Form 213

Skip information indexElectronic filing of form 213

Verify your identity

- With Cl@ve Mobile

- With certificate / ID card electronic

Login

- In my own name.

- With power of attorney

- Through social collaboration

- By Succession

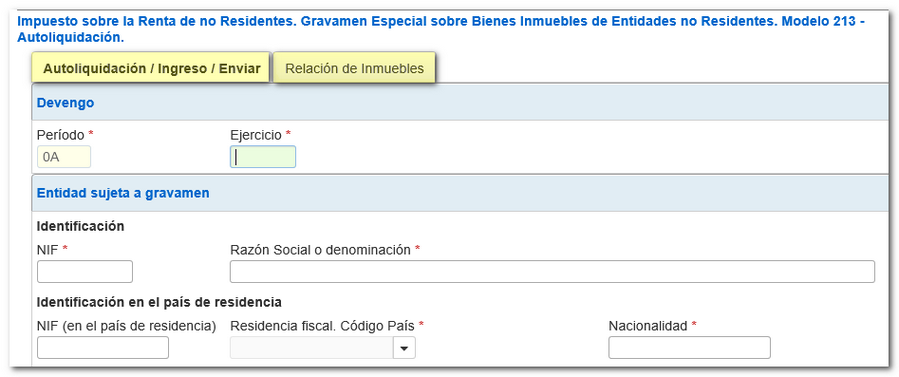

At the top of the model there are two tabs: "Self-assessment/Income/Send" and "List of properties".

Complete the required information in the "Self-assessment / Payment / Submit" tab (information marked with an asterisk is mandatory).

In the "List of properties" tab there is a button panel from which you can register, deregister and navigate between records. To register a record, click the "New record" icon identified by a "+" sign.

At the bottom you will find the index of sections and the button panel with the different functionalities of the form.

Can Matter a statement file in the format BOE, exported from the Formalize payment / refund window of the same form or generated with an external program.

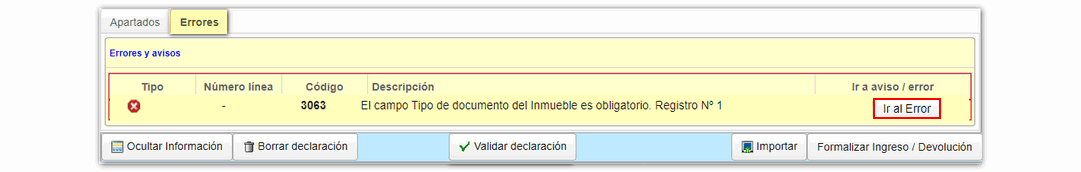

To check if there are errors in the declaration, click on "Validate declaration" . If it contains errors or warnings, the "Errors" tab will be enabled with the description of the error or the warning and the "Go to Error" or "Go to Warning" button, as appropriate, which will lead to the box to modify or complete.

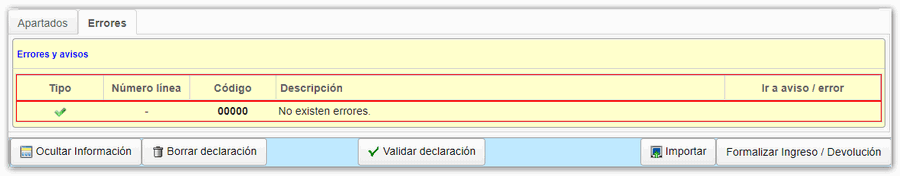

If no errors are detected, you can submit the statement by pressing "Formalize Entry / Refund.

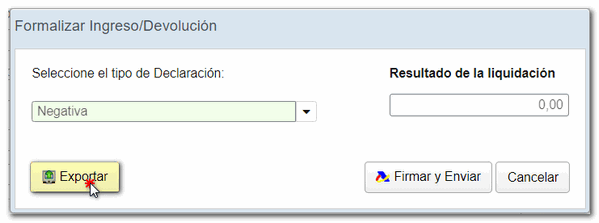

Using the button Export, you will get a file in the format BOE which you can import back into the form and which is valid for submission. The file that will be named tax ID number of the declarant_Exercise_0A and the extension .213.

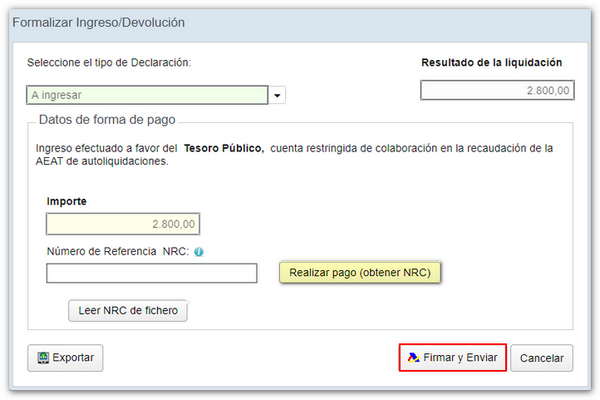

In declarations with a positive result, select the type of declaration from the available options.

If you select the option To enter You will need to make the payment and obtain the (Complete 22-character Reference Number that serves as proof of payment).

In the same window you will find the button "Make payment (NRC)", which links directly to the payment gateway to make the payment by debiting the account, or by card or Bizum.

You can also make the payment through the self-assessment payment procedures available on the Electronic Office website. AEAT or through the options offered by your bank.

The option "Recover a previous payment (NRC)" allows to recover a NRC of a payment made previously and which you wish to include for the self-assessment filing. This button will only be available for submissions made on one's own behalf and with power of attorney, not for social collaborators, and the details must match: model, exercise, period, NIF of the holder and amount to be deposited.

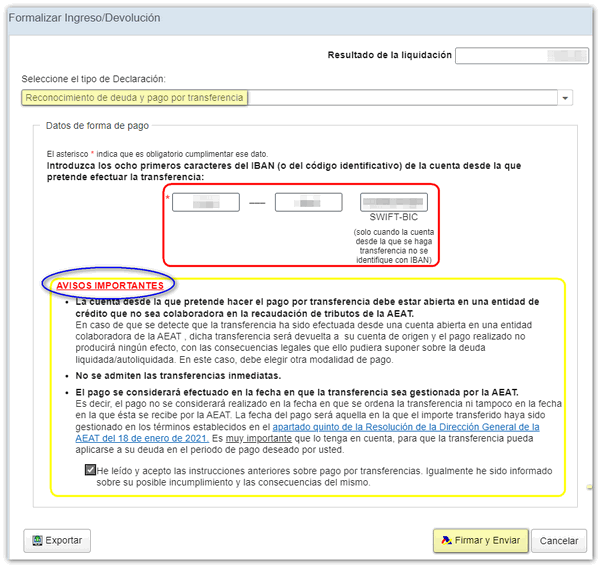

form 213 offers different debt acknowledgment options. One of them is Acknowledgment of debt and payment by transfer which allows the use of a bank account opened in a NON-COLLABORATING Credit Institution, for example, a foreign account.

NOTE : Immediate transfers are not accepted.

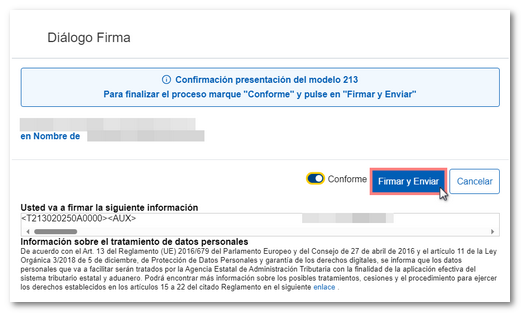

In the new window, click "Accept" to confirm the submission of the declaration. The text box will display the encoded content of the declaration. Finally, press "Sign and send".

The result of a correct filing of form 213 will be a response page with a PDF embedded corresponding to the electronics copy of the statement which contains a first page with the information of the filing (registration entry number, Secure Verification Code, receipt number, date and time of filing and presenter details) and, on subsequent pages, the complete copy of the statement.