Form 222

Skip information indexElectronic filing of form 222

To electronically submit form 222, you can use the online form available at the Electronic Office of the AEAT , within the procedures for form 222. "Model 222. Fiscal year 2025 and following years. Presentation"

This procedure requires identification with an electronic certificate and Cl@ve .

To correctly view all parts of the form, before accessing it, check the zoom and font size set in the browser (once the declaration has been submitted, you can return to the previous zoom and font size).

-

In Microsoft Edge , access the three horizontal dots, in zoom select 100% with the "+" and "-" signs. Go back to the three horizontal dots to enter "Settings", select "Appearance" and under "Fonts", "Font size" select "Medium (recommended)", under "Page zoom" select 100%.

-

In Google Chrome , go to "Settings" (from the three vertical dots), "Appearance", "Font size" and select "Medium (recommended)", in "Page zoom" select 100%. You can also select 100% zoom from "Zoom In/Out".

-

In Mozilla Firefox , access the three-stripe icon, in "Size" select 100% with the "+" and "-" signs, press "Options", "General", "Language and appearance" and in "Fonts and colors" select a size smaller than the current one, if you do not see the form correctly.

-

In Safari , go to "View," "Enlarge," or "Reduce."

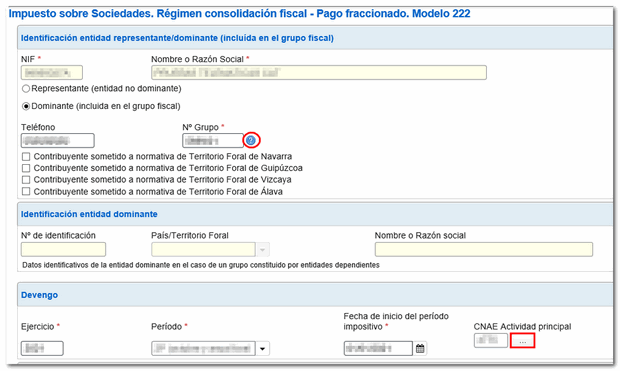

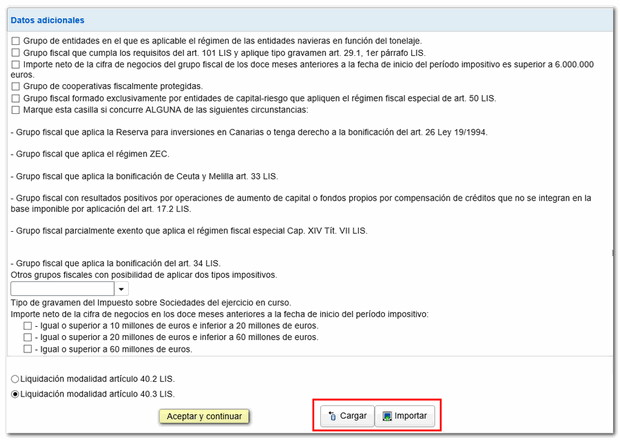

In the identification data window, select the period and enter your identification data, NIF , surname and first name or company name. If you want to import a file generated with the form or with a program other than AEAT you have the "Import" option in this same window. Please note that this file must be text and must conform to the published record layout. You can find the registration design for Form 222 for electronic filing in the "Registration Designs" shortcut. Models 200 to 299" and in the "Help" section, "Registration designs" at the bottom of the web page.

The system detects whether you have been working on the declaration in a previous session, giving you the option to continue with it by clicking the "Continue" button, if you have submitted the declaration or if you wish to create a new declaration.

Once in the form, fill in the identification data, accrual and additional data from the initial window. To view the required format in field "Group No." , place your mouse over the question mark icon symbol. You can also consult the "code CNAE Main activity" by pressing the button with the pencil icon located next to the corresponding field.

Select the type of settlement according to the modality of article 40.2 LIS or article 40.3 LIS and press the button "Accept and continue" . Please note that you will not be able to modify the fiscal year, period, CNAE Main activity and settlement method later. We suggest you click the "Validate" button at the top before continuing.

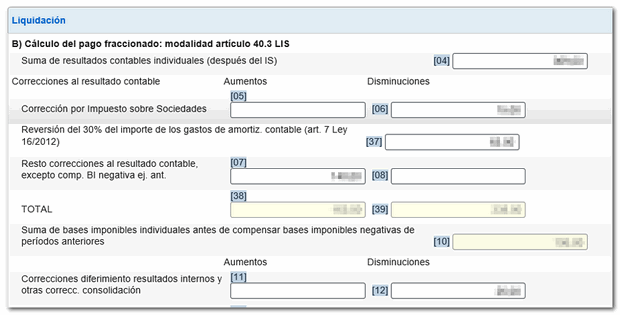

Next, enter the settlement details according to the split payment calculation method you selected in the previous step.

If you need to submit a supplementary declaration, check the corresponding box below and enter the supporting document number of the previous declaration.

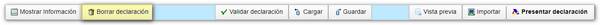

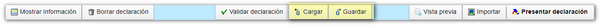

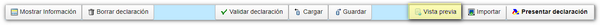

At the top of the form is the button bar with the available functions:

-

"Delete Return" deletes the data from the return you are working on to start a new one.

-

The " Save " button allows you to store the declaration data on the AEAT servers even if it is incomplete and contains warnings or errors. If a tax return has been saved previously, it will be overwritten. When you access the model again, in the initial login window, if it detects that there is already a saved session in which you have been working, you will be given the option to recover the data by clicking "Continue."

-

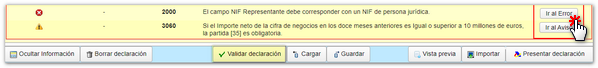

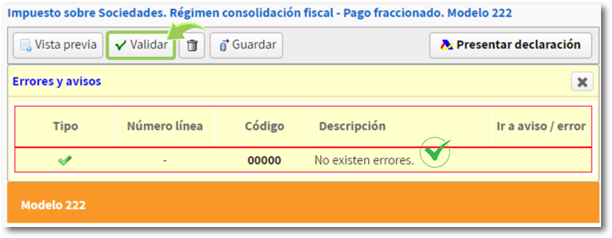

Using the " Validate " button, check if you have any warnings or errors. The "Errors" tab will appear with the warnings or errors detected, which you can access for correction from the button "Go to Error" either "Go to the Notice". Remember that the notices provide relevant information that should be reviewed but do not prevent the filing of the tax return. If the declaration contains errors, these must be corrected.

-

You can view your return before filing it by clicking the "Preview", although it is not valid for the presentation of the declaration.

-

Use the button "File a statement" to submit the declaration once it has been completed and validated.

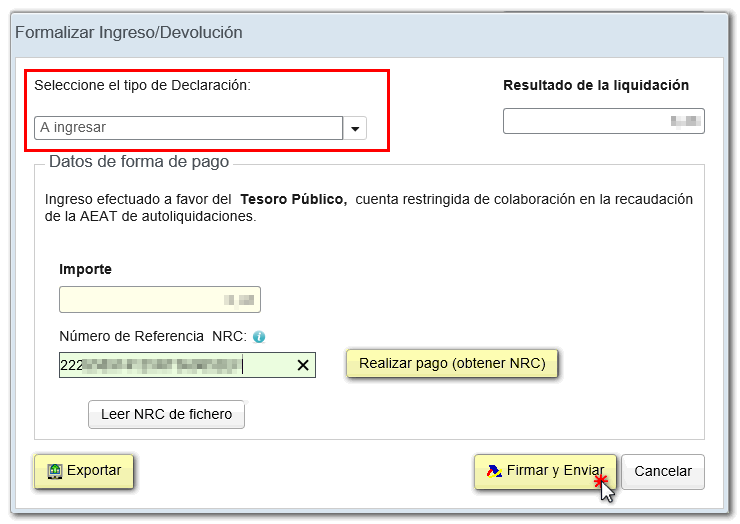

In the pop-up window, select the type of return.

If you select the option To enter You will need to make the payment and obtain the NRC (Complete 22-character Reference Number that serves as proof of payment).

In the same window you will find the button "Make payment (NRC)", which links directly to the payment gateway to make the payment by debiting the account, or by card or Bizum.

You can also make the payment through the self-assessment payment procedures available on the Electronic Office website. AEAT or through the options offered by your bank.

The option "Recover a previous payment (NRC)" allows to recover a NRC of a payment made previously and which you wish to include for the self-assessment filing. This button will only be available for submissions made on one's own behalf and with power of attorney, not for social collaborators, and the details must match: model, exercise, period, NIF of the holder and amount to be deposited.

In this same window it is also possible to export the declaration with the format of the published logical design from the " Export " button. The file will be named " NIF del declarante_ejercicio_periodo.222" and will be saved by default in the computer's download folder, although you can select another location. You can later retrieve this file from the "Import" button in the initial window.

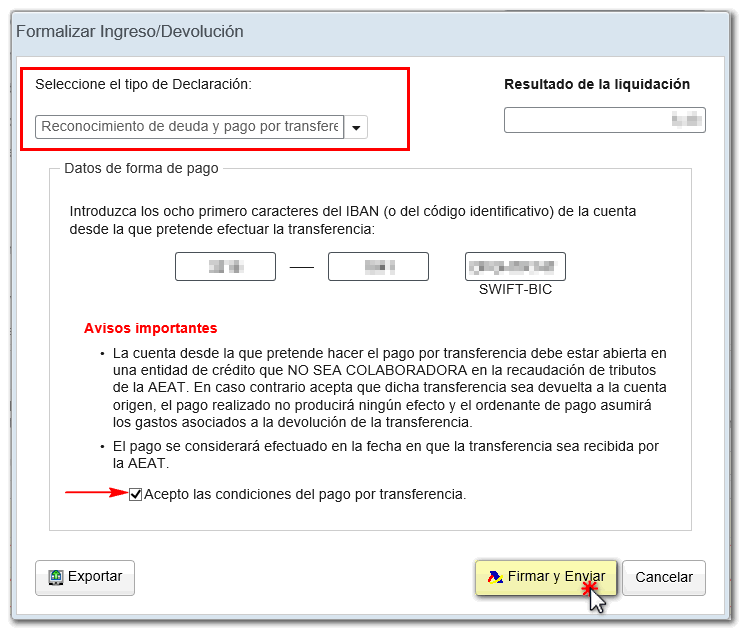

Form 222 also includes the option of debt recognition and payment by transfer from a bank account opened in a NON-COLLABORATING Credit Institution, by choosing "Debt recognition and payment by transfer" from the drop-down menu "Select the type of Declaration".

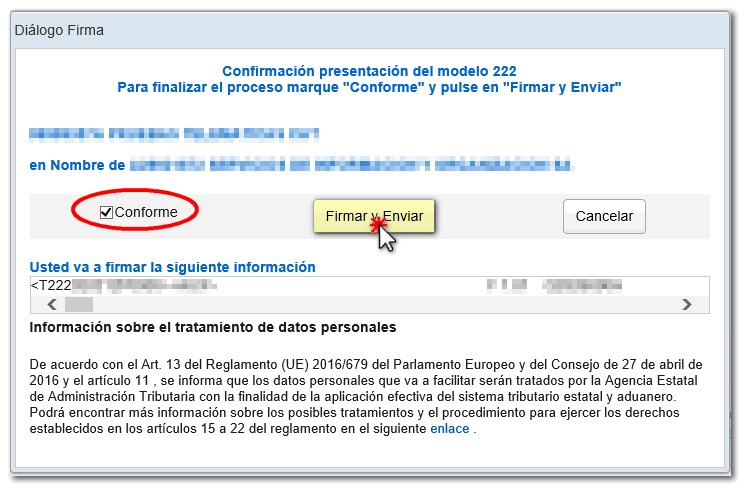

Finally, click on "Sign and send", in the next window tick the "I agree" box and click again on "Sign and send" to submit the return.

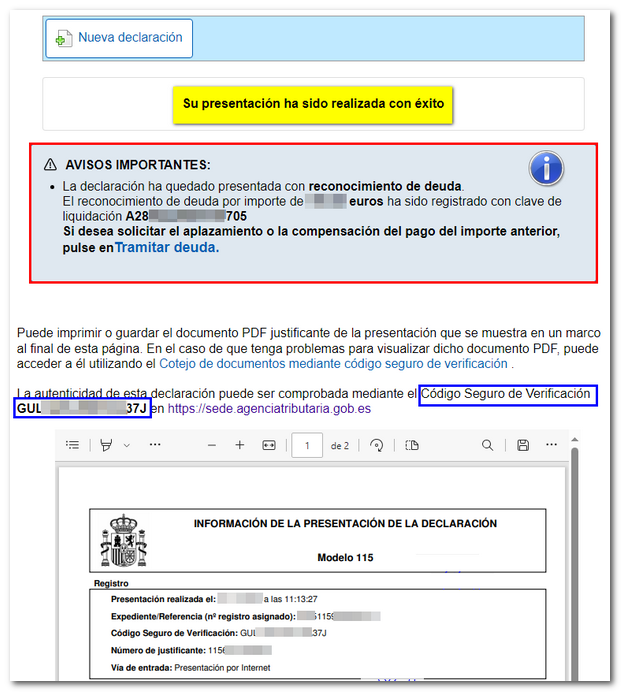

If everything is correct, you will get the response sheet with the message "Your submission has been successfully completed" and an embedded PDF containing a first page with the submission information (registration entry number, Secure Verification Code, receipt number, day and time of submission and presenter details) and, on the subsequent pages, the complete copy of the declaration.

In cases where there is recognition of debt, a link to submit the deferral or compensation request will be displayed on the response sheet for successfully submitting the request. Press " Process debt ". Subsequently, the settlement details will appear with the debtor details and the settlement code. You will have to choose between one of the available options: defer, compensate or pay.