Methods of payment and filing Form 200

Skip information indexHow to change the IBAN after submitting Form 200

If after filing the corporate tax return with payment by direct debit you need to modify the IBAN of the account you have communicated, access from the procedures page of form 200 to "Direct debits - Query, revocation, rehabilitation or rectification of the direct debit account".

Access requires identification using an electronic certificate, eIDAS either Key.

Please note that modification of IBAN is only possible during the direct debit period. In this case, the direct debit period is from July 1 to July 22, 2025, inclusive.

As you may know, if "Permanent establishment" or any other specific case is marked in Form 200, the declaration will be generated as "Form 206" and would appear with this name in the modification of IBAN and in the receipt number, which will also begin with 206.

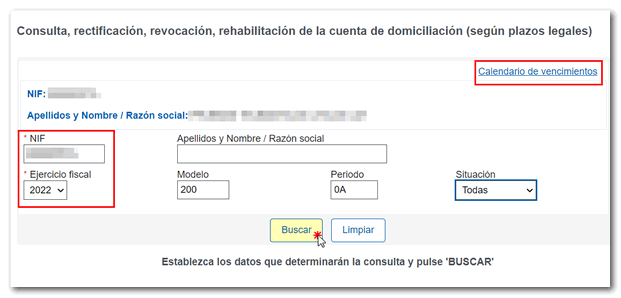

Complete the mandatory search filters " NIF " and "Fiscal Year". Optionally, you can also narrow your search by indicating the model and period. Finally press "Search".

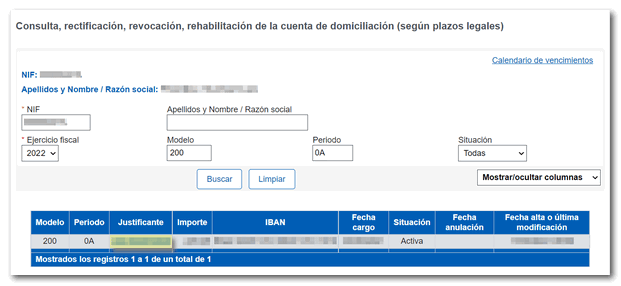

At the bottom, the file that matches the established filters will appear. Click on the receipt number to access the details of the direct debit and see the available options.

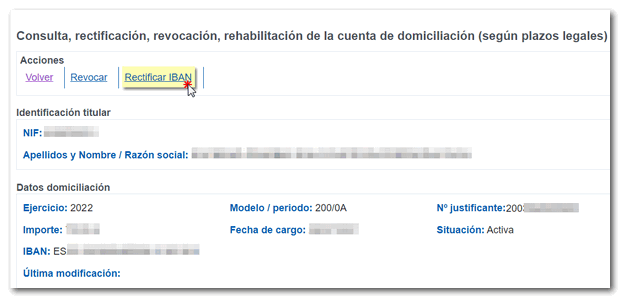

Use the option "Rectify IBAN " .

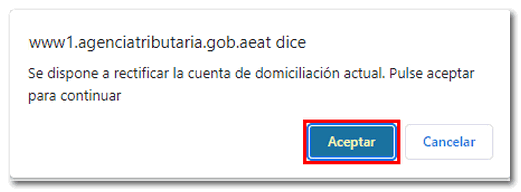

A pop-up window will appear warning that the direct debit account will be corrected. If you agree, click "Accept".

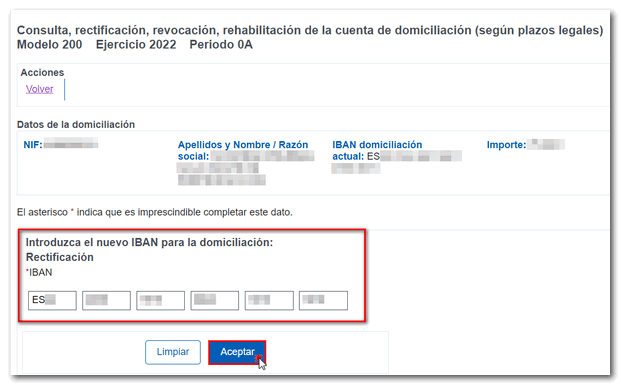

Enter the IBAN of the new account where the amount to be paid will be domiciled and press "Accept" to send the modification and obtain confirmation of the operation on the screen.

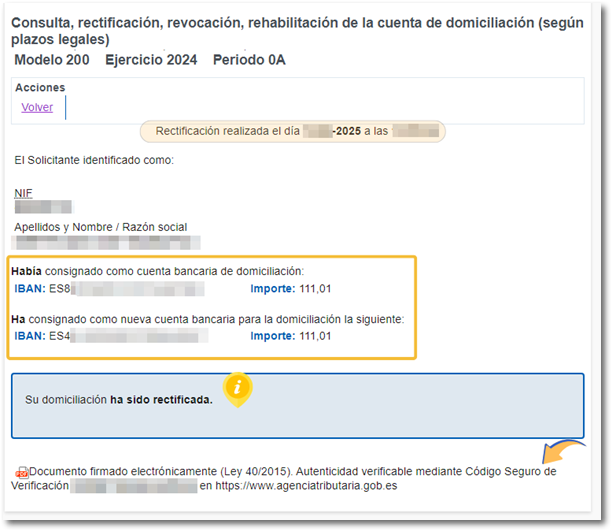

You will receive confirmation that the direct debit has been rectified, date and CSV of the presentation along with a document in PDF electronically signed.

Please note that if the result of the declaration is a refund, the bank account correction cannot be made online. In this case, go to the Administration.