Form 131

Skip information indexPaper submission by file of model 131 pre-declaration. Fiscal year 2023 and earlier

You can submit Form 131 in paper form by importing the file with the declaration to be transmitted, with the data adjusted to the registration layout. The registration design is published on the website in the "Help" section, at the bottom of the page and also in the right-hand margin block under "Registration designs for models 100 to 199".

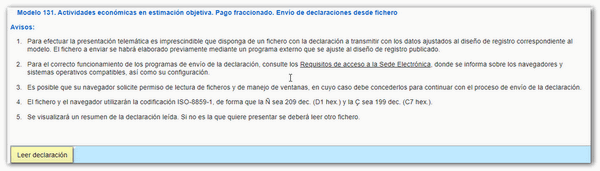

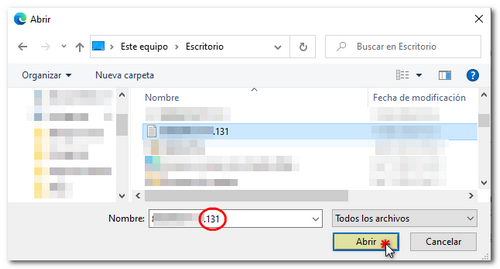

Access the link "Model 131. Fiscal year 2023. Form for submission (pre-declaration with file)" . On the next page, click the "Read declaration" button and locate the file with the declaration data.

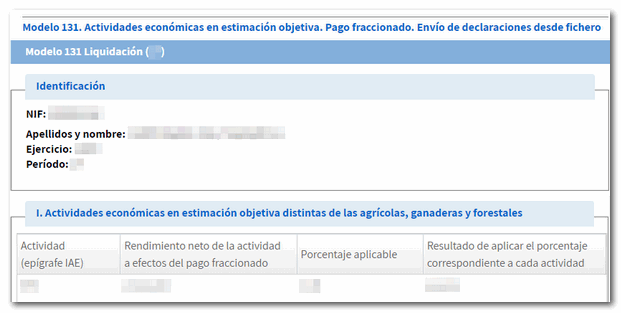

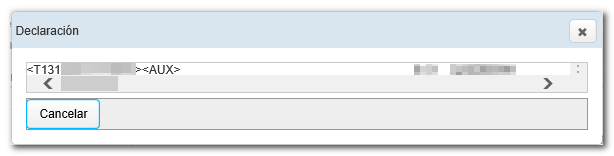

The form with the declaration data will then be displayed.

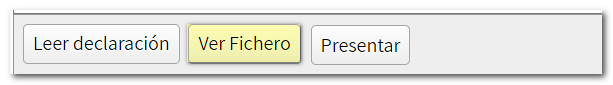

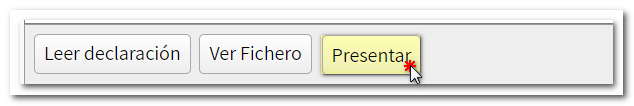

At the bottom are the available options. You can view the uploaded file by clicking the "View file" button.

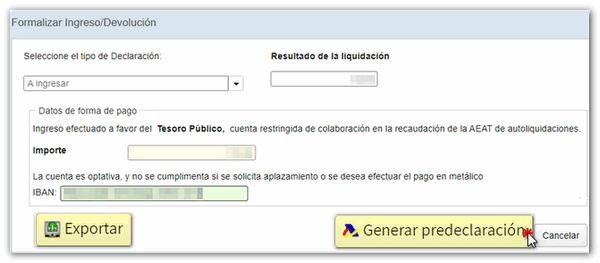

Check that the declaration does not contain errors before selecting the type of declaration from the "Submit" button. If the selected declaration type is "To be paid", you can optionally include the bank account in which you want the charge to be made.

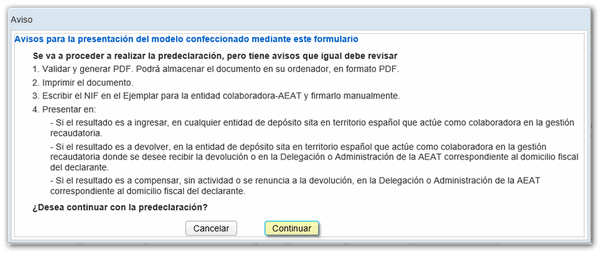

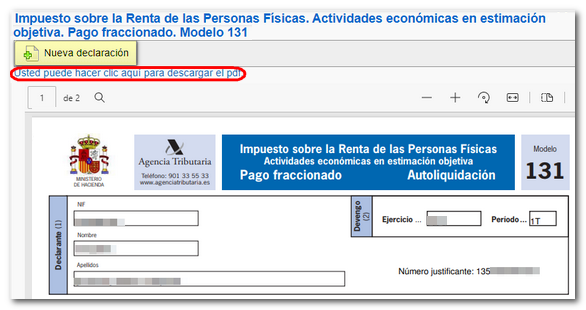

Finally, press the button "Generate pre-declaration" to generate the document PDF with the content of the declaration. You will be able to save the document, print it and submit it in paper form.

Remember that for tax-related questions you should contact Basic Tax Information at 91 554 87 70 or consult in person at your Administration or Delegation.