Form 222

Skip information indexHow to report changes in the composition of the tax group (Annex model 222)

To report changes made to the composition of the tax group you can use form "Model 222. Exercises 2024 and following. Submission of the communication of variation in the composition of the tax group" , available at the Electronic Office of the AEAT , within the procedures of model 222 in the option "Annex 222. "Communication form for variation in tax group composition".

The procedure requires identification with an electronic certificate and Cl@ve .

Before accessing, check the zoom and font size set in the browser (once the declaration has been submitted, you can return to the previous zoom and font size).

-

In Microsoft Edge , access the three horizontal dots, in zoom select 100% with the "+" and "-" signs. Go back to the three horizontal dots to enter "Settings", select "Appearance" and under "Fonts", "Font size" select "Medium (recommended)", under "Page zoom" select 100%.

-

In Google Chrome , go to "Settings" (from the three vertical dots), "Appearance", "Font size" and select "Medium (recommended)", in "Page zoom" select 100%. You can also select 100% zoom from "Zoom In/Out".

-

In Mozilla Firefox , access the three-stripe icon, in "Size" select 100% with the "+" and "-" signs, press "Options", "General", "Language and appearance" and in "Fonts and colors" select a size smaller than the current one, if you do not see the form correctly.

-

In Safari , go to "View," "Enlarge," or "Reduce."

In the identification data window, select the period and enter your identification data, NIF , surname and first name or company name. If you want to import a file generated with the form or with a program other than AEAT you have the "Import" option in this same window. Please note that this file must be text.

The system detects whether you have been working on the declaration in a previous session, giving you the option to continue with it by clicking the "Continue" button, if you have submitted the declaration or if you wish to create a new declaration.

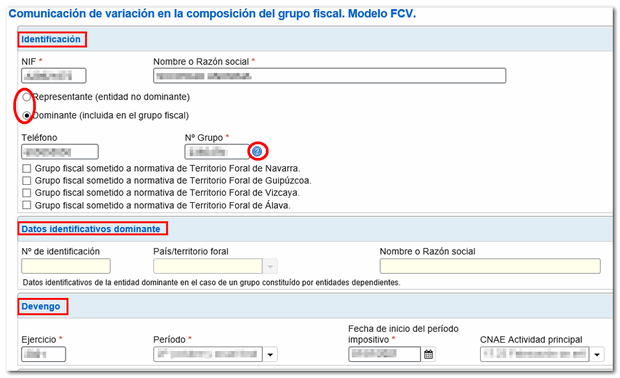

In section "Identification" fill in the NIF and the Name or Business Name and select one of the two options (Representative or Parent). To fill in the group number in the correct format, place the cursor over the help icon in the corresponding box.

Next, fill in, if applicable, the "Dominant identification data" and the fields in the section "Accrual" .

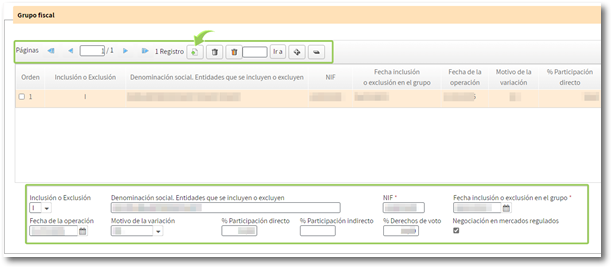

In section "Tax group" you can create a new record by clicking the corresponding icon in the top bar and filling in the data that will be enabled at the bottom. To access the different records created, use the navigation arrows and to delete a record, press the button with the trash can icon.

Only when it is a supplementary or substitute declaration, check the corresponding box and include the supporting document number of the previous declaration.

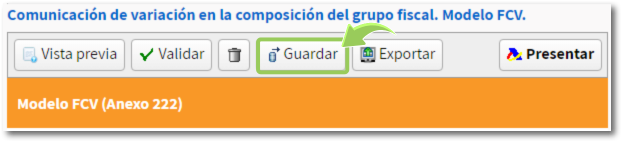

The form has a timeout so we suggest you save the declaration using the "Save" button. The statement will be stored on the servers of the AEAT the data completed up to this point even if they are not validated. If a previously saved statement already exists, it will be overwritten. The recovery of this data is done from the button "Continue" in the initial window.

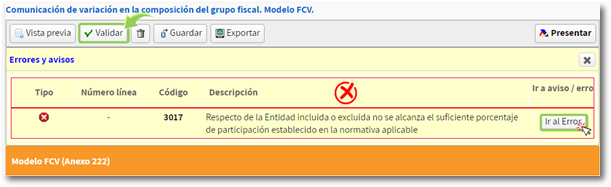

After completing the required data, press the button "Validate". If there are errors or warnings, the description and buttons will be displayed. "Go to Error" either "Go to the Notice" to access the box you need to correct.

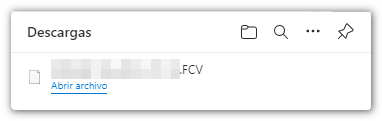

Once the validation is correct, you can generate a declaration file with format BOE (valid for presentation) using the button "Export" . The file will be named NIF of the Representative Entity, fiscal year, period and the extension FCV. It will be saved by default in your computer's downloads folder, although you can select another location.

You can later recover this file from the button "Matter" in the identification window. From this same button you can also upload to the form a file obtained with a program external to the AEAT that conforms to the current registration design.

You can view your return before filing it by clicking the button" Preview", although it is not valid for the presentation of the declaration.

The button "Delete statement" delete the data from the return you are working on to start a new one.

To submit the declaration press the button "Submit" .

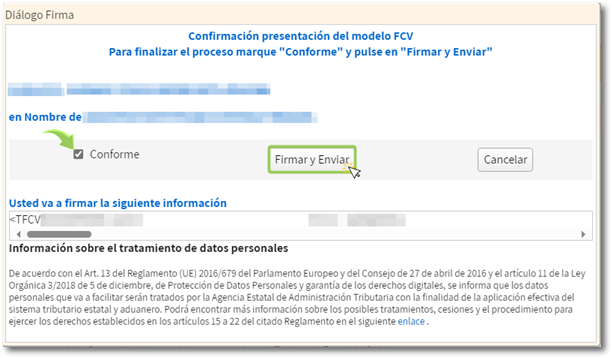

In the next window, check the box "I agree" and press "Sign and Send" .