Form 222

Skip information indexHow to provide additional data to the declaration (Annex model 222)

To communicate additional data to model 222 you can use form "Model 222. Fiscal year 2025 and following years. Submission of additional data communication to the declaration" , available at the Electronic Office of the AEAT , within the procedures of model 222.

The procedure requires identification with an electronic certificate and Cl@ve .

To correctly view all parts of the form, before accessing it, check the zoom and font size set in the browser (once the declaration has been submitted, you can return to the previous zoom and font size).

-

In Microsoft Edge , access the three horizontal dots, in zoom select 100% with the "+" and "-" signs. Go back to the three horizontal dots to enter "Settings", select "Appearance" and under "Fonts", "Font size" select "Medium (recommended)", under "Page zoom" select 100%.

-

In Google Chrome , go to "Settings" (from the three vertical dots), "Appearance", "Font size" and select "Medium (recommended)", in "Page zoom" select 100%. You can also select 100% zoom from "Zoom In/Out".

-

In Mozilla Firefox , access the three-stripe icon, in "Size" select 100% with the "+" and "-" signs, press "Options", "General", "Language and appearance" and in "Fonts and colors" select a size smaller than the current one, if you do not see the form correctly.

-

In Safari , go to "View," "Enlarge," or "Reduce."

In the identification data window, select the period and enter your identification data, NIF , surname and first name or company name. If you want to import a file generated with the form or with a program other than AEAT you have the "Import" option in this same window.

The system detects whether you have been working on submitting additional data to the declaration in a previous session, giving you the option to continue by clicking the "Continue" button, whether you have filed the declaration or if you wish to submit a new one.

Complete the sections corresponding to identification, accrual and the rest of the required information. To check the correct format of the group number, place the cursor over the help icon in the field "Group number" . Likewise, to indicate the " CNAE main activity" press the button with the ellipsis.

If you need to submit a supplementary or substitute declaration, check the corresponding box below and enter the supporting document number of the previous declaration.

After completing the required data, press the button "Validate". If there are errors or warnings, the corresponding description will be displayed and the buttons "Go to Error" or "Go to Notice" to directly access the box you need to review or correct.

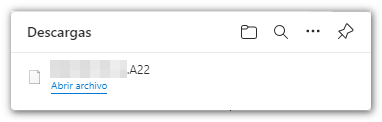

Once the validation is correct, you can generate a declaration file with format BOE (valid for presentation) using the button "Export" . The file will be named " NIF del declarante" with the extension A22 and will be saved by default in the computer's download folder, although you can select another location.

From the button "Matter" Located in the initial window, you can retrieve the file exported from the form and also a file generated with an external program, adjusted to the current record design.

The button "Delete statement" delete the data from the return you are working on to start a new one.

The " Save " button allows you to store the declaration data on the AEAT servers even if it is incomplete and contains warnings or errors. If a tax return has been saved previously, it will be overwritten. When you access the model again, in the initial login window, if it detects that there is already a saved session in which you have been working, you will be given the option to recover the data by clicking "Continue."

You can also view your return before filing it by clicking the "Preview", you will get a PDF which is not valid for the presentation but will serve as a reference.

To submit the declaration press the button "Submit" .

In the next window, check the box "I agree" and press again "Sign and Send" to finish the submission.

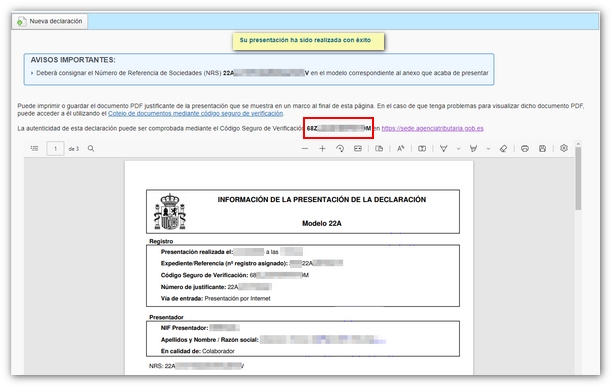

If everything is correct, you will get the filing receipt on screen and an embedded PDF with the filing information (registration entry number, Secure Verification Code, receipt number, filing day and time and filer details) and the full copy of the declaration.