Form 140 preliminary tax return form

For applications for advance payment of the maternity deduction made from the 2020 financial year onwards, the submission on pre-printed paper is eliminated and a link to the pre-declaration of form 140 is enabled in the Electronic Office to obtain the declaration in PDF and submit it to any Administration or Delegation afterwards.

Access to the form does not require electronic identification.

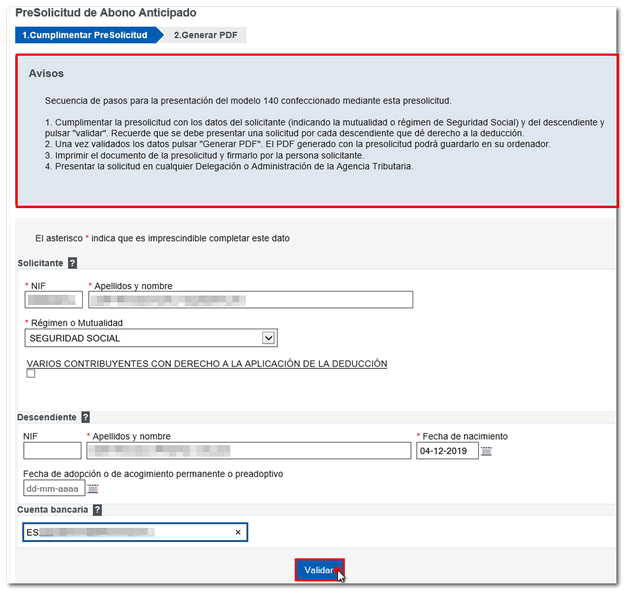

Once in the form, review the information that appears in the "Notices" box and complete the form, making sure to enter the data correctly, including the full IBAN of the bank account into which you want the payment to be made. In this step, you must also indicate whether there is more than one beneficiary of the deduction, by checking the box "VARIOUS TAXPAYERS WITH THE ERD TO APPLY THE DEDUCTION." A new field will be enabled to identify this taxpayer, for whom the Form 140 will also have to be submitted later.

From the floating icon "ADI"Do you need help?" which appears in the lower right corner, within the form itself, you can contact a specialist agent via chat (subject to opening hours) and request that they call you back by providing a phone number.

To proceed to the next screen, press the "Validate" button.

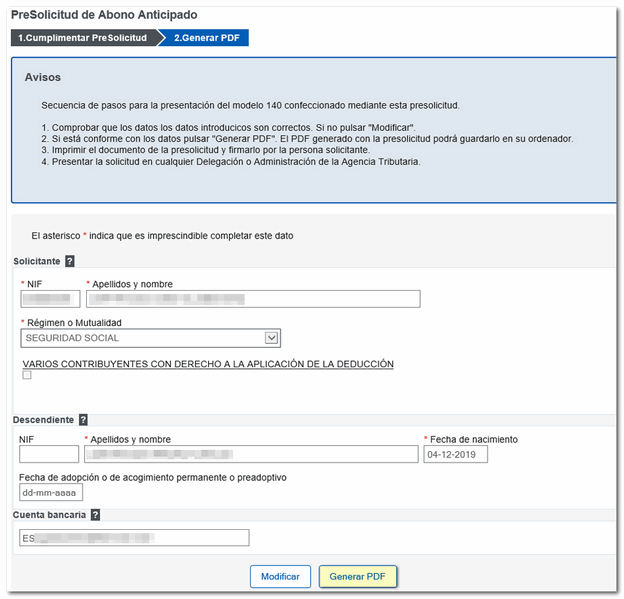

Review the application data and, if it is correct, press the "Generate PDF " button.

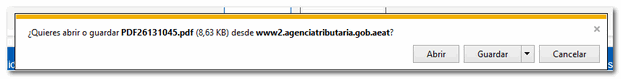

The browser will save the PDF generated in the folder you have set as your default for downloads.

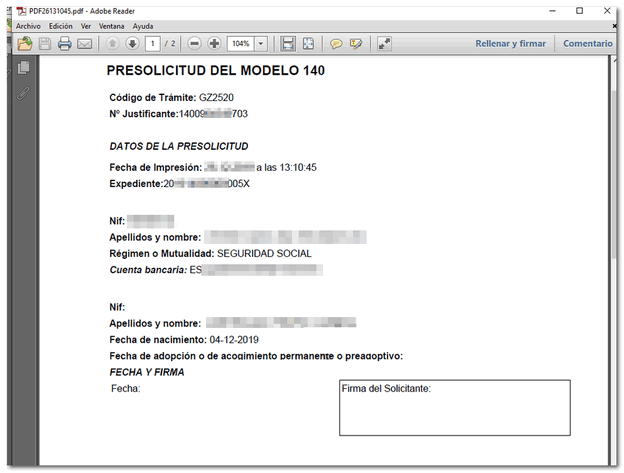

Two copies of the application are obtained, one for the Administration, which must be signed by the applicant, and another copy for the applicant.

After printing the document, you can go to any Administration or Delegation with an appointment, so that the submission of application is made effective.

We remind you that from the "Assistance and appointment" section you can request personalized attention for any of the services in the catalog offered by the Tax Agency through these channels: telephone appointment, offices appointment or chat. In addition, both the general information and appointment telephone number, 91 333 53 33, and the Basic Tax Information telephone number, 91 554 87 70, are available.