Form 222

Skip information indexHow to report additional data to the declaration for the 2017 and 2018 fiscal years

Form "Model 222. Exercise 2018. Submission of additional data communication to the declaration." is available in the list of procedures for "Model 222. IS Tax consolidation regime. "Split payment", within "Annex 222".

The procedure requires identification with an electronic certificate.

Enter the identification data. You can check the format in which you must enter the Group Number by placing the mouse over the question mark icon symbol. To indicate the " CNAE "main activity" press the button with the ellipsis, then fill out the form with the additional data you want to communicate.

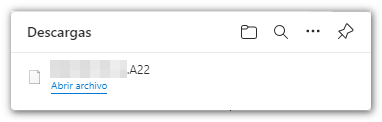

The form allows you to generate a file with the format BOE that follows the registry layout and save it from the " Export " button, as long as it does not contain errors. The file is saved by default in the computer's download folder, however you can select an alternative path, with the name " NIF del declarante.A22". From the " Import " button you can recover the file generated with the form on the website or with a program external to the Tax Agency and that follows the registration design published on the website in "Help", "Registry designs".

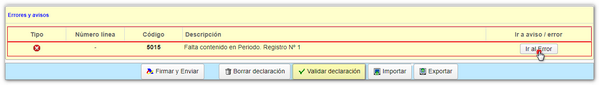

Once you have completed the corresponding boxes, click on " Validate declaration ". The list of errors and warnings detected will be displayed, which you can access for correction from the "Go to Error" or "Go to Warning" button.

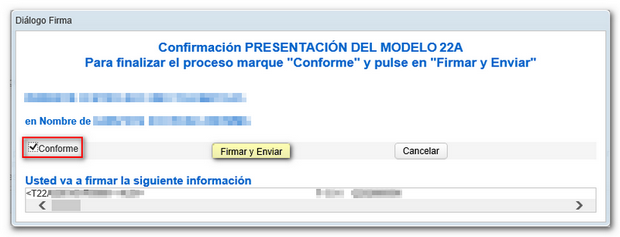

If the declaration does not contain errors, click on " Sign and Send ".

In the next window, check the "I agree" box and click "Sign and Send" to finish the submission.

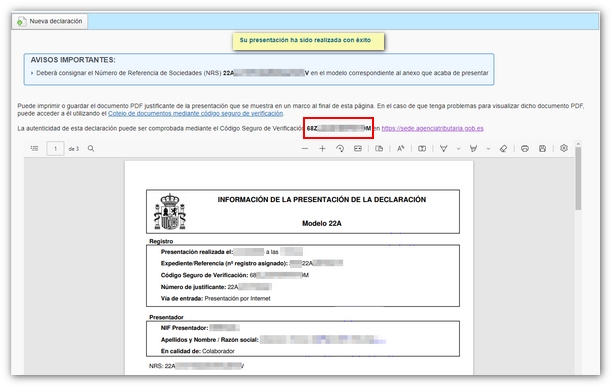

If everything is correct, you will receive the response sheet stating "Your submission has been successfully completed" with an embedded PDF document containing a first page with the submission information (registry entry number, Secure Verification Code, receipt number, day and time of submission and presenter details) and, on the subsequent pages, the complete copy of the declaration.