Model 303 - Technical assistance

Skip information indexElectronic submission of form 303 by file for 2022 and previous years

The presentation file must comply with the specifications of the published registration design, available on the Tax Agency website.

You can access by identifying yourself with Cl@ve , certificate or DNI electronic. If you have questions about how to obtain an electronic certificate or how to register in the Cl@ve system, consult the information available in the related content.

If the declarant does not have an electronic certificate, it is necessary that the person making the submission be authorized to submit declarations on behalf of third parties, either by being registered as a collaborator or by being authorized to carry out this procedure.

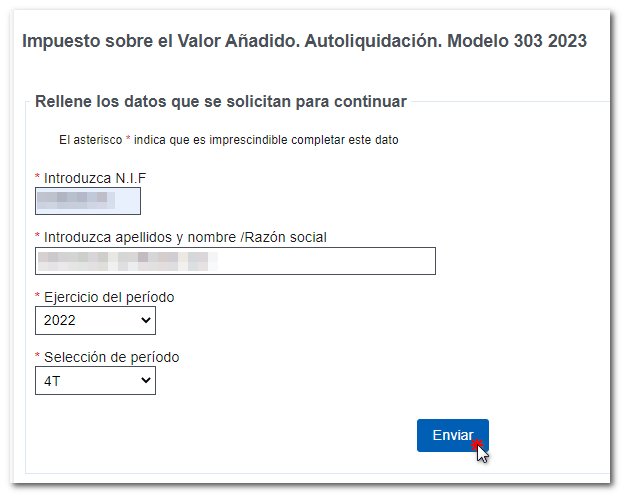

After identification, fill in the required data in the initial window and press "Send".

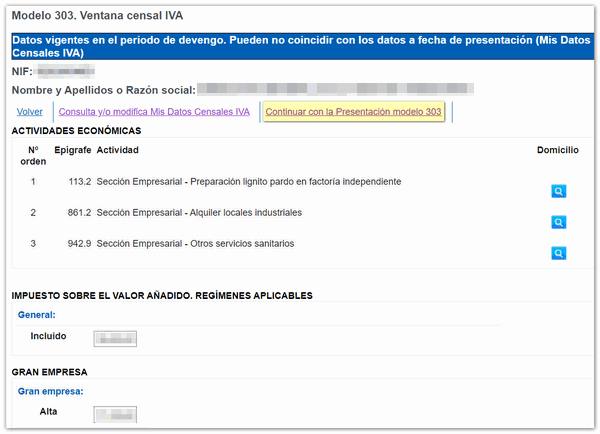

It will open the "Census Window VAT", where you will find the current information for the accrual period on the VAT and the PIT and you will be able to access the available options at the top: "Consult and/or modify my census data" VAT" and "Continue with the submission of form 303." For each activity, there is a magnifying glass icon to check the details of the address where each activity is carried out.

- "Consult and/or modify my census data" VAT":

You will obtain the corresponding census data and you will be able to modify it from the link "To modify this data (Registration, Deregistration) click here".

- Continue with Presentation Model 303:

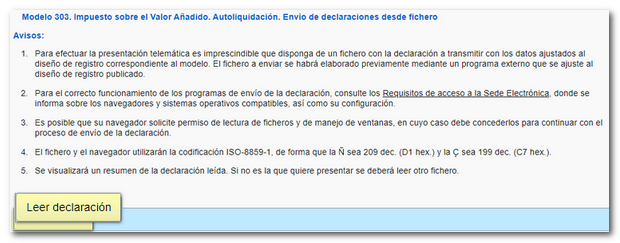

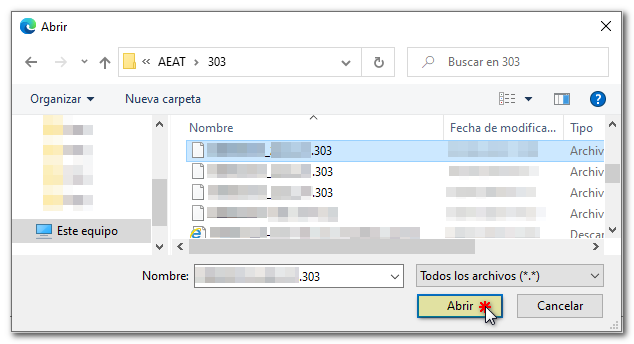

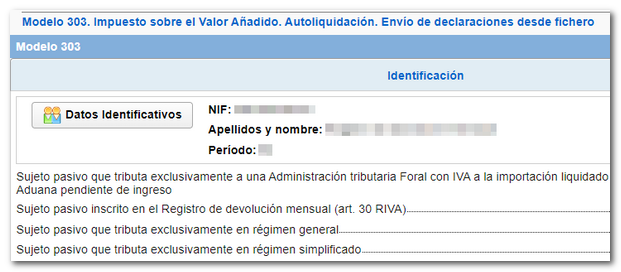

Check the notices and click on the "Read declaration" button to locate the generated file.

All the data from the declaration will then be displayed, although, when submitting via file, the fields are not editable. Any changes will have to be made in the file or in the application you used to generate it.

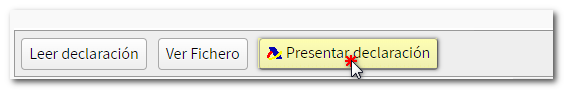

If the declaration is validated without errors, press " Submit declaration" at the bottom of the window.

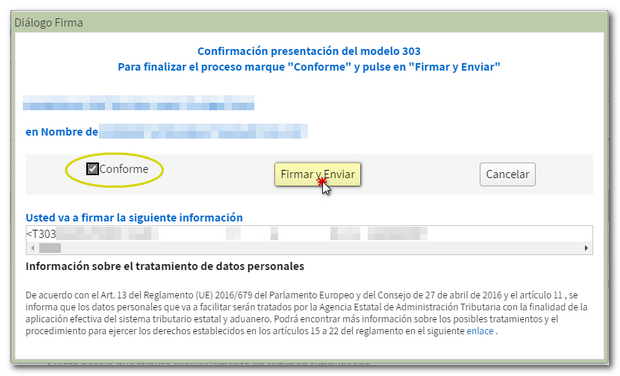

A submission confirmation window will appear. Check the box " Agree " and press " Sign and Send ".

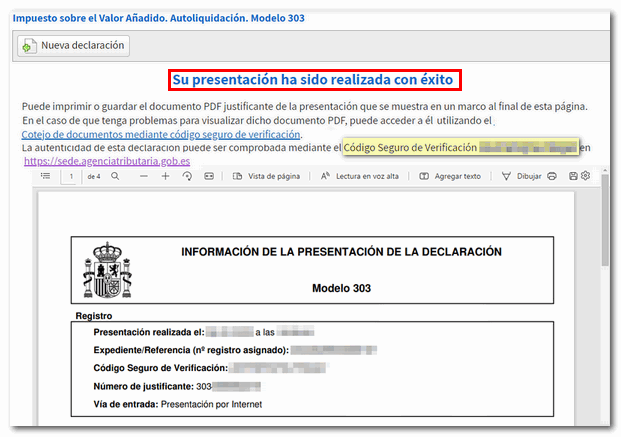

After signing and submitting, you will receive a response sheet with the message "Your submission has been completed successfully" and the secure verification code. The embedded PDF contains the filing information on the first page (registration entry number, Secure Verification Code, receipt number, filing date and time, and filer details) and the full copy of the return on the subsequent pages.

In cases where there is recognition of debt , a link will be displayed on the response sheet to make the request for deferral or compensation. Press " Process debt ". The settlement details will then appear with the debtor's data and the settlement key. Select one of the available options to continue: defer, compensate or pay.