Methods of payment and filing Form 200

Skip information indexSubmission of Form 200 of 2024 with acknowledgment of debt

If the result of the declaration of Form 200 is an income and is submitted with a request for recognition of the debt, you must first submit the declaration and then, using the corresponding settlement code, process the debt.

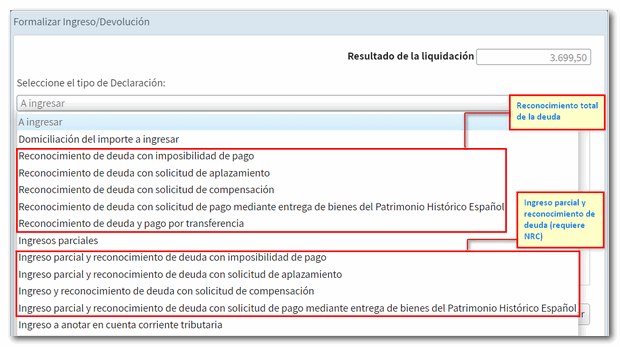

You can process the recognition of the amount of the debt in full or in part, but in any case, since the result is positive, in the declaration you must select one of the payment options that do not involve direct debiting the payment.

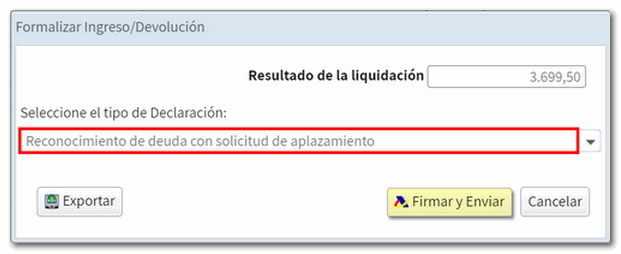

To select the payment method, once the declaration is validated without errors, press the " Submit declaration" button. In the drop-down menu "Select the type of Declaration" , choose the corresponding option from among the different types of debt recognition. For debt recognition options that involve partial payment (make payment of part of the amount and process the remaining amount as debt), you must obtain the NRC proof of payment from the "Make payment (get NRC )" option that will be enabled next to the NRC field. If you have previously contacted your Bank, you can include it directly in this field.

Once you have selected the corresponding option and included the NRC in case of partial payment, click "Sign and Send" to submit the declaration.

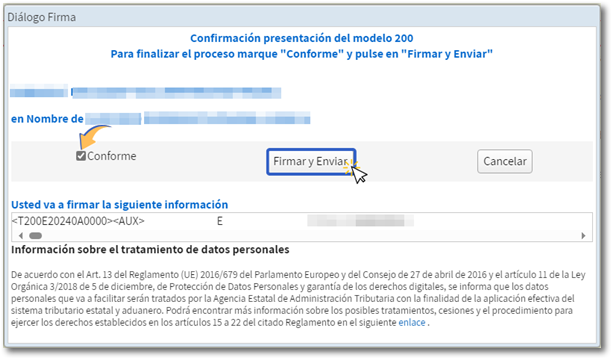

To complete the process, check "I agree" and press "Sign and Send."

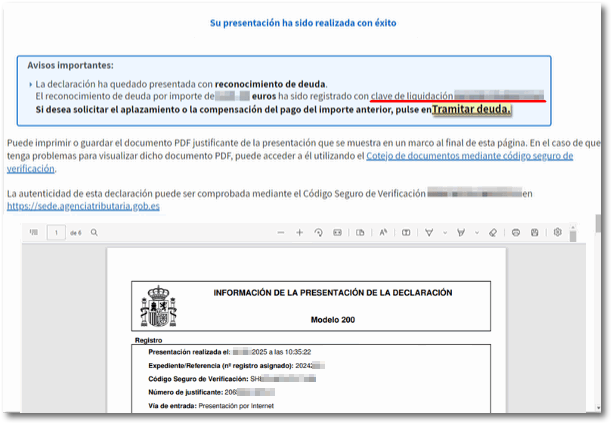

If the submission has been made correctly, a response page will be displayed with the secure verification code ( CSV ), a link to "Document verification using secure verification code" to verify the authenticity of the document and the PDF with proof of submission and a copy of the declaration.

In addition, in the case of debt recognition, a notice will appear reminding that the debt processing is pending and the settlement key and the direct link for "Process debt" will be provided.

You can also process the debt later from the Electronic Office.