Methods of payment and filing Form 200

Skip information indexSubmission of Form 200 of 2024 with payment via NRC and debit from account

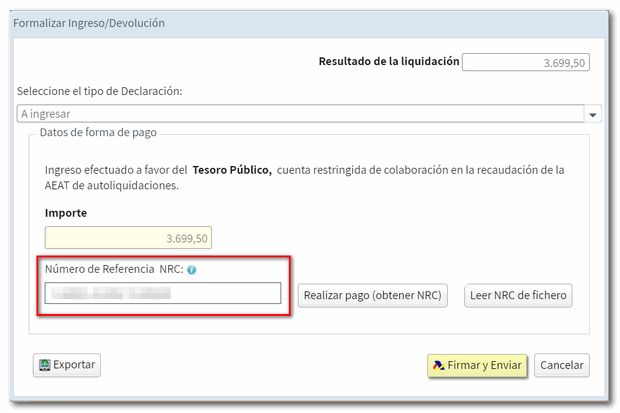

If the result of the declaration is positive and you do not opt for direct debit or for total or partial recognition of the debt, you must make the payment and include the NRC (proof number of the operation) in the field available in the window "Formalize Payment / Refund" . One of the options to obtain the NRC is the payment by direct debit.

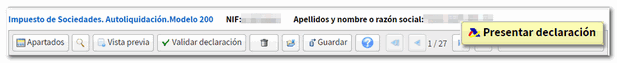

To select the payment method by direct debit, once the declaration is validated without errors, press the button "File a statement". Next, in the "Select the type of Declaration" drop-down, choose the option "To enter" .

Field is enabled "Reference Number: NRC " to include proof of payment once the payment has been made. This is a 22-digit code that can begin with 200 or 206 depending on the characters selected at the beginning of the declaration.

You can also get the NRC at the moment using the option "Make payment (NRC)".

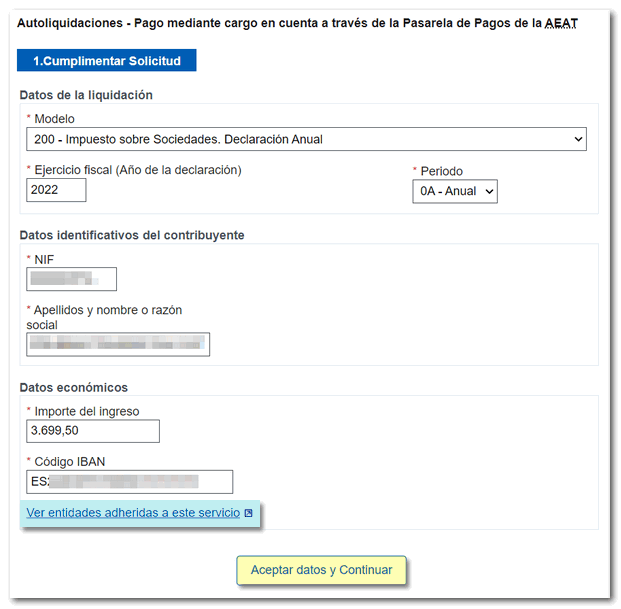

This action links to the payment gateway of the AEAT, select "Payment by direct debit".

In the next window, the data for the fiscal year, period, NIF of the declarant and amount will be automatically transferred from the declaration. Fill in the IBAN and press "Send" to make the payment.

You can access the link "See affiliated entities and service hours" to check if your bank is a collaborator with the AEAT and accepts payment of the tax.

If you used an account to make the payment in the previous exercise, the application gives you the option to use that same IBAN by checking the corresponding box.

Once the payment has been made, you will see on screen the proof of the transaction and the NRC obtained by the bank, which must be included in the declaration to make the submission.

In addition to using the link available in form 200, you can also access the AEAT payment gateway available in the "Pay, defer and check debts" section of the Electronic Office.

You can also manually include the NRC if you have previously contacted your Bank providing all the data related to the model you want to submit. You do not need to provide any form but only the data used to generate the NRC :

-

NIF of the taxpayer or the parent company or group head entity

-

Period to which the declaration corresponds = 0A

-

Model and fiscal year:

-

Corporate Tax = form 200. Fiscal exercise: 2024.

-

Corporate Tax for Non-Residents (permanent establishments and entities under the income attribution regime established abroad with a presence in Spanish territory) = form 206. Fiscal exercise: 2024.

-

-

Self-assessment type = "I", Income

-

Exact amount of income in euros

Note: If on the first page of the declaration (Characteristics of the declaration) you have marked box 00021 (permanent establishment) and box 00046 (Entity under the income attribution regime established abroad with a presence in Spanish territory) the bank must generate the NRC for model 206 and not for model 200.

Once the payment has been made and the NRC has been moved to the corresponding field, you can submit the declaration by clicking the "Sign and Submit" button.

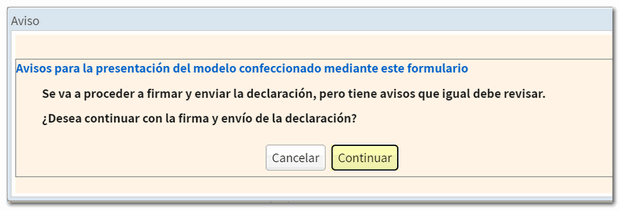

If there are no errors that need to be corrected, a confirmation notice will appear confirming signature and submission. If you want to check pending notifications, click "Cancel". To continue with the presentation, click "Continue".

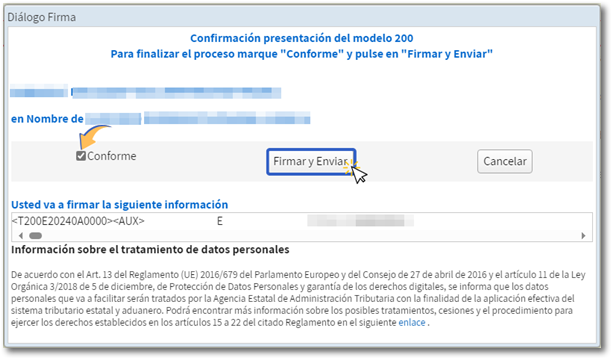

To complete the process, check "I agree" and press "Sign and Send."

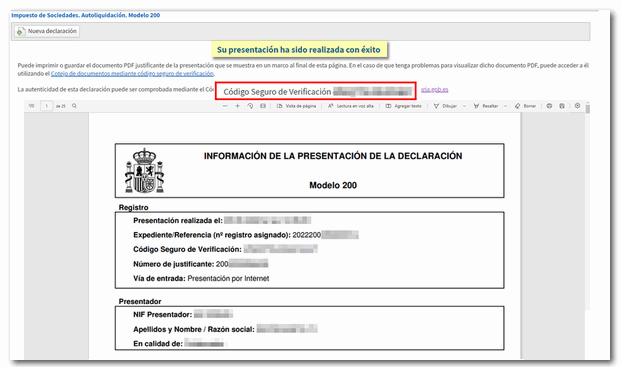

If the submission has been made correctly, a response page will be displayed with the secure verification code ( CSV ) and the PDF with proof of submission and a copy of the declaration.