Consultation and management of form 140 tax returns submitted from 1 March 2020

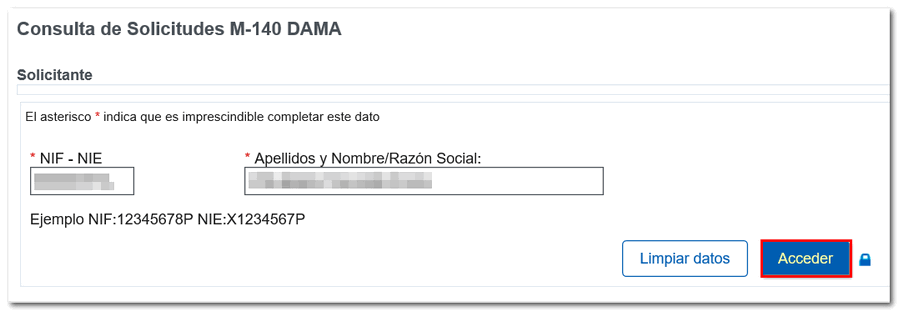

Access to this option requires identification with an electronic certificate, DNIe or Cl@ve . If the applicant's details are correct, click the "Access" button.

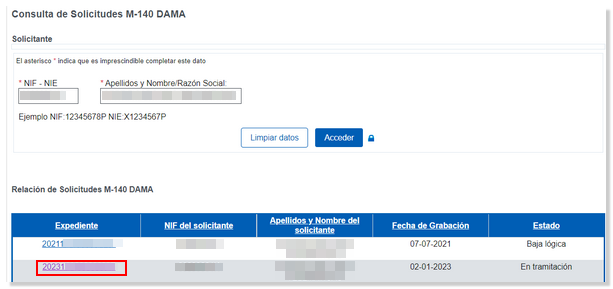

A list of the applicant's Model 140 files will be displayed. To access the details, click on the file link.

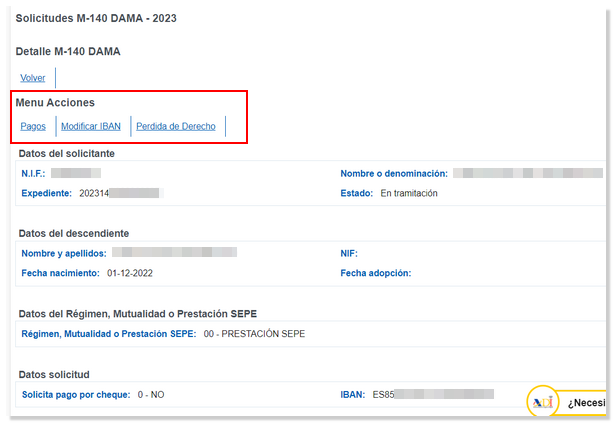

In addition to checking the data submitted, the possible actions available that can be taken on the file are offered:

- Query payments made

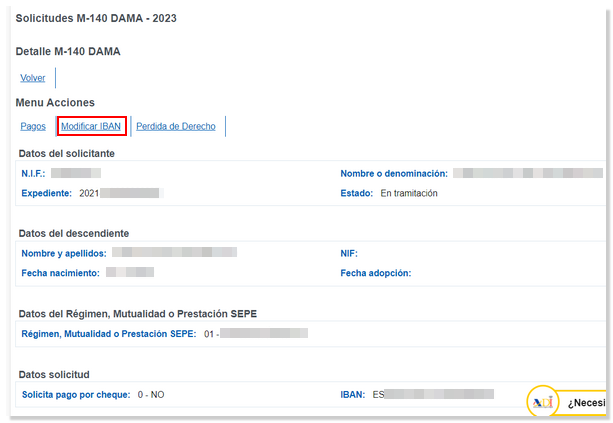

- Modify the IBAN

- Communicate the loss of the right to deduction

The "Payments" option will display information regarding payments made so far.

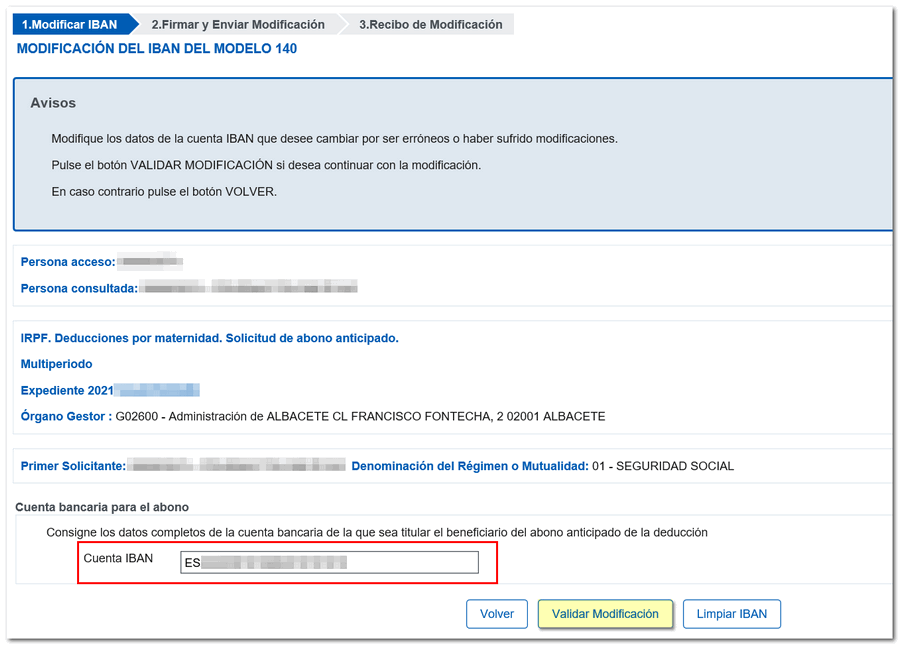

In the case of modification of IBAN , the field IBAN is editable to modify it or you can use the option "Clear IBAN " to delete the content of the field and enter the new IBAN . After entering the new IBAN , press the "Validate Modification" button to continue with the modification.

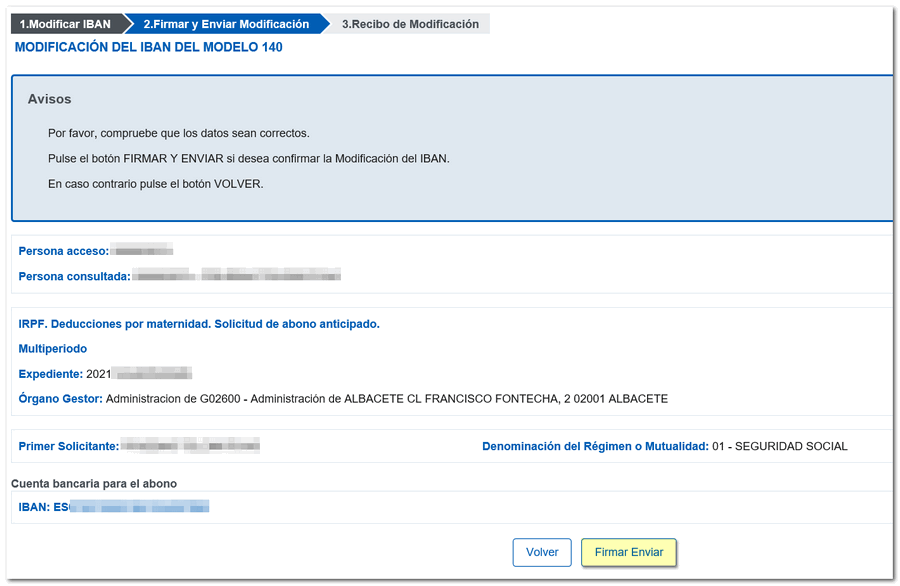

If the data is correct, click "Sign and Send". The transaction is then requested for approval; Check the "I agree" box and press "Sign and Send" again.

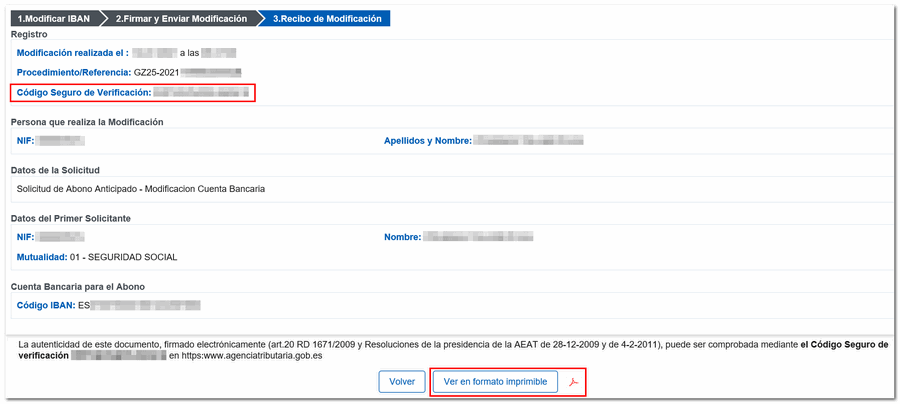

If the modification is registered correctly, the presentation receipt is generated, with the corresponding Secure Verification Code ( CSV ). However, to obtain the receipt in PDF , you have the link "View in printable format".

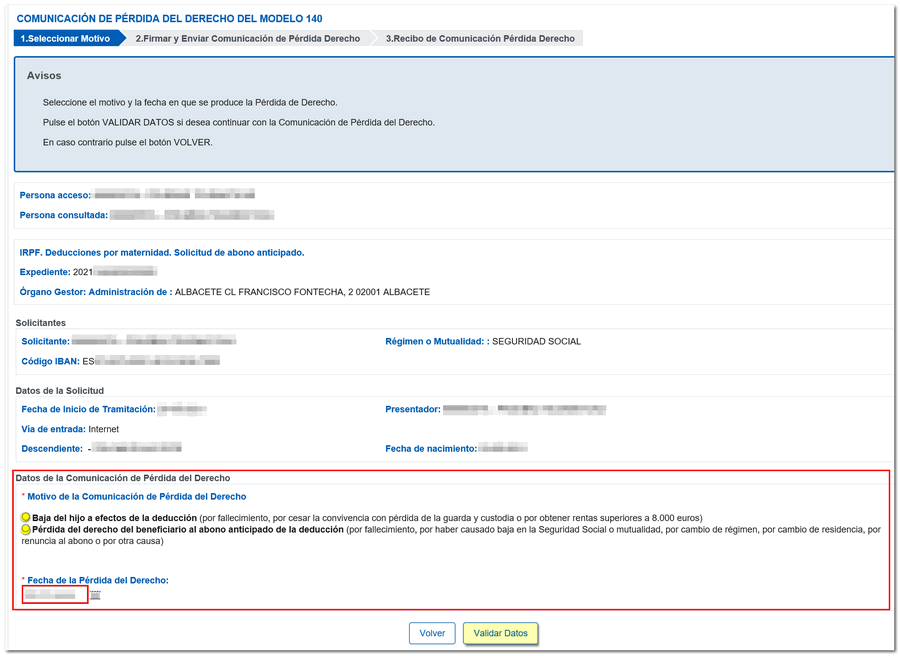

Finally, if there is any change in the situation that may affect the requirements for collecting the deduction, you can report it using the "Loss of right" option. You must indicate the reason for the communication, as well as the date of the loss of the right, and click on "Validate data".

From the floating icon "ADI"Do you need help?" which appears in the lower right corner, within the form itself, you can contact a specialist agent via chat (subject to opening hours) and request that they call you back by providing a phone number.