Form 131

Skip information indexPaper submission using form 131 pre-declaration

Remember that if you want to import data from files with format BOE you must use the "Model 131" option. Exercise 2024. Presentation".

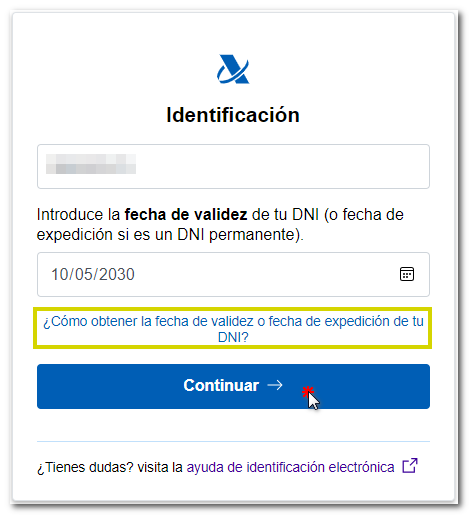

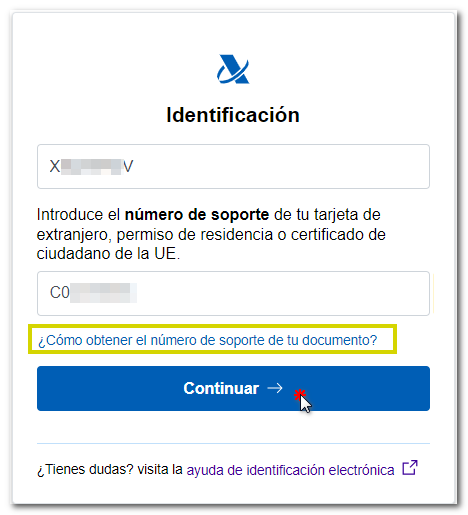

First of all, it will be necessary to authenticate yourself by indicating the DNI / NIE and the corresponding contrast data of the declarant. In the identification window you have links to check how to enter the contrast data.

-

-

If it is a DNI you must indicate the validity date, if the validity date is PERMANENT (01/01/9999) then you must indicate the date of issue.

- If it is a NIE you must indicate the support number.

-

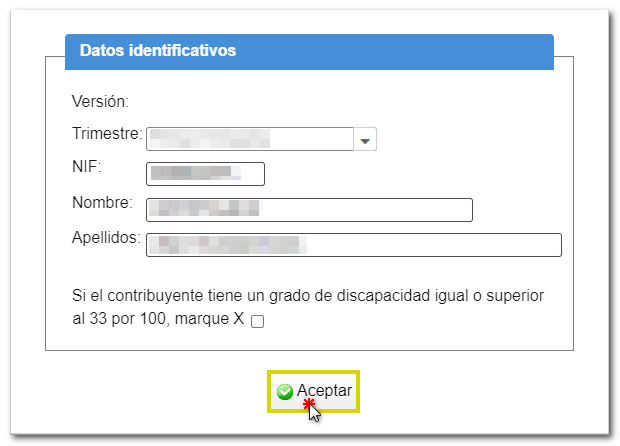

In the next window, fill in the rest of the information and click "Accept".

In the form, you can change the identification data by clicking on the button "Identification data" located at the top identified by the icon of two people together.

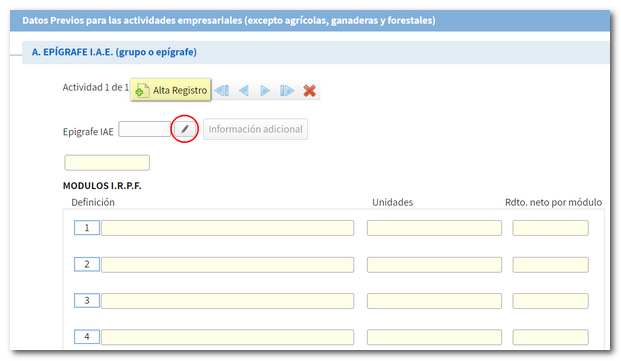

Click on the icon next to the box "Heading IAE " to select the activity and fill in the necessary data. To register a new activity, click "Registration". You can navigate through the different records using the arrows to move forward or backward or press the cross icon to delete a particular record.

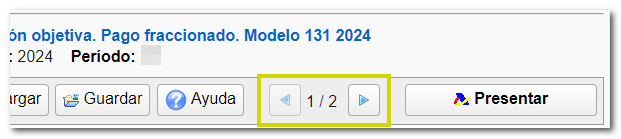

At the top of the screen are arrows to move forward or backward between pages.

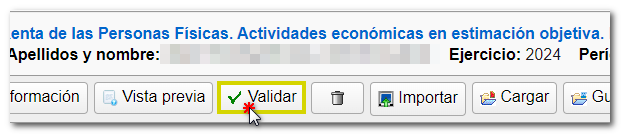

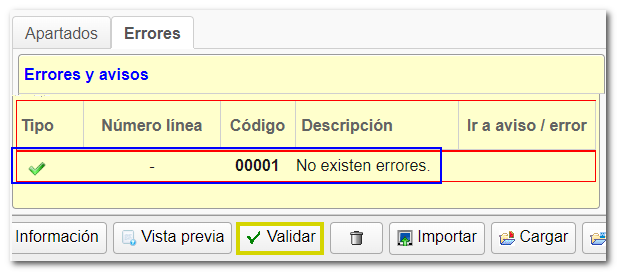

Once the data has been completed, you can validate the declaration from the button "Validate" .

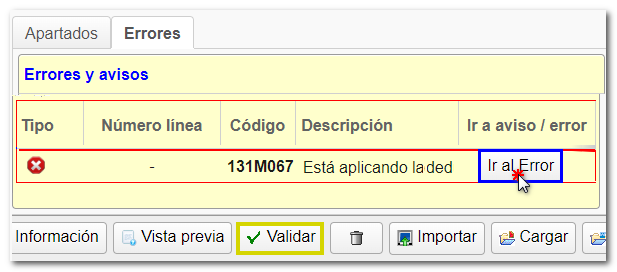

When validating the declaration, the list of errors and warnings detected will be displayed, which you can access for correction from the "Go to error" or "Go to warning" button next to the description of the fault. If you need help filling out the form, press the button "Help" .

If no errors are detected in the declaration, the description will state that there are no errors.

You can also get help with tax matters and completing the form by contacting the virtual counter " ADI Do you need help?", which opens when you enter the form, in the lower right corner.

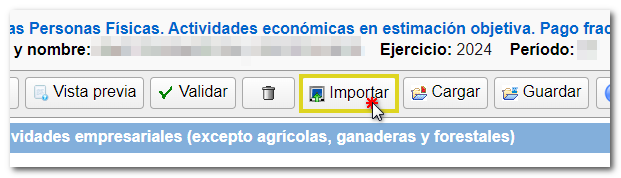

From the " Import " button, you can import a file with the declaration with the data adjusted to the registration design published on the website in "Help", "Registry Designs", "Models", "Models 100 to 199".

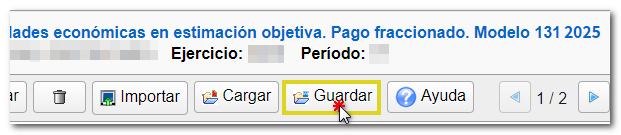

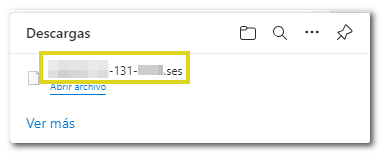

The "Save" option allows you to save the data already completed even if the declaration has not been validated correctly. This way you can keep the data and continue filling it out at another time. In this case, you can indicate the path where you want to locate the file that will be named " NIF declarante-131-2024.ses". However, you can change the file name to something more easily recognizable when saving it.

You can later retrieve the file using the "Upload" option within the form. Locate the previously saved .ses file.

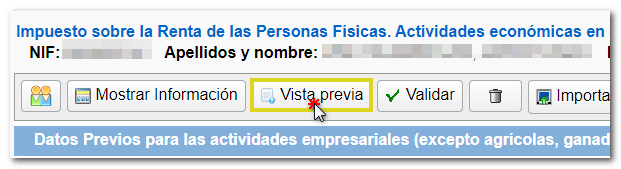

The form also allows you to obtain a draft of the declaration in PDF format from the "Preview" option which, although not valid for filing, can be used as a reference. The PDF will be displayed with a diagonal watermark indicating that it is not valid for presentation.

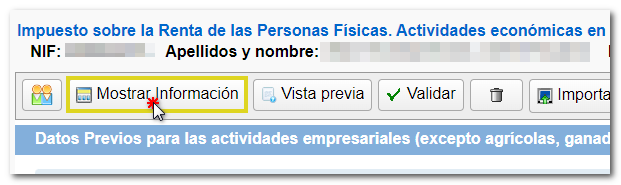

The "Show information" button allows you to activate or deactivate information about warnings and errors, as well as sections of the declaration.

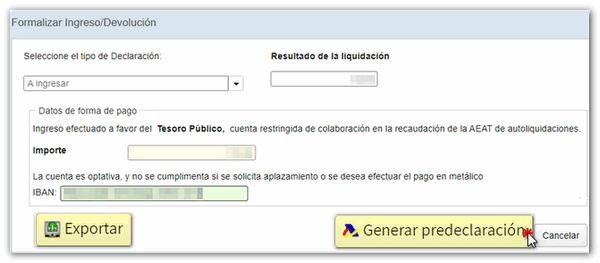

To select the type of declaration press the button "Submit" . If the selected declaration type is "To be paid", you can optionally include the bank account in which you want the charge to be made.

From this window you can also generate a file with the BOE format adjusted to the registry layout using the " Export " button, which you can import into the pre-declaration form from the "Import" button located in the menu bar at the top.

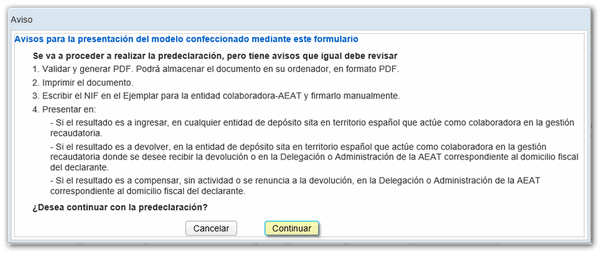

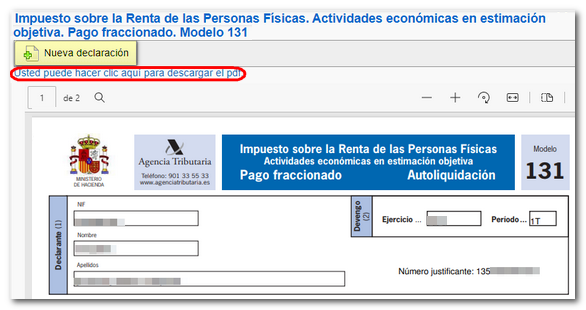

Finally, if the declaration does not contain errors, press the button "Generate pre-declaration" to generate the document PDF with the contents of the declaration. You will be able to save the document, print it and submit it in paper form.

Remember that for tax-related questions you can contact Basic Tax Information at 91 554 87 70, through the virtual help desk.ADI Do you need help?", or you can consult in person at your Administration or Delegation.