Electronic filing of form 140

The request for advance payment of the maternity deduction can be made electronically by submitting form 140. Access to the procedure is available with both an electronic certificate or DNIe and with Cl@ve .

Please note that this option is only enabled for the submission of new applications and that, for applications initiated after March 1, 2020, changes will be made from the specific procedure, "Consultation and management of submitted declarations" .

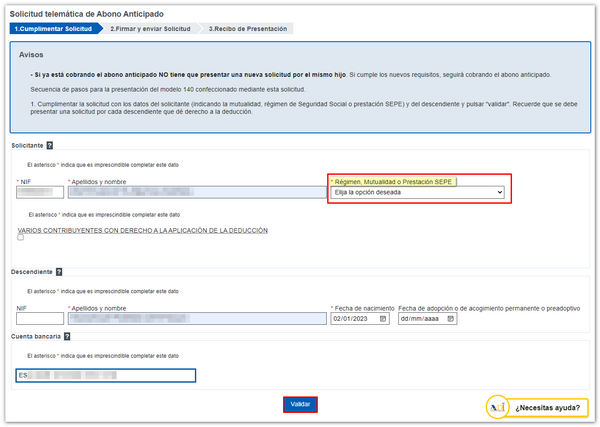

Once on the form, review the information that appears in the "Notices" box and proceed to complete the form, making sure to correctly enter the data, the scheme, mutuality or benefit SEPE corresponding. Also the full IBAN of the bank account into which you want the payment to be made.

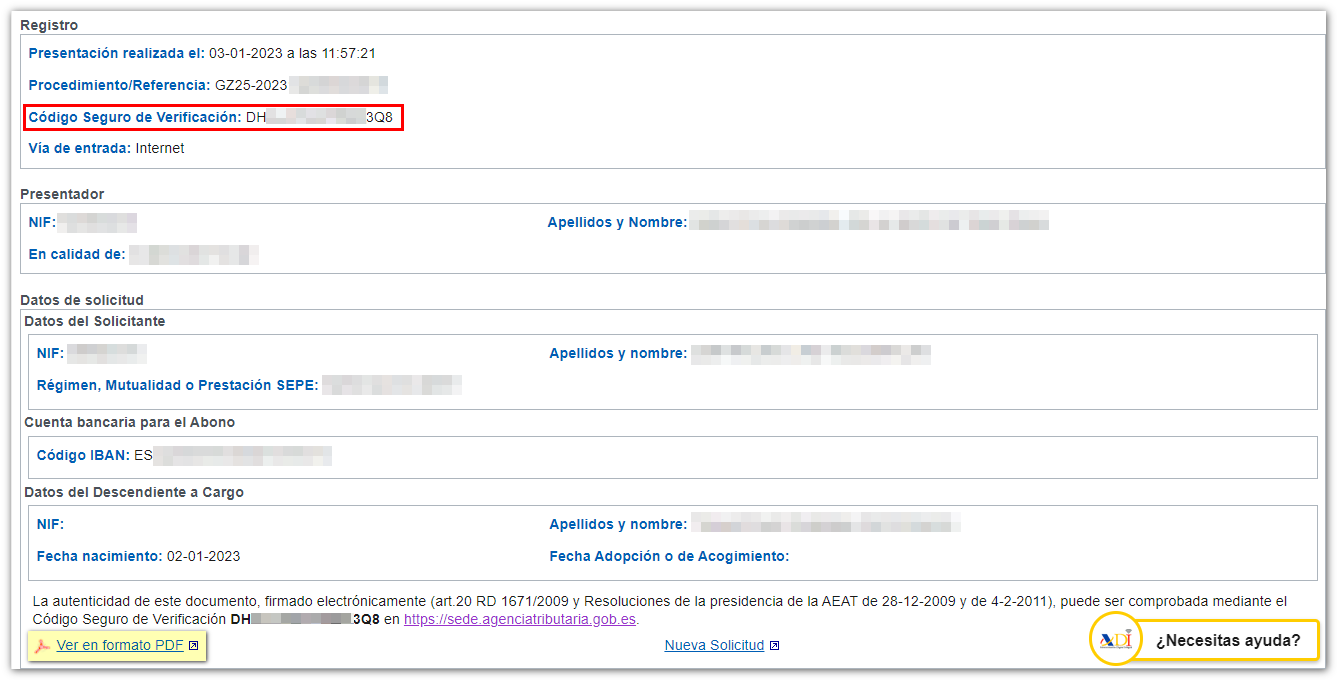

From the floating icon "ADI"Do you need help?" which appears in the lower right corner, within the form itself, you can contact a specialist agent via chat (subject to opening hours) and request that they call you back by providing a phone number.

To move on to the next screen, press "Validate".

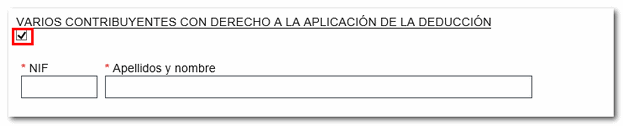

Indicate whether there is more than one beneficiary of the deduction by checking the box "VARIOUS TAXPAYERS WITH THE ERD TO APPLY THE DEDUCTION." In this case, a new field is enabled to identify this taxpayer.

Remember that after submitting this declaration, a new application must be submitted for this beneficiary.

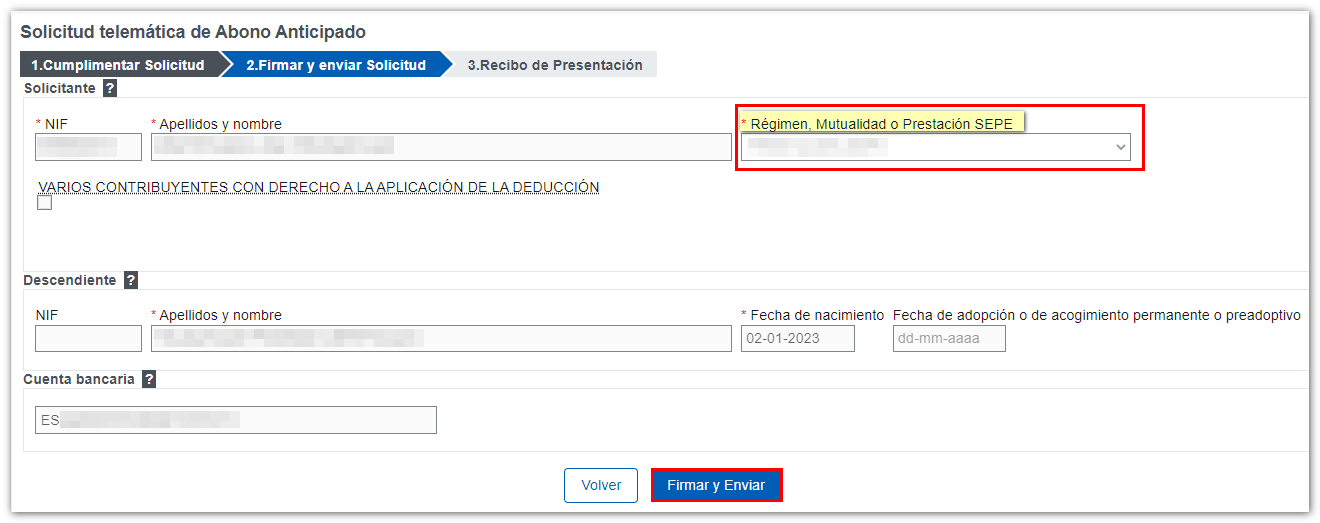

If the data is correct, click "Sign and Send".

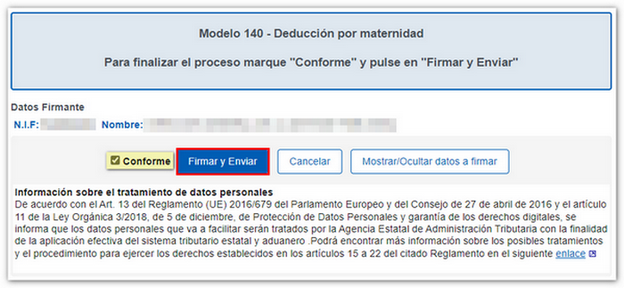

Check "I agree" and "Sign and Send".

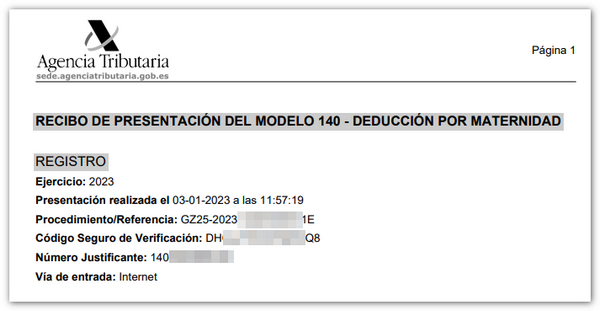

If the submission was successful, a registration confirmation page is provided, which includes the Secure Verification Code ( CSV ).

If you wish to obtain the receipt in PDF , click the link "View in PDF format".

If you wish to obtain the receipt in PDF , click the link "View in PDF format".

If you need to submit another application, the "New Application" link is available to return to the form.

We remind you that from the "Assistance and appointment" section you can request personalized attention for any of the services in the catalog offered by the Tax Agency through these channels: telephone appointment, offices appointment or chat. In addition, both the general information and appointment telephone number, 91 333 53 33, and the Basic Tax Information telephone number, 91 554 87 70, are available.