpayers or entities representing the tax group whose tax period coincides with the calendar year and therefore have indicated in their tax return that it ended on December 31, 2024, may use direct debit as a payment method at the depository entity that acts as a collaborator in the collection management (Bank, Savings Bank or Credit Cooperative) in which the account from which the payment is direct debited is open in their name. You may also select an account opened abroad belonging to entities that do not collaborate in the state collection management that are within the zone EU / SEPA .

Direct debit payments can be made from July 1 to July 22, 2025, inclusive.

The Tax Agency will notify the designated Collaborating Entity of the direct debit order, which will then debit the account with the direct debit amount on the indicated date, which will generally coincide with the last day of payment during the voluntary period, July 25, 2025.

Payments are deemed to have been made on the date of direct debit charges to the account, and proof of payment is considered to be the proof issued for this purpose by the deposit institution.

Persons or entities authorised to submit declarations electronically on behalf of third parties may also, by this means, forward the direct debit orders that have previously been communicated to them by the third parties they represent.

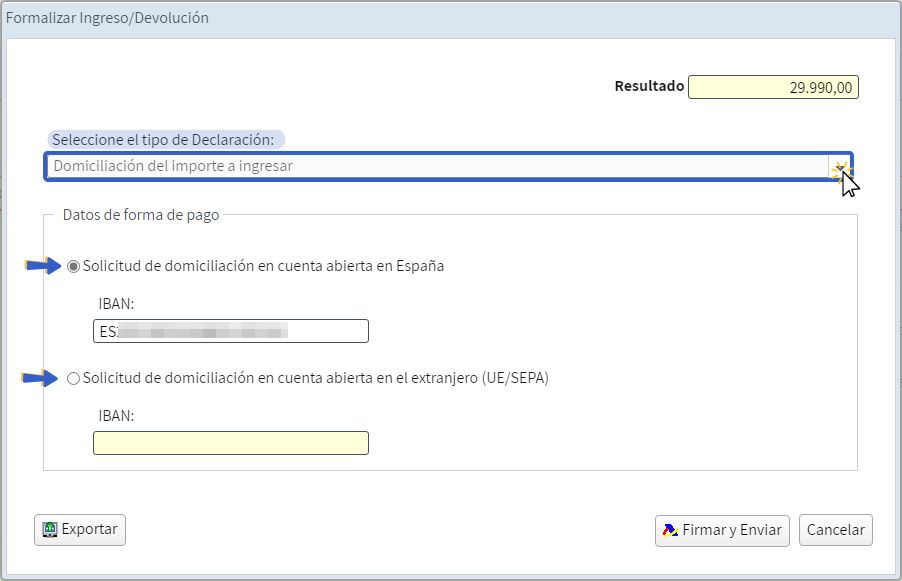

If you want to direct debit the payment of Form 200, once the declaration is validated without errors, press the button " Submit declaration ". In the "Select the type of Declaration" drop-down menu, choose " Direct debit of the amount to be paid " and indicate the IBAN of the account in which you want the charge to be made.

It is important to ensure that the IBAN provided to which the amount to be paid will be debited corresponds to a current account (current or savings), and that the taxpayer's NIF appears as the holder of the account. The financial institution will only accept payment if this requirement is met. To file your return, press "Sign and Submit" .

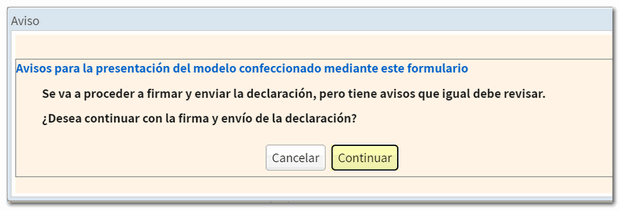

If there are no errors, a confirmation notice of signature and submission will appear. If you want to view pending notifications, click "Cancel." To continue with the presentation press "Continue" .

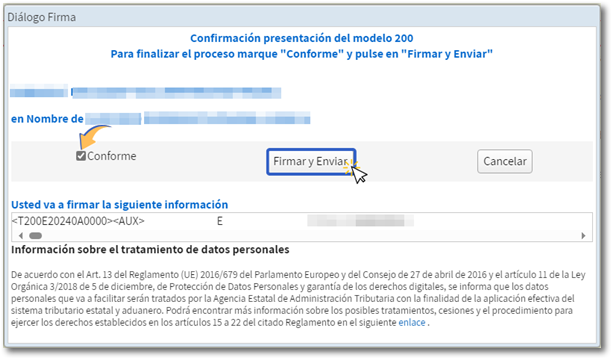

To complete the process, check "I agree" and press "Sign and Send."

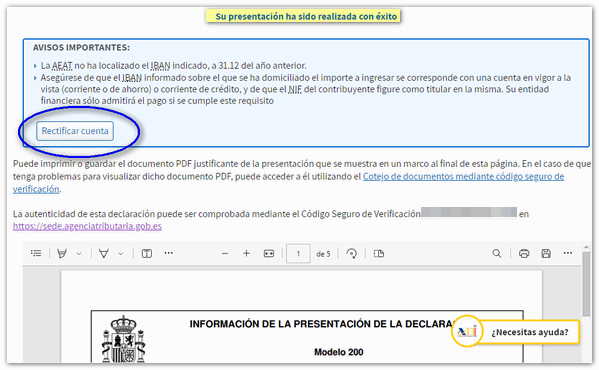

If the submission has been made correctly, a response page will be displayed with a PDF document of the submission receipt and the copy of the declaration, together with the secure verification code ( CSV ) that will allow you to verify the authenticity of the document through the "Document verification using a secure verification code" service.

In this payment option, if the IBAN is not recognized by the AEAT , a notice will be displayed indicating this fact and offering the possibility of "Correct account" .

You can recover the copy of the submitted declaration if you access the procedure "Consult submitted declarations" with the electronic certificate.