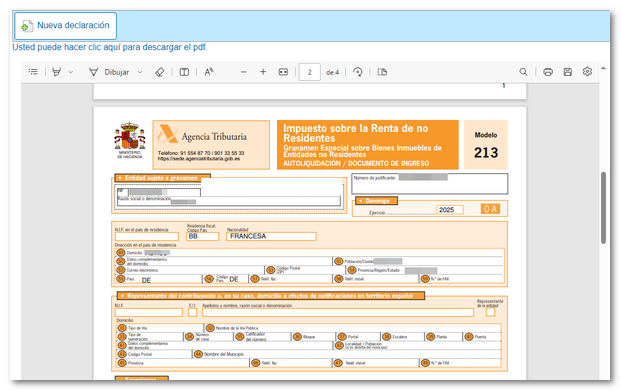

Form 213

Skip information indexForm 213 for paper submission

The form for the paper submission of model 213 can be obtained from the Electronic Office within the procedures of model 213, specifically using the link "Model 213. Form for submission (pre-declaration)".

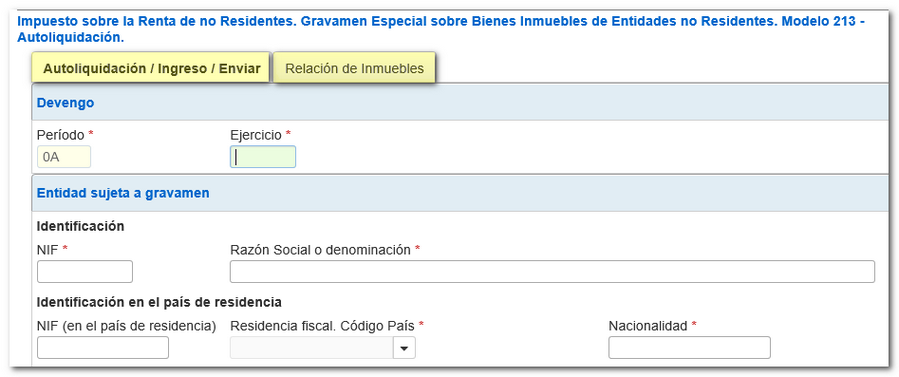

To complete the declaration, enter data in the fields marked with an asterisk, which must be completed.

At the top of the model there are two tabs: "Self-assessment/Income/Send" and "List of properties".

In the "List of properties" tab there is a button panel from which you can register, deregister and navigate between records. To register a record, click the "New record" icon identified by a "+" sign.

At the bottom you will find the index of sections and the button panel with the different functionalities of the form.

Can Matter a statement file in the format BOE, exported from the Select Income / Return window of the same form or generated with an external program.

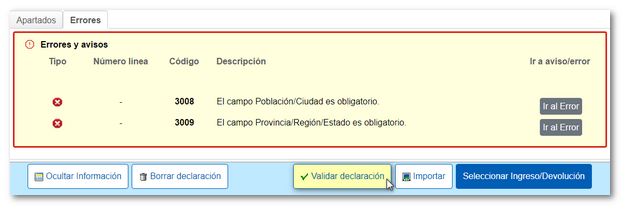

To check if there are errors in the declaration, click "Validate declaration". If it contains errors or warnings, the "Errors" tab will be enabled with the description of the error or the warning and the "Go to Error" or "Go to Warning" button, as appropriate, which will lead to the box to modify or complete.

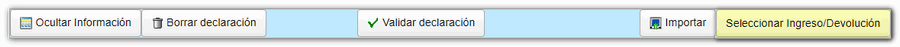

If no errors are detected, you can submit the statement by pressing "Select "Income / Return".

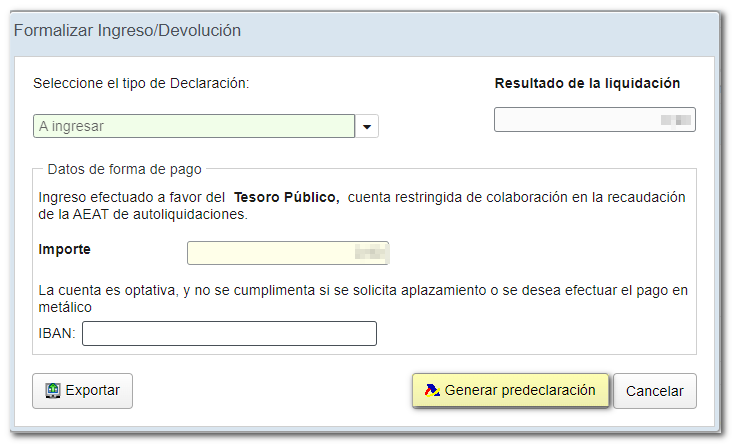

Select the type of declaration. If the tax return result shows an payment, optionally, the IBAN of the bank account where the payment will be made, although if the payment will be made in cash or a deferral is requested, it is not completed.

From the "Export" button you can generate a file with the published logical design format, provided that the declaration does not contain errors, it is saved in the "Downloads" folder of the system or in the directory established by the browser to save the downloaded files. This file is named NIF of the declarant, the fiscal year and the period and by extension the model number ( NIF _ejercicio_periodo.213).

Finally, press "Generate preliminary tax return".

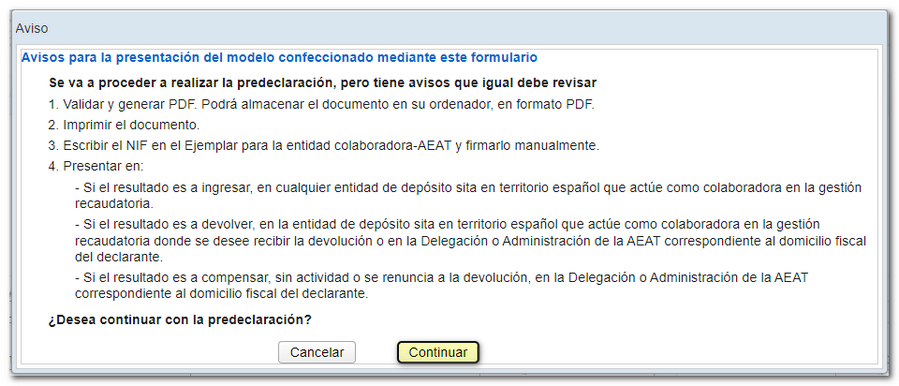

Review the notices and click "Continue"

The PDF will be generated with the declaration consisting of two copies; the "Copy for the Non-Resident Entity/Representative" and the "Copy for the Collaborating Entity / Administration", with the Income or Refund Document.

After printing the document, you must write the NIF on the Income or Refund Document and sign it to proceed with its presentation where appropriate, depending on the type of declaration selected.